Launched in 2018, Uniswap is a decentralized trade protocol that permits customers to swap between any two ETH-based tokens. Apart from offering a easy platform to liquidity suppliers, Uniswap has made the entire strategy of offering liquidity and incomes buying and selling charges rather a lot easier.

Uniswap liquidity suppliers earn buying and selling charges on each commerce made on Uniswap. In return, the liquidity suppliers facilitate buying and selling between totally different ETH-based tokens, which is able to enhance the commerce quantity and the recognition of the platform.

On September 17th, 2020 Uniswap launched its UNI token with an enormous airdrop that distributed 400 UNI to all of the customers who used their protocol up to now. In complete, 15% of UNI complete provide was distributed by the airdrop.

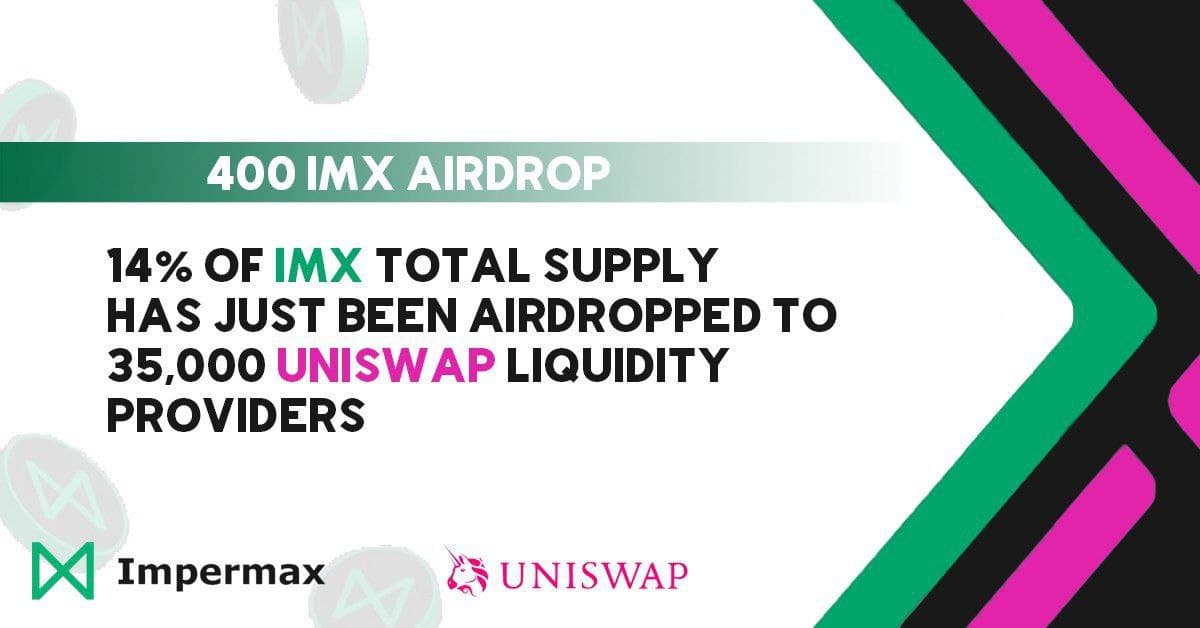

Following the identical sample, Impermax Finance, a DeFi lending protocol, airdropped 14 Million IMX tokens to 35,000 Uniswap V2 Liquidity Providers on April 29. Each one of many 35,000 acquired 400 IMX, an quantity impressed by the infamous UNI airdrop. IMX token is a governance token with a max provide of 100 million, and the airdropped quantities to 14% of its complete provide.

Uniswap V2 Liquidity Providers welcomed this information with nice pleasure as they are going to be in a position to leverage these tokens to add liquidity to the swimming pools and earn rewards.

Airdrop Details

- Impermax Finance airdropped 14% of IMX Governance token from the max provide of 100 Million tokens to 35,000 Uniswap V2 Liquidity Providers on April 29. LPs that had been offering at the least $952 in liquidity to Uniswap V2 on April 25 on the time of the snapshot are eligible to declare the 400 IMX airdrop.

- To declare the airdrop, Liquidity Providers can go to the Impermax app, join their wallets, and declare the tokens by the declare button.

- The IMX TGE goes dwell on Uniswap on April 29 at 12:00 pm UTC with a beginning circulating market cap of $1.eight million.

- This airdrop was aimed to distribute IMX governance participation.

- This airdrop may even assist improve utilization throughout the Uniswap Liquidity Provider base, that are supposed to be the first customers of the platform.

- Impermax is attempting to improve consciousness of leveraged liquidity offered within the DeFi trade. This protocol helps Liquidity Providers enhance their yields by x20 by borrowing in opposition to their LP token holdings.

- The skill to use LP tokens as collateral for borrowing can doubtlessly make the most of billions of {dollars} which might be locked in LP token contracts.

Why Impermax Finance is a breakthrough in DeFi

Impermax Finance is a complicated DeFi ecosystem that helps Liquidity Providers to leverage their LP tokens and holdings by making a set of monetary instruments primarily based on these tokens. It is a permissionless lending market that Liquidity Providers can make the most of to leverage LP tokens as collateral to borrow different tokens of their ETH pair. For occasion, Liquidity suppliers can use the LP token of the pair ETH/DAI as collateral to borrow DAI or ETH.

Impermax Finance acts because the lacking piece within the automated market maker’s puzzle, which is filled with inefficiencies. Impermax solves this downside by utilizing its lending protocol that depends solely on LP tokens.

This progressive collateralization mannequin designed for LP tokens will assist Liquidity Providers to reap the benefits of the truth that the property are straight backed by the collateral. The first AMM that the corporate added is Uniswap V2.

This airdrop was additionally an intention to incentivize the Uniswap V2 Liquidity Providers in buying and selling IMX and enhance the recognition and utilization of Impermax Finance.

This airdrop of 14 million IMX was adopted by a Pre-launch airdrop by the corporate. In that airdrop, the corporate centered on their early supporters and airdropped 500,000 IMX to the customers who utilized their protocol earlier than April 29. However, each the airdrops passed off on April 29, which can be the official date for his or her token launch.

For extra details about the airdrop and the platform, you may go to their official website.