Is there a right way to invest? Not really. Each person has their own individual style, but what ultimately matters are the results. This holds especially true in the realm of investing, where even the most successful stock pickers on Wall Street employ diverse strategies to achieve their goals. And what are those goals? Big returns, of course.

Take Billionaires Steve Cohen and Ken Griffin, for example. Both have had incredible careers, but each’s route to riches has been distinct. Griffin, who runs the Citadel hedge fund, adheres to quantitative investment methods, while Cohen, who leads the Point72 asset management firm, is famous for his high-risk/high-reward strategy.

That doesn’t mean their stock choices never cross paths. In fact, some specific equities make up a part of each’s respective portfolios. And if two investing gurus feel strongly about the same names, it’s only natural for investors to get curious as to why they’re both invested.

With this in mind, we used TipRanks’ database to find out if two stocks the billionaires recently added to their funds represent compelling plays. According to the platform, the analyst community believes they do, with both picks earning “Strong Buy” consensus ratings. Let’s check the details.

Humana Inc. (HUM)

Uncertain times make the healthcare segment an ideal destination, as the sector is seen as one touting defensive qualities able to withstand any harsh macro developments. So, it’s not that surprising to find both Cohen and Griffin invested in Humana, an American healthcare giant and a leading provider of health insurance plans and related services.

The Louisville, Kentucky-based firm is one of the largest managed care organizations in the U.S., offering a broad range of health insurance products, including individual and group plans, Medicare Advantage, and prescription drug plans. Humana serves millions of customers and boasts a market cap of over $64 billion.

Such a value proposition enabled the company to dial in a strong Q1 report. Revenue climbed by 11.6% year-over-year to $26.74 billion, coming in ahead of the forecast by $340 million. Likewise on the bottom-line, adj. EPS of $9.38 beat the $9.20 expected by the analysts. Humana also reaffirmed its target for 2023 individual Medicare Advantage (MA) membership growth of no less than 775,000, amounting to a 17% uptick compared to FY 2022’s ending membership whilst outpacing industry growth.

As for the bigwigs’ involvement, in Q1, Griffin increased his HUM stake by a huge 2,216% with the purchase of 973,754 shares. In total, he now holds 1,017,699 shares, currently worth $522.4 million. In the same period, Cohen opened a new position by acquiring 189,079 shares of HUM, which currently hold a market value of $97 million.

Mirroring these investor heavyweights’ confidence, Morgan Stanley’s Michael Ha highlights the company’s growth expectations as key to his investment thesis.

“Amidst the recent rising investor concern around 2024 MA growth, we view mgmt’s commentary very favorably,” Ha said. “Management believes Humana can grow ‘at or above HSD’ Individual Medicare Advantage growth in 2024 – We also believe this and continue to see Humana as boasting the strongest multi-year earnings growth story in Managed Care.”

These comments underpin Ha’s Overweight (i.e., Buy) rating, while his $637 price target suggests the shares will post 12-month growth of 24%. (To watch Ha’s track record, click here)

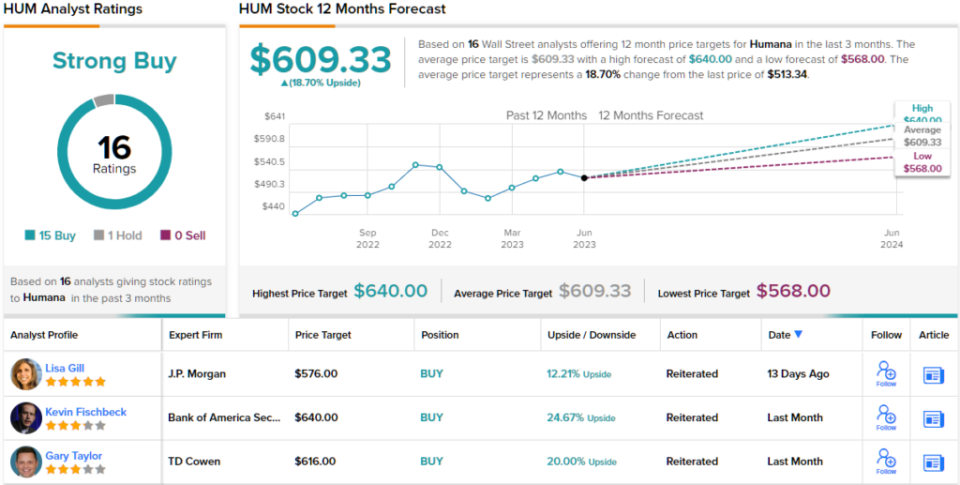

The rest of the Street almost unanimously agrees. One fencesitter aside, all 15 other recent analyst reviews are positive, making the consensus view here a Strong Buy. Going by the $609.33 average target, a year from now, the stock will be changing hands for ~19% premium. (See HUM stock forecast)

Cousins Properties (CUZ)

Another way to shelter from macro uncertainty is by investing in real estate investment trusts (REITs), a defensive segment known for its juicy dividends. The next Cohen/Griffin-backed name under the spotlight here is Cousins Properties.

With its history stretching back to 1958, this REIT has established itself as a leading owner, operator, and developer of high-quality office properties. Cousins Properties primarily focuses on the acquisition, development, and management of Class-A office buildings in prominent markets across the Sunbelt region. The company’s portfolio includes a diverse range of assets, including corporate headquarters, urban office towers, and suburban office parks.

While some have been sounding the alarm around the precarious state of the U.S. commercial property market, that didn’t stop Cousins from delivering a strong statement in the most recently reported quarter – for 1Q23. Revenue reached $202.73 million, representing an 8.5% year-over-year increase whilst beating the prognosticators’ forecast by $7.64 million. At the other end of the scale, the company dialed in FFO of $0.65, edging ahead of the $0.63 consensus estimate.

Cousins also pays a regular dividend. The current payout stands at $0.32 and yields an inflation-beating 6.46%.

All of this must be attractive to Cohen and Griffin. As for their involvement, Cohen pulled the trigger on the stock, buying 1,071,615 shares worth over $23.1 million at the current share price, while Griffin took an even bigger position, purchasing 3,257,081 shares. This move increased the total size of his holding to 3,295,280 shares, with the value reaching an impressive $71 million.

This stock has also impressed Baird analyst Wes Golladay, who believes CUZ appears “well-positioned to maneuver the current macroeconomic headwinds the sector faces.”

“CUZ’s late-stage leasing pipeline doubled in the quarter to 700ksf, including some activity at its Neuhoff development in Nashville,” Golladay wrote after scanning the Q1 print. “This pipeline, along with 480ksf of signed deals yet to commence this year, will help drive occupancy higher throughout the year. In addition, CUZ’s balance sheet provides the flexibility for the company to take advantage of price dislocations in the market and add to its trophy Sun Belt portfolio.”

To this end, Golladay rates CUZ shares an Outperform (i.e., Buy) backed by a $27 price target. Should the figure be met, a year from now, investors will be sitting on returns of 25%. (To watch Thillman’s track record, click here)

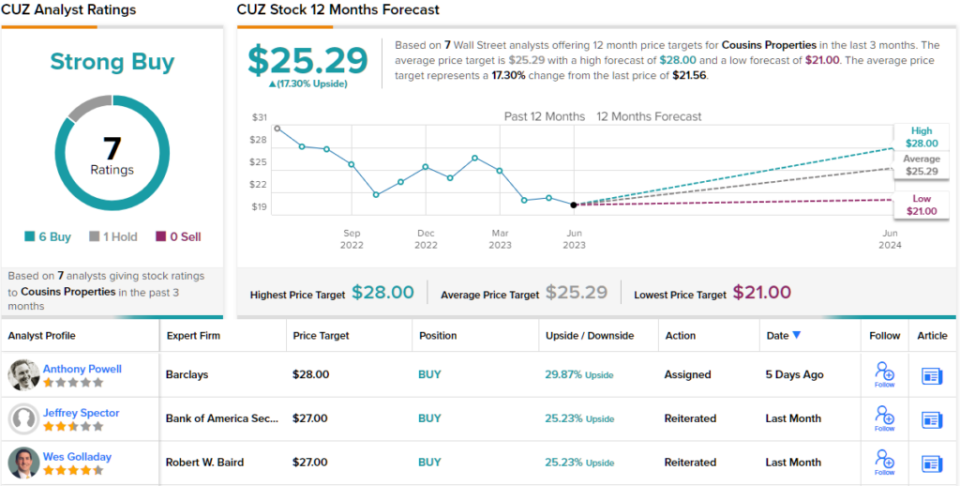

All in all, CUZ has picked up 7 analyst reviews in recent months, with 6 Buys and 1 Hold making for a Strong Buy consensus rating. The stock’s $25.29 average price target suggests it has a 17% upside from the current trading price of $21.56. (See CUZ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.