The market has been struck by the bears, however Ethereum (ETH) has managed to keep up facet motion in the 24-hour chart. Trading at $2.404,36, ETH moved in the direction of a brand new all-time excessive earlier than the crash. Investors in search of entry for an extended place may benefit from the present dip.

Analyst Ben Lilly has been maintaining a detailed eye on the buying and selling pair ETH/USD. Predicting the current bullish worth motion, the analyst claimed elevated volatility for the pair because it moved close to a low level on its gamma curve.

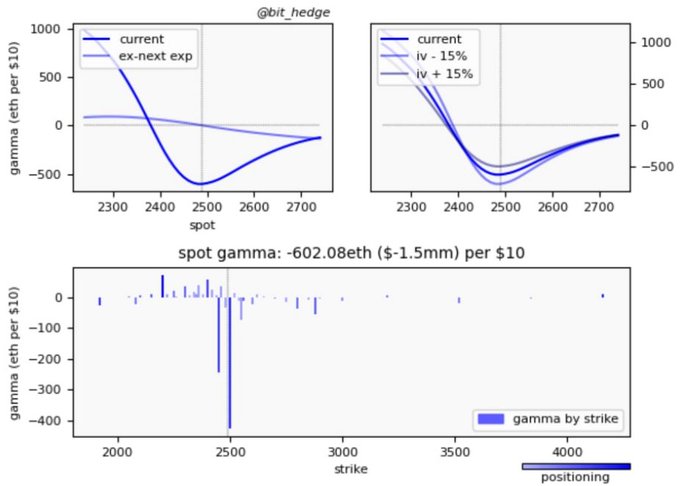

Used as a metric to measure how briskly the worth of an asset can change in relation with every one-point improve, the gamma on this buying and selling pair additionally hinted at a “more explosive” worth motion to the upside and additional volatility in the direction of the weekend, as Ben Lily said:

(…) again at max detrimental gamma, about $1.5mn per $10 strikes. (Volatility) nonetheless excessive till the weekly shut tomorrow.

At the time of writing, Bitcoin’s (BTC) price is sinking on the lower and high timeframes. On the opposite hand, ETH holds key assist on the aforementioned ranges. This worth motion coincides with a drop in Bitcoin’s dominance to comparable ranges not seen because the 2017 bull market.

During this era, “altcoins went bananas”, because the analyst said whereas sharing the chart beneath exhibiting two-moment when ETH’s worth has exceeded “in expectations”. Ben Lilly added:

The preliminary break larger resulted in almost 800% returns whereas the second, over 400%. These varieties of “effects” are what I think about breaking the norm (…) . And for now I see the potential of 1 altseason starting to take type.

Ethereum’s Most Bullish Factor

Two extra occasions might function as catalyzers for ETH’s worth. As the analyst mentioned in a earlier evaluation, on the finish of April funding agency Grayscale will start buying belongings for its product.

At first, this might have favored Bitcoin’s worth because the Grayscale Bitcoin Trust (GBTC) represented a lot of the demand for this cryptocurrency in the previous months. The state of affairs now may very well be totally different, as Ben Lilly said:

One factor I’d like so as to add is the movement of capital from GBTC impact may not re-enter. But nter ETHE or the opposite trusts. The different Trusts have much less circulating provide and creating premiums in these automobiles is much less capital intensive. Grayscale Effect 2.0 – Altcoin model?

However, ETH’s worth greatest catalyst may very well be carried out with Hard Fork London and EIP-1559. To be deployed in July, this replace will change Ethereum’s charge mannequin and can make ETH an asset with deflationary strain and a provide in steady discount. Co-Founder of Ethhub.eth, Anthony Sassano, explained it as comply with:

Once EIP-1559 is carried out, each single transaction on Ethereum will burn $ETH. Every liquidation, each ETH switch, each layer 2 proof, each DEX commerce, and even each rug pull – it doesn’t matter what the transaction is – ETH will proceed being burned. Forever.