The derivatives alternate Bitget issued an official announcement that in order to satisfy the wants of extra buying and selling customers and enhance consumer expertise, Bitget will formally launch USDT Unified Account and Quanto Swap Contract on the finish of March. Several days in the past, Bitget launched a brand new function voting and arrange a $100,000 prize pool to ask customers to take part. Bitget will invite international customers to expertise the beta model of USDT Unified Account and Quanto Swap Contract

Bitget will divide the contract merchandise into 4 main sectors after the brand new function is launched: USDT Margined contract/Coin Margined Contract/USDT Unified Account/Quanto Swap Contract. The USDT Margined Contract makes use of secure foreign money USDT because the margin; The Coin Margined Contract makes use of the coin held because the margin, and is priced, traded and settled by the coin

The largest spotlight of USDT Unified Account is that customers can select USDT to commerce a number of buying and selling pairs on the similar time, in which a number of contracts share the fairness of 1 account, and the revenue and loss, occupation and danger in the account are shared. Currently, Bitget can help as much as 20 currencies comparable to BTC, ETH, UNI, AAVE, and many others. This signifies that customers can open contracts of a number of buying and selling pairs in the identical account when utilizing USDT because the margin, and notice the multi-currency hedging in one account.

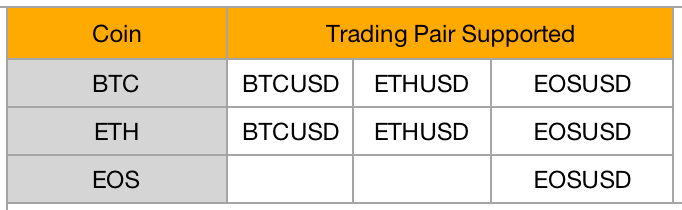

Quanto Swap contract helps a number of currencies as a margin to commerce different cash. The spotlight is that it has modified the normal buying and selling methodology that coin margined contracts solely apply to commerce the margined coin contract. Now one coin can be utilized as a margin for a number of buying and selling pairs on the similar time, with out the necessity for foreign money alternate.

For instance, a dealer holds and is optimistic about BTC for the long run, however predicts that ETH goes to rise just lately. The dealer hopes that after finishing the contract transaction, BTC will likely be returned to his account.

It just isn’t tough to inform that, in contrast with conventional Coin Margined Contract, the benefits of Quanto Swap Contract are significantly apparent. First of all, throughout the transaction course of, the operation is very simple, with out the loss brought on by the foreign money alternate course of. Secondly, in the settlement, the foreign money of the account can be utilized as a margin for revenue and loss settlement, and the consumer can lastly get the specified foreign money. Thirdly, you may get a revenue when the margin coin worth rises whereas buying and selling. For instance, if you commerce ETH, use BTC because the margin. If the BTC rises, you may get each the buying and selling earnings and the elevated earnings. Lastly, the Quanto Swap Contract helps utilizing sure margin currencies to commerce a number of buying and selling pairs on the similar time and accomplishes inner hedging, fairness sharing, and risk-sharing.

It is reported that the Bitget Quanto Swap Contract will likely be launched on the finish of March, and the worldwide public beta will likely be launched. Bitget will help the three mainstream currencies of BTC, ETH, and EOS. Bitget CEO Sandra mentioned, “USDT Unified Account and Quanto Swap Contract are a sincere work launched by Bitget for global users this year. After it is launched at the end of March, welcome to experience them and give us suggestions. Quanto Swap Contract will add more coins based on user feedback”