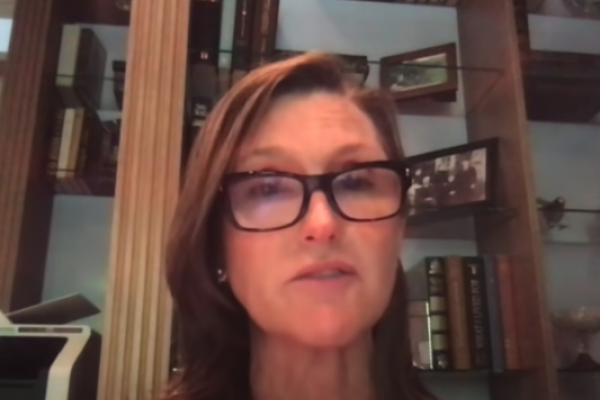

Ark Funds CEO and Co-Founder Cathie Wood joined Benzinga for the “Raz Report” interview earlier this month. At that point, Wood promised a brand new value goal was approaching Tesla from Ark.

On Friday, it arrived.

Ark Funds on Tesla: Ark Funds updated its price target for shares of Tesla Inc (NASDAQ: TSLA) to $3,000 within the 12 months 2025.

Last 12 months, Ark Funds listed a cut up adjusted value goal on Tesla shares of $1,400 by the 12 months 2024.

Ark Funds makes use of a Monte Carlo mannequin, based mostly on a sequence of simulations to find out the chance of various outcomes with random variables. A complete of 34 inputs and over 40,000 doable simulations have been used to create the brand new value goal.

The bear case from Ark Funds is for shares of Tesla to hit $1,500 in 2025. The new bull case from Ark Funds is for Tesla shares to hit $4,000 in 2025.

The value goal from Ark Funds doesn’t embrace Tesla’s vitality storage or photo voltaic enterprise within the fashions. The influence of the worth of Bitcoin can also be not included within the mannequin from Ark Funds.

See additionally: How to Invest in Tesla Stock

Growth Ahead: Ark Funds stated Tesla can promote between 5 million and 10 million automobiles in 2025 after new expertise and manufacturing enhancements. Tesla bought over 500,000 automobiles in 2020.

The common sale value for Tesla’s electrical automobiles was $50,000 in 2020. Ark requires that determine to return in between $36,000 and $45,000 within the new value goal mannequin.

For the primary time, Ark Funds is together with alternatives in insurance coverage in its forecasting mannequin.

“Ark estimates that Tesla could achieve better than average margins on insurance thanks to the highly detailed driving data it collects from customer vehicles,” Ark says within the report.

Tesla launched its insurance coverage product in 2019. It is presently solely out there in California. Ark believes within the subsequent few years, Tesla may roll out insurance coverage to different states, underwriting its personal insurance policies.

Ark Funds up to date its pricing mannequin for Tesla to incorporate assumptions on totally autonomous driving. Ark estimates the chance of delivering totally autonomous driving by 2025 at 50%. Ark beforehand listed a 30% probability by the 12 months 2024.

Related Link: Auto Companies That Catered To Shareholders Instead Of Future Growth Will Be Sorry: Cathie Wood

Ark Funds and Tesla: Wood has been a notable Tesla bull for years. She famously gave a cut up adjusted price target of $800 that was criticized by many on Wall Street. Her prediction got here proper earlier this 12 months.

Tesla is the biggest holding within the Ark Innovation ETF (NYSE: ARKK) with over 3.7 million shares value $2.Four billion.

Tesla can also be the biggest holding within the Ark Next Generation Internet ETF (NYSE: ARKW) with 1.1 million shares held value $752.5 million.

Tesla represents 10.5% of property in each ARKK and ARKW.

Price Action: Shares of Tesla closed at $654.87 on Friday. Tesla shares have traded between $82.10 and $900.40 during the last fifty-two weeks.

Watch the complete interview with Cathie Wood and Benzinga here.

Latest Ratings for TSLA

|

Mar 2021 |

Mizuho |

Initiates Coverage On |

Buy |

|

|

Mar 2021 |

New Street |

Upgrades |

Neutral |

Buy |

|

Feb 2021 |

Morgan Stanley |

Maintains |

Overweight |

View More Analyst Ratings for TSLA

View the Latest Analyst Ratings

See extra from Benzinga

© 2021 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.