Bitcoin’s on-chain picture is flashing a rare combination: substantial profits across cohorts, rising realized capitalization, and record network hashrate—yet none of the price-accelerating euphoria that typically marks late-stage bull legs. That is the central takeaway from CryptoQuant CEO Ki Young Ju’s latest thread, which parses holder cost bases, cohort profitability, leverage, and the evolving role of ETFs and corporate treasuries in setting the tape.

Is The Bitcoin Bull Run Over?

The headline number is startling on its face. “Bitcoin wallets’ avg cost basis is $55.9K, meaning holders are up ~93% on average,” Ju wrote, adding that realized capitalization climbed by roughly $8 billion this week, a clean read that “on-chain inflows remain strong.” Realized cap—an alternative valuation measure that sums coins at their last transacted price rather than today’s market price—has historically served as a lower-variance proxy for true money-at-work. Its continued rise typically implies that fresh cost basis is being set higher on chain, even when spot stalls.

So why hasn’t price budged in tandem? Ju’s answer is straightforward: “Price hasn’t gone up because of selling pressure, not because demand was weak.” That framing is consistent with a market digesting gains while liquidity providers and profitable cohorts distribute into strength. It also helps explain the co-existence of healthy inflows with flat price action around the $110,000 handle that Ju cites as the current print.

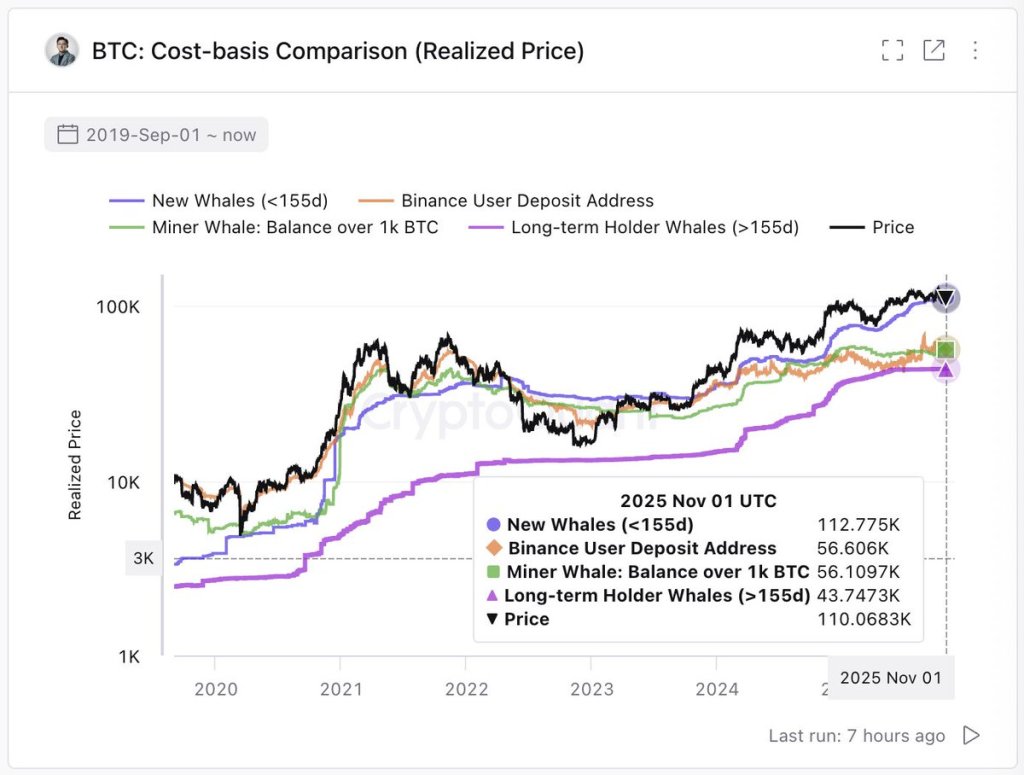

Where the marginal demand is coming from—and where it has slowed—matters. According to Ju, “New inflows mostly come from ETFs and Bitcoin treasury companies, while CEX traders & miners are sitting on ~2x gains.” He broke out estimated cohort cost bases and mark-to-market performance as follows: “ETFs / Custodial Wallets: $112K (-1%), Binance Traders: $56K (+96%), Miners: $56K (+96%), Long-term Whales: $43K (+155%). Current Price: $110K.”

If those estimates hold, short-horizon institutional buyers are hovering near breakeven, while long-tenured entities still carry deep embedded profits. That distribution dampens forced selling risk at the very top but also withholds the kind of fresh momentum that typically arrives when new buyers push decisively into the money.

Valuation context helps. Ju notes that in pronounced bull phases, market cap tends to outrun realized cap, creating a widening “valuation multiplier.” “When the growth rate gap between market cap and realized cap widens, it shows a stronger valuation multiplier,” he wrote.

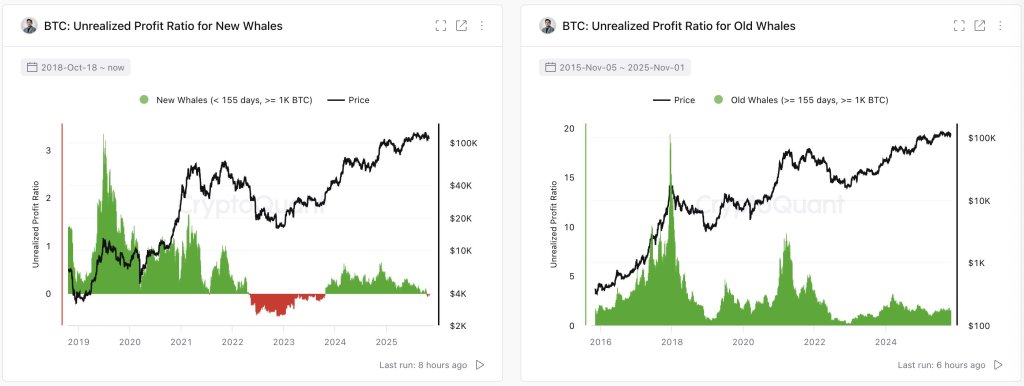

“Roughly $1T in onchain inflows has created a $2T market cap. The gap seems moderate for now.” A moderate gap is a double-edged signal: not obviously frothy, but also not the kind of exuberant expansion that ends cycles. It complements Ju’s assessment of large-holder positioning: “Whales’ unrealized profits aren’t extreme.” That scenario admits two interpretations he spelled out explicitly: “Hype hasn’t arrived yet—we’re still far from euphoric sentiment.” Or, “This time is different—the market is too big for extreme profit ratios.”

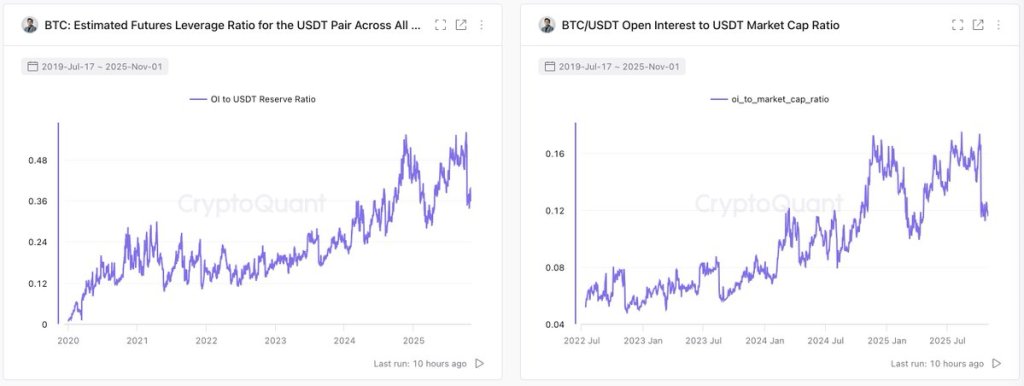

Perpetuals and collateral flows round out the microstructure picture. Ju highlights a “sharp” drop in BTC moving from spot-focused venues to futures exchanges—an indication that “whales are no longer opening new long positions with BTC collateral as actively as before.”

If the marginal long is no longer pledging coins, the market loses a mechanical source of bid intensity and convexity from collateralized positioning. Yet leverage itself has not reset: “Bitcoin perp leverage remains high despite the recent wipeout,” Ju writes, pointing to ratios such as BTC-USDT perpetual open interest relative to exchange USDT balances and to USDT market cap.

In simple terms, conviction longs appear less collateral-heavy in BTC, but system-wide leverage, as proxied by perps, remains elevated versus two years ago. That combination can suppress clean trending behavior: fewer collateralized longs to chase upside, but enough leverage in the system to impose choppy liquidations.

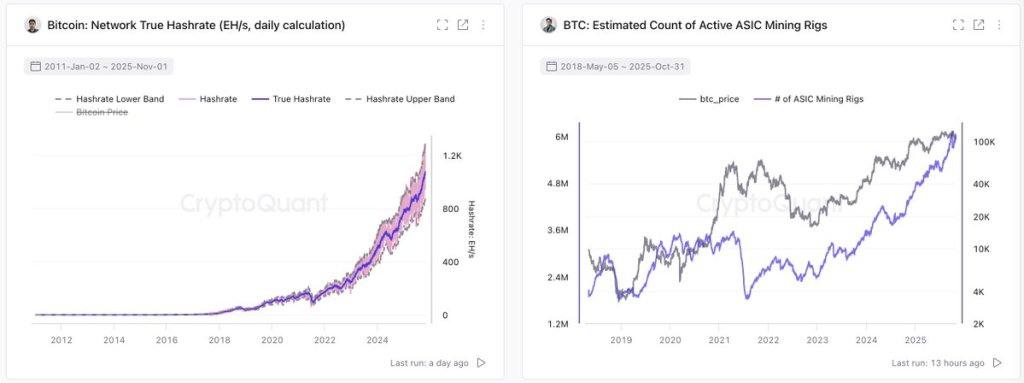

Hashrate and industrial supply trends complicate the narrative further. “Bitcoin hashrate keeps hitting new highs (~5.96M ASICs online). Public miners are expanding, not downsizing, which is a clear long-term bullish signal. The Bitcoin ‘money vessel’ keeps growing.”

Rising hashrate plus expanding public miner fleets typically points to forward investment and confidence in long-run fee and subsidy economics. It does not, however, guarantee short-term price appreciation; if anything, it can expand miner treasury management needs, interacting with market liquidity in ways that are neutral-to-price absent fresh demand.

New Demand Push Needed

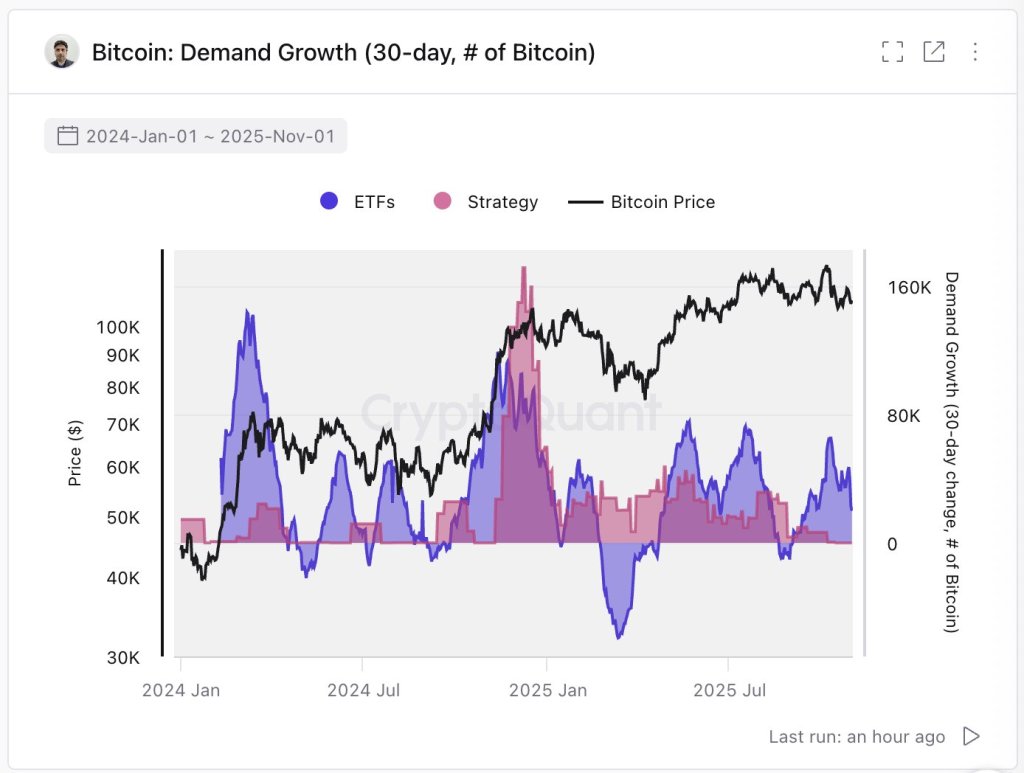

The demand side, in Ju’s read, is presently dominated by two channels: “Demand is now driven mostly by ETFs and Strategy, both slowing buys recently. If these two channels recover, market momentum likely returns.” That is a clean, falsifiable thesis: if primary institutional conduits re-accelerate, spot should regain buoyancy; if they remain tepid, realized cap can still grind higher on steady inflows while price chops as distribution absorbs them.

Cohort profitability provides an additional boundary condition for scenarios. “Short-term whales (mostly ETFs) from the past 6 months are near break-even. Long-term whales are up ~53%,” Ju wrote. Historically, cycle tops have often coincided with extreme unrealized profit ratios for dominant cohorts, creating structural sell pressure when every marginal uptick unlocks significant gains.

Ju is effectively saying we are not there. At the same time, he cautions that the market’s regime may have already decoupled from the textbook four-year cadence: “In the past, the market moved in a clear four-year cycle of accumulation and distribution between retail investors and whales. Now it’s harder to predict where and how much new liquidity will enter, making it unlikely for Bitcoin to follow the same cyclical pattern again.”

Taken together, the thread sketches a market with three defining traits. First, fundamentals of “money in” look resilient: realized cap rising, holders broadly in profit, and network security hitting new highs. Second, microstructure is unspectacular and even a touch cautionary: fewer whales seeding BTC-collateralized longs, while system leverage remains high enough to destabilize clean moves. Third, the demand baton is concentrated in ETF and corporate treasury channels that have recently eased off—the very actors whose re-acceleration could reignite momentum.

At press time, BTC traded at $107,609.

Featured image created with DALL.E, chart from TradingView.com