Bitcoin is holding effectively above the vital assist at $47,000. Trading at $50.067 with 1.6% within the 1-hour chart and sideways motion within the 24-hour chart, BTC appears to be on a path to restoration on the decrease timeframes. As many within the crypto house have stated, this bull-run will likely be outlined by its fast bounce backs and consolidations intervals.

Trader Josh Rager compared BTC’s previous worth motion with the present worth efficiency. For Rager is a traditional a part of a bull-run for BTC to development under its 100 days Exponential Moving Average (EMA). During 2017, the cryptocurrency noticed a minimum of three drops under this metric.

The dealer believes buyers needs to be “concerned” if the worth breaks under its 200D EMA. In distinction, BTC by no means developments under this metric whereas on bullish worth motion.

During the weekend, the dealer expects a bounce if BTC drops to the mid-$40,000. Currently, the 10W EMA is converging with the weekly assist stage, as Rager defined. This may function entry level for a protracted place in each BTC and altcoins, because the dealer stated:

The backside may very well be in, but when Bitcoin bounces after which goes right down to decrease $40ks. Would love to purchase in that space each $BTC and alts. As lengthy as worth holds there we may see some main rallies over the subsequent few months as BTC slowly uptrends.

In the meantime, some aspect motion may very well be Bitcoin’s new regular for the brief time period. Lex Moskovski, CIO at Moskovski Capital, believes the current crash “cooled off” BTC’s main overheating indicators.

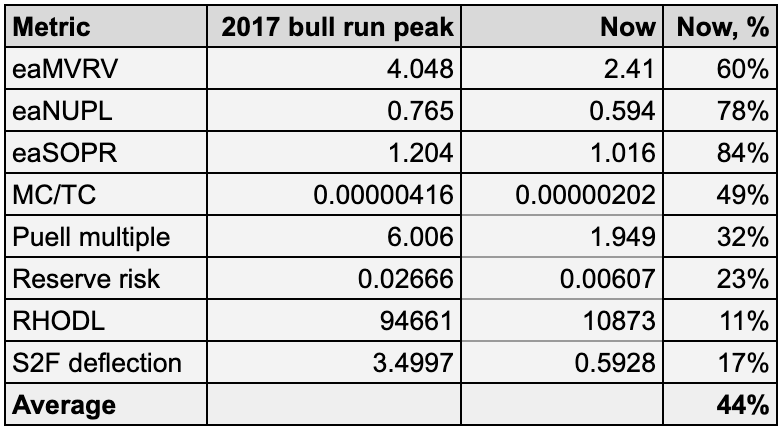

As seen under, Moskovski compares 2017 bull run metrics with the present market and decided that Bitcoin is round 44% from probably reaching a peak on its upside development. On the opposite, there may very well be much more upside momentum after this week’s crash. Moskovski said:

Bitcoin has cooled off a bit and based on the main overheating indicators has much more upside now.

What Could Break Bitcoin’s Market Structure?

Economist and dealer Alex Krüger supplied additional arguments for a long-term BTC bullish case. As Krüger stated, this cryptocurrency has seen massive adoption with macro-economic conditions that benefit it. Since 2020, the thesis of Bitcoin as a retailer of worth has gained a variety of power amongst institutional buyers.

Krüger laid out two potential situations. In one, “major catalysts” re-heat the market, and BTC’s worth pushes into a brand new discovery interval. The economist said:

The first half of this dump was anticipated, not so the second, which was news-driven. Shit occurs. But nothing main has modified apart of a wholesome cleaning. When anticipating a variety good to keep away from getting bullish on breakouts, or threat getting head chopped off.

In the second situation, the U.S. Government and its Secretary of Treasury Janet Yellen launch new regulations for crypto and digital property. Krüger expects any “draconian” guidelines to negatively influence the market.