Ethereum has the most important beneficial properties on the day by day chart for the primary cryptocurrencies by market cap. At the time of writing, ETH is up 4.9% and trades at $2.328,58. With sideways motion within the weekly and 46.7% beneficial properties on the month-to-month chart.

More appreciation for ETH appears to be imminent. The community seems to be fixing a “disadvantage” that has been leverage by its competitor to gain market share, excessive transaction charges. Data from EthGasStation signifies {that a} quick or customary transaction has a value between 45 to 50 gwei.

As proven within the chart under, ETH’s fuel charges are on a decline since April 20th. At that second, this metric soared to a median of $37, their highest cost since February 2021. The development seems to be reversing and the metric is near its lowest level this yr with a median price of $10.22 per transaction.

Co-founder of EthHub, Anthony Sassano, believes there are 4 foremost causes for charges getting cheaper: the rise within the fuel restrict (block dimension) by 20%, a cooled down on the crypto market, implementation of second-layer options, and the adoption of Flashbots. The latter appears to be taking part in a significant position.

As reported by NewsBTC, Flashbots is a corporation that develops instruments to scale back and improved defends Miner Extractable Value (MEV). They are the alternative of Priority Gas Auction (PGA) since Flashbots have a constructive impact on decreasing fuel’ price. The group defends a “transparent” MEV ecosystem.

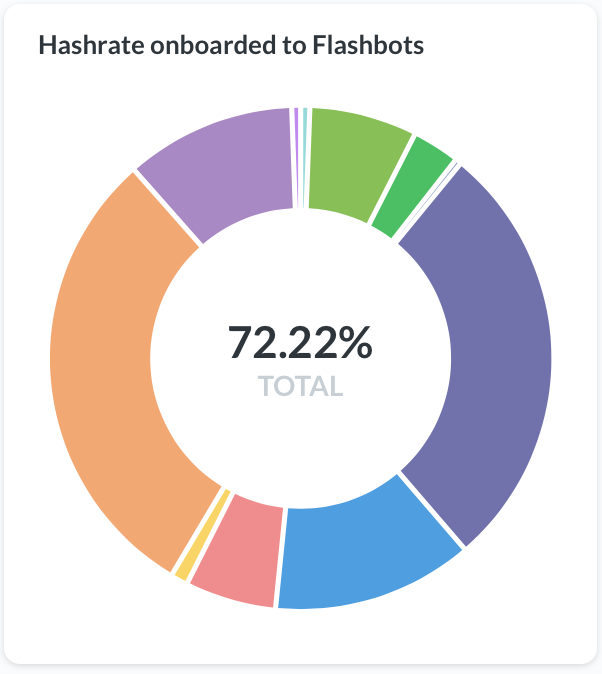

As reported by pseudonym developer “Stephane” there’s near 72.22% of Ethereum hashrate has onboarded to Flashbots and their instruments. Miners used them to maximise their rewards. This metric has seen nearly a 15% improve over the previous two weeks.

The Future of Ethereum Gas Fees

The implementation of EIP-1559 with Hard Fork London has triggered numerous discontent from the miner sector. Others have been devoted to discovering new methods to maximise their earnings. As investor Spencer Noon said, Flashbots might develop into a spine of ETH’s new price market:

Been diving into the early #Flashbots knowledge and *good lordy* $ETH miners simply bought gifted an unimaginable new income. ~5% further income per block and that determine is barely going to proceed climbing. Few perceive how profound an influence this has on $ETH’s safety funds.

In addition, Ethereum investor Aftab Hossain believes EIP-1559 might scale back transaction biddings wars and stabilize charges prices. On high of this, some destructive MEV methods might develop into unprofitable to the good thing about Flashbots.

However, Hossain expects charges to be “scale back up” to present ranges as Ethereum’s blockchain is used for extra functions. Therefore, growing the demand, not less than for the brief time period as sharding and new options on ETH2 are beneath improvement. Hossain mentioned:

by no means thoughts the truth that L1 will nonetheless be used for quite a lot of tx’s as a result of it has distinctive composable utility and worth L2s might not be capable of provide for a while.