Chipsets known as graphics processing units (GPUs) are an integral component in the development of artificial intelligence (AI) applications. At the moment, Nvidia (NASDAQ: NVDA) holds an estimated 88% of the AI GPU market thanks to its industry-leading A100 and H100 GPUs.

In the coming months, Nvidia is set to add another GPU — called Blackwell –to its roster. During the company’s most recent earnings call, Nvidia CFO Colette Kress said “demand for Blackwell platforms is well above supply” and that the new chipsets were forecast to generate billions in revenue by the fourth quarter.

While Blackwell appears to be a short-term tailwind for Nvidia, I see two other stocks as potentially better opportunities in the long run.

Here’s why I think Super Micro Computer (NASDAQ: SMCI) and Dell Technologies (NYSE: DELL) could be more savvy buys for the upcoming Blackwell launch.

1. Super Micro Computer

Supermicro is an IT infrastructure company that specializes in storage cluster and server rack designs for GPUs. Soaring demand for GPUs over the last couple of years has been a major catalyst for Supermicro’s business.

While the Blackwell GPUs should ignite new opportunities among IT architecture specialists, I’m anticipating that Supermicro will be a particular beneficiary given the company’s strong relationship with Nvidia. With that said, there are some important things to note about Supermicro’s business right now.

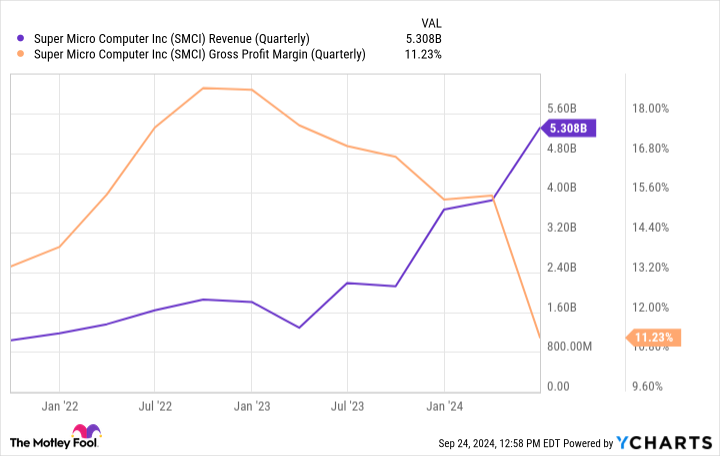

First, the company’s latest earnings report from early August was a mixed bag. While revenue continues to grow at an impressive rate, the company’s gross margin is a glaring issue.

In general, Supermicro’s business is going to carry lower margins compared to a software business or a company that has outsize pricing power, such as Nvidia. The reason for this is that designing storage clusters requires hefty capital expenditures (capex), which can take a toll on profit margins.

In addition to the financial results, Hindenburg Research recently published a short report alleging that Supermicro’s financial controls and accounting practices are weak. It is important for investors to understand that short-sellers such as Hindenburg benefit when a stock price goes down — as is the case with Supermicro right now — but this is not the first time Supermicro has been at the center of accounting-related accusations. In 2020, the Securities and Exchange Commission fined Super Micro Computer and its CFO for violating federal securities laws by “engaging in improper accounting — prematurely recognizing revenue and understating expenses from at least fiscal year … 2015 through FY 2017.”

Furthermore, the company is set to execute a 10-for-1 stock split in the next week; such an event will almost certainly trigger some momentum-driven trading activity.

Lastly, on Sept. 26, The Wall Street Journal reported that unnamed sources told it the Department of Justice (DOJ) is probing Supermicro and seeking information apparently tied to allegations of accounting violations.

However, at this time details are sparse. I would let this situation play out before fleeing and writing Supermicro off.

On top of all of this, investor uncertainty surrounding macro factors such as interest rate tapering from the Federal Reserve have also influenced selling activity in the market over the last several weeks.

Supermicro stock has been experiencing quite the precipitous sell-off as of late, and much of this revolves around a mixture of hearsay, panic selling, and the macroeconomy.

Right now, Supermicro’s forward price-to-earnings (P/E) multiple is just 14 — nearly 72% off its highs from earlier this year. Moreover, this pales in comparison to the S&P 500‘s forward P/E of 23.

This discount to prior valuation levels could make Supermicro stock a compelling opportunity as the Blackwell launch sits on the horizon.

2. Dell Technologies

Earlier in the summer, Elon Musk’s AI start-up, xAI, tapped Dell and Supermicro for server rack designs for its GPU clusters. Although this deal came with high-profile headlines, Dell’s entire infrastructure solutions group (ISG) is a winning operation.

During its second quarter of fiscal 2025 (ended Aug. 2), Dell had $3.2 billion in AI-optimized server orders and ended the quarter with $3.8 billion in backlog.

From a revenue perspective, ISG increased 38% year over year to a record $11.6 billion. Within ISG, sales from servers and networking equipment rose 80% year over year to $7.7 billion. Meanwhile, storage revenue of $4 billion actually dropped nominally year over year by 5%.

I see the Blackwell launch as an additional catalyst for Dell’s ISG segment across both servers and networking as well as storage solutions. To me, Blackwell should help spur even more demand for Dell’s infrastructure solutions. I suspect investors could begin to get a glimpse of Blackwell’s impact on Dell by looking at backlog details in upcoming earnings reports.

The bottom line

I think buying Supermicro stock right now comes with some risk, considering its shares will likely continue experiencing outsize volatility leading up to the split on Oct. 1 and as details of any government probe emerge. In the long run, however, I think the Blackwell GPUs will be a catalyst for Supermicro’s services and newfound demand could ignite a rebound in the stock.

While Dell’s forward P/E of 14.9 is in line with that of Supermicro, I see the company as the more prudent investment right now since there is less hoopla surrounding the company compared to its peer.

Nevertheless, I see both Supermicro and Dell as beneficiaries of the Blackwell launch and think the growth spurred from these new GPUs will last quite a long time. For these reasons, investors may want to consider positions in each as Nvidia’s newest chipset release looms.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

These 2 Artificial Intelligence (AI) Stocks May Be Better Buys Than Nvidia for the Blackwell Launch was originally published by The Motley Fool