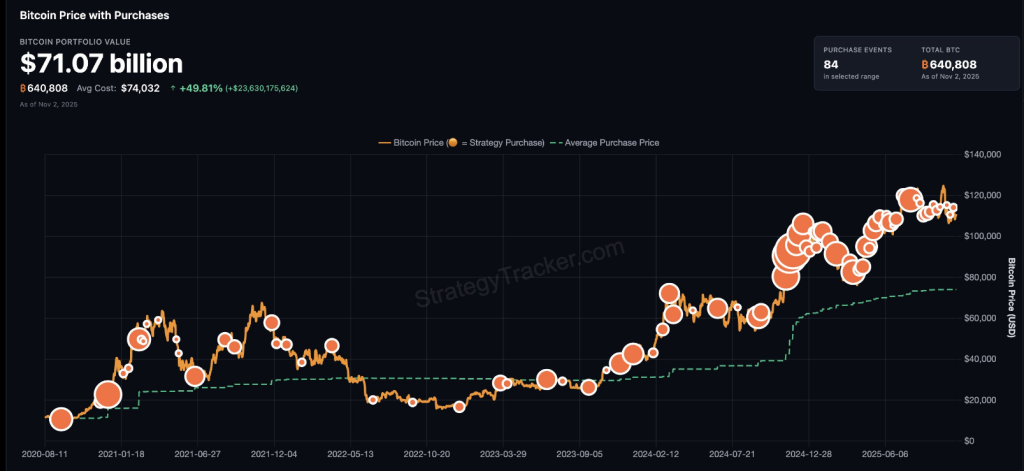

Michael Saylor sent a short, cryptic message on X on November 2, 2025: “Orange is the color of November.” The post included a chart tied to Strategy’s (formerly MicroStrategy) Bitcoin tracker. Reports have disclosed that crypto outlets and market watchers quickly read the line as a hint at another corporate Bitcoin buy.

Related Reading

Bitcoin Buy: Orange Dot Signals

According To screenshots and media coverage, the post echoed past Saylor posts that used orange imagery to flag Bitcoin moves. Some outlets called it a tease for a 13th straight purchase by Strategy.

That description comes from reporters tracking the firm’s buying pattern, not from an official Strategy statement. The tweet did not lay out timing or dollar amounts.

Strategy Holdings And Recent Buys

Based on reports and filings summarized in market coverage, Strategy currently holds roughly 640,808 BTC, with an average cost basis near $74,302 per coin.

The company’s last disclosed acquisition was about 390 BTC, which market trackers put at roughly $43 million. Those figures come from public disclosures and tracking services that follow corporate treasury buys.

Orange is the color of November. pic.twitter.com/M3JoIuDpRk

— Michael Saylor (@saylor) November 2, 2025

Market Reactions And Risks

Traders reacted fast. Some buyers pushed prices higher on the idea that another corporate buyer was about to enter the market.

Others sold into the noise, treating the tweet as a signal that might not immediately lead to a trade. Headlines linking the post to other big political or economic events—such as reporting on US President Donald Trump—appeared in a few outlets, but analysts say such connections are speculative unless tied to filings or on-chain moves.

Why Watch For Filings

Based on past practice, Strategy tends to file disclosures after completing purchases. That pattern makes regulatory filings and on-chain addresses worth watching for anyone tracking actual flows.

If a fresh 8-K appears or a wallet tied to the company posts movement, that will turn rumor into confirmed action. Until then, the market runs on interpretation and expectation.

What This Means For Investors

For holders, corporate accumulation often serves as a sentiment boost. For short-term traders, it raises volatility. Institutional watchers will be looking not only for more purchases but also for any change in scale.

The company’s large stake—hundreds of thousands of BTC at a multi-thousand dollar average—means that public buys or sales have the power to move sentiment.

Related Reading

What To Watch Next

Based on reports, the clearest signs to watch are regulatory filings, updates from Strategy itself, and on-chain transfers tied to known company addresses.

Market data providers who tracked the last 390 BTC purchase will likely flag any new movement quickly. Until those items appear, the tweet remains a strong hint but not proof of an imminent large purchase.

Featured image from Unsplash, chart from TradingView