Microsoft shares have fallen heavily as the software giant reported disappointing results that deepened investors’ fears about the artificial intelligence boom.

Shares in the company fell by more than 7pc in after-hours trading, wiping more than $200bn (£155bn) off the company’s value and sending its market capitalisation below $3 trillion.

Microsoft reported a 15pc increase in quarterly revenues to $64.7bn, while profits rose by 10pc to $22bn.

Despite the figures being better than forecast, investors took fright at lower-than-expected sales in its cloud computing division, which is seen as the company’s key growth driver.

Shareholders had been on edge after last week’s disappointing results from Google’s parent company Alphabet, a rival in the AI race.

The Seattle-based company has been at the forefront of AI thanks to a major investment in OpenAI, the US start-up behind ChatGPT, and is spending billions building the computing infrastructure it says will be needed to power the next generation of systems.

However, tech stocks have fallen in recent weeks amid fears about overspending and concerns that AI is failing to produce revenues that match the hype.

On Tuesday, shares in Nvidia, the microchip company that has been the poster child of the AI boom, fell by more than 6pc.

Microsoft’s figures triggered a wider sell-off in after-hours trading with Nvidia falling a further 2pc and British semiconductor company Arm falling 2.6pc.

The Nasdaq index, dominated by big tech companies, is currently trading at its lowest level for two months, although it has still risen by 16pc so far this year.

The so-called “magnificent seven” of Microsoft, Apple, Tesla, Alphabet, Meta, Amazon and Nvidia have lost $1.5 trillion in value between them in the last three weeks.

Meta is due to report quarterly figures on Wednesday, followed by Amazon and Apple on Thursday.

Microsoft’s figures came after the company had faced a widespread outage involving its services such as Outlook email and cloud hosting.

Cambridge Water and Starbucks were partially affected by the problem. Microsoft said it had largely resolved the issue.

The outage came less than two weeks after a flawed update in the security software CrowdStrike meant millions of Windows computers were able to boot up, in what was seen as the biggest IT outage in history.

09:39 PM BST

That’s all for today…

Thanks for joining us as we’ve covered the results from Microsoft and beyond.

Chris Price will be back in the morning with the latest from the markets and the world of business.

09:36 PM BST

Rally in small-cap companies ‘unsustainable’, claims analyst

While Big Tech is having a bad time, other stocks have been rising up to cushion some of Big Tech’s recent softness.

These include smaller stocks and companies whose profits are closely tied to the strength of the economy. The Dow Jones Industrial Average of 30 leading US firms, including 3M, American Express and Coca-Cola, is up 4pc over the past month.

Many companies have rallied on hopes that inflation is slowing enough to get the Federal Reserve to soon begin cutting interest rates.

The Russell 2000 index of smaller stocks added 0.3pc today to stretch its market-leading gain for the month to 9.5pc.

Many along Wall Street expect this rotation from Big Tech to smaller stocks to continue, but more cautious voices are still urging skepticism.

“In our view, the recent rally is likely unsustainable as the fundamental support is lacking,” according to Austin Pickle, investment strategy analyst at Wells Fargo Investment Institute, who pointed to how more than 40pc of small-cap companies are not making any profits, among other challenges.

09:26 PM BST

Nasdaq falls again while Dow advances

The tech-rich Nasdaq tumbled again today while the Dow Jones forged higher as investors continued to steer funds away from artificial intelligence stocks toward other sectors.

The ongoing so-called “rotation” from tech giants to smaller and medium-sized company comes as some of the biggest tech companies are set to report quarterly results in the coming days.

But Art Hogan, chief market strategist at B. Riley Wealth, noted that this buying trend may be almost over now that Microsoft, Nvidia and others have fallen significantly from their peaks.

The Dow Jones Industrial Average gained 0.5pc to 40,743.33.

The broad-based S&P 500 dropped 0.5pc to 5,436.44, while the tech-rich Nasdaq Composite Index fell 1.3 percent to 17,147.42.

Microsoft reported after the market closed Tuesday, while Apple, Amazon and Facebook parent Meta will report over the next two days.

“This rotation likely stops when we get the majority of these mega caps to report,” Mr Hogan said.

09:19 PM BST

Starbucks quarterly revenue falls on weak traffic in US and China

Starbucks’ revenue fell 1pc in the April-June period as customer traffic weakened in the US and China.

The Seattle coffee giant reported revenue of $9.1bn (£7.1bn) for its fiscal third quarter. That was lower than the $9.2bn Wall Street anticipated, according to analysts polled by FactSet.

Starbucks said global same-store sales – or sales at locations open at least a year – fell 3bn. Analysts had expected a 2.7bn drop.

In China, where Starbucks is feeling pressure from lower-priced rivals, same-store sales plunged 14bn. Chinese customers visited less often and spent less per visit, Starbucks said.

In the US, same-store sales fell 2pc. Starbucks said higher spending per visit helped offset a slowdown in traffic.

Starbucks said its net income fell 7.6pc to $1.05bn. That was in line with analysts’ forecasts.

09:16 PM BST

After-hours sell-off among Big Tech firms

The market is not happy with Microsoft’s results, which might ordinarily be seen as strong if there was not so much hype around AI. Shares have plunged in after-hours trading, currently down more than 6pc.

Amazon has droped more than 3pc, and Tesla is down 0.9pc, in after-hours trading. Arm, which dropped 6pc during trading, has dipped 2.9pc after hours, while AMD, down 0.9pc during trading, has dropped 1.7pc after hours.

07:36 PM BST

Signing off…

Thanks for joining us today. We’re closing the live updates for the time being but will be back after 9pm to update you on Microsoft’s financial results.

07:35 PM BST

Airbus boss admits delayed jet deliveries are frustrating airline efforts to cut CO2 emissions

Airbus admitted that delayed aircraft deliveries are starting to impact the ability of airlines to cut carbon emissions after Air New Zealand abandoned green targets for 2030. Christopher Jasper reports:

Boss Guillaume Faury said Tuesday that disruption to supply chains at his own company and a safety and quality-control crisis at rival Boeing are having a knock-on effect for carriers relying on new fleets to deliver ambitious reductions in CO2 output.

Air New Zealand said earlier it would drop the 2030 goal as delivery delays make it increasingly likely that less-efficient jets will need to be retained. At the end of March it had outstanding orders for five Airbus A320neo short-haul jets and eight Boeing 787 widebodies.

Mr Faury conceded that the move reflected “the broader situation of slower deliveries from the aircraft manufacturers. Replacing the old generation of planes with modern ones is a significant driver of CO2 reduction. And a slowdown in the ramp up has an impact on the speed of the replacement.”

He said that new aircraft typically reduce fuel burn and emissions by 20pc, rising to as much as 40pc when very old models are being stood down.

Air New Zealand, which withdrew from the UN-backed Science Based Targets initiative, said efforts to reduce emissions were also being held back by the lack of availability – and cost – of sustainable aviation fuel.

Airbus confirmed that it expects to deliver 770 airliners this year, down from an initial target of around 800, as suppliers struggle to meet demand for components including engines, seats, cabin trim and landing gear. The company has pushed back plans to lift A320 build rates to 75 per month by a year to 2027 as a result of the parts crunch.

Operating profits at the company fell by more than half in the second quarter as its space business booked a charge of €989m against underperforming telecoms, navigation and observation programmes, more than flagged in a profit warning last month. Faury said Airbus is evaluating all options for the division, including a restructuring or partial sale.

07:23 PM BST

Nvidia slumps as Big Tech sell-off deepens

US chip giant Nvidia dropped 5.7pc today as investors waited with bated breath for a steer from tonight’s Microsoft results on how well artificial intelligence-focused companies are performing.

The sell-off of technology stocks pushed the Nasdaq index down 1pc.

Microsoft, widely seen as a frontrunner in the artificial intelligence race, will release its quarterly results at 9pm today. Its stock was down 1.4pc.

Other Big Tech stocks such as Apple, Amazon, Facebook owner Meta, Google parent Alphabet and Tesla also fell.

The bar is set high for these highly valued technology behemoths, whose quarterly results during Wall Street’s current earnings season will be scrutinised for signs they have the momentum to spur further AI-led share price rallies.

Last week, results from Tesla and Alphabet induced a broad-based market sell-off.

Brian Klimke, chief market strategist at Cetera Investment Management, said: “Big Tech has had a great rally and for it to continue, they’re going to have to show benefits of AI and the investments they made in it.

“If not, we could see more of a rotation into smaller cap stocks and value stocks.”

Hopes of early rate cuts have prompted an investor run to mid- and small-cap stocks and away from market dominating tech-related sectors.

07:10 PM BST

Microsoft says outage is improving

Microsoft cloud computing service Azure has seen an “improvement in service availability”, Microsoft has said, but it is continuing to “investigate reports of specific services and regions that are still experiencing intermittent errors”.

06:21 PM BST

Labour scraps dozens of planned railway lines in blow to small town Britain

Labour has axed plans to reopen dozens of railway lines and stations closed during the 1960s Beeching cuts. Christopher Jasper reports:

The closure of the £500m Restoring Your Railway fund, announced by Rachel Reeves on Monday, leaves the future of projects across England and Wales hanging in the balance in a blow to small-town Britain.

The fund was established in 2020 as part of Boris Johnson’s “levelling up” agenda and has so far helped finance the reopening or near reopening of two lines and six stations. A dozen more projects are at an advanced stage and 20 others have received some funding.

Briefing notes issued following the Chancellor’s speech, in which she claimed that Labour had inherited a £22bn hole in the public finances from the Tories, suggest that scrapping the Restoring Your Railway programme will save £76m next year.

RailFuture, which campaigns for better passenger and freight services and has 20,000 members, said Ms Reeves’ intervention was “shortsighted” and at odds with Labour’s aim of putting infrastructure and construction at the heart of plans to revive the economy.

06:15 PM BST

Shell and Exxon sell southern North Sea assets

Shell and Exxon are to sell some North Sea production facilities to Viaro Energy, and independent British oil and gas producer.

With this deal, Exxon will complete its exit from the North Sea region, where it has been present since 1964.

The US oil major sold most of its assets in the central and northern North Sea to Neo Energy in 2021 and its rival Chevron is also in the process of selling its last remaining assets in the ageing basin.

In 2023, the assets produced around 28,000 barrels of oil equivalent per day, about 5pc of UK’s total gas production, Viaro said.

Pending regulatory approval, Viaro will acquire a portfolio consisting of 11 operated offshore assets and one exploration field, all tying back to the onshore Bacton Gas Processing Terminal.

The exit is the latest step in a steady retreat of top energy companies from the declining British basin which pioneered deepwater production in the 1970s, as they focus on newer assets around the world.

Shell remains one of the main producers in the North Sea, operating several fields.

05:46 PM BST

L’Oréal posts less-than-expected growth

French cosmetic giant L’Oréal reported sluggish sales growth for the second quarter of the year.

It came amid weak consumer confidence in China, the French producer’s second-largest market.

Sales rose 5.3pc, less than analyst predictions of a 6pc rise.

Growth at the French company’s dermatological unit, which includes brands such as La Roche-Posay and CeraVe, also fell short of estimates.

05:30 PM BST

London housebuilding target cut in boost for Khan

Labour has cut housebuilding targets for London in a boost for Sadiq Khan, at the same time as raising them in towns and villages across rural Britain. Melissa Lawford reports:

Angela Rayner, the Deputy Prime Minister, will cut the capital’s housebuilding target from 100,000 homes per year to 80,000 as she tears up the Tory method for calculating housing need.

Ms Rayner plans to scrap the old system that placed a huge emphasis on building in cities, according to her draft National Planning Policy Framework (NPPF) published on Tuesday.

Although this will mean more houses are needed in many rural parts of the country, the demands on London are being cut in a move that will make targets easier to hit for Mr Khan, the capital’s Mayor.

Ms Rayner intends to restore councils’ mandatory targets after they were scrapped by the Tories, as part of Labour’s manifesto pledge to build 1.5m homes over the next five years.

05:24 PM BST

Nasdaq falls as investors await Microsoft results

The Nasdaq Composite is down 1.3pc this afternoon as US shares took a hit ahead of Big Tech earnings.

Microsoft, widely seen as a frontrunner in the artificial intelligence race, will release its quarterly results after markets close at 9pm. Its stock is down 1.5pc.

Other megacap stocks such as Apple, Amazon, Facebook-owner Meta, Alphabet and Tesla also fell, as investors refrained from big bets ahead of tech earnings scheduled through the week.

AI favorite Nvidia slumped 6.2pc, leading a sharp erosion in chip stocks and pushing the Philadelphia Semiconductor index of 30 top US semiconductor companies down 2.9pc.

Last week, results from Tesla and Google-owner Alphabet induced a broad-based market sell-off in the previous week.

The bar is set high for these highly valued technology behemoths, whose quarterly results will be scrutinised for signs they have the momentum to spur further AI-led equity rallies.

Brian Klimke, chief market strategist at Cetera Investment Management, said:

Big Tech has had a great rally and for it to continue, they’re going to have to show benefits of AI and the investments they made in it.

If not, we could see more of a rotation into smaller cap stocks and value stocks.

05:17 PM BST

Pfizer lifts profit forecast on strong sales of cancer and heart drugs

Pfizer raised its annual profit forecast on Tuesday. Bits shares dipped 0.9pc this afternoon with investors unconvinced that over its future plans.

It was helped by cancer treatments acquired through a $43bn deal for Seagen and strong sales of its heart disease drug as the company deals with a sharp revenue drop from Covid products.

The market for Pfizer’s Covid vaccine and treatment has shrunk by billions of dollars a year.

Pfizer chief Albert Bourla responded with several acquisitions, including the Seagen deal and cost-cutting measures. The New York-based drugmaker has also sharpened its focus on cancer treatments.

Investors fled from Pfizer as Covid worries declined and the company’s shares are trading at around half their pandemic-era highs.

J.P. Morgan analyst Chris Schott said he expects Pfizer’s stock to continue to trade in the current range due to limited revenue growth and stronger expectations for many of its rivals.

He said:

We believe stronger new launch performance and/or further progress on the pipeline will be necessary to significantly change the narrative.

05:13 PM BST

Facebook agrees $1.4bn settlement in privacy lawsuit

Facebook-owner Meta has agreed to a $1.4bn (£1.1bn) settlement with Texas in a privacy lawsuit.

The tech giant is to pay out over claims that it used biometric data of users without their permission, officials from the US state said on Tuesday.

Ken Paxton, the Texas Attorney General, said the settlement is the largest-ever secured in a legal action by a single state. In 2021, a judge approved a $650m settlement with the company over similar claims in Illinois.

Filed in 2022, the Texas lawsuit alleged that Meta was in violation of a state law that prohibits capturing or selling a resident’s biometric information, such as their face or fingerprint, without their consent.

Meta, which made no admission of wrongdoing, said:

We are pleased to resolve this matter, and look forward to exploring future opportunities to deepen our business investments in Texas, including potentially developing data centers.

05:07 PM BST

Airbus profits plunge despite Boeing woes

Airbus said Tuesday that its net profit in the first half year fell 46 percent to €825m (£695m), dragged down by a massive writedown in its space operations.

Overall, revenue in the first half of the year rose 4pc to €28.8bn as its commercial aircraft deliveries rose by seven planes to 323.

Airbus announced in June that it had decided to make a roughly €900m charge against first-half earnings after an extensive review of its space business.

On Tuesday it said the charge for the space business was in fact €989m.

“The half-year financial performance mainly reflects significant charges in our space business,” Airbus chief executive Guillaume Faury said in a statement, adding the issues were being treated.

In June Airbus also reduced its forecast for 2024 operating earnings to €5.5bn, down from its previous guidance of between €6.5bn and €7.0bn, due to supply chain issues that are holding back increasing aircraft production.

“In commercial aircraft, we are focused on deliveries and preparing the next steps of the ramp-up, while addressing specific supply chain challenges and protecting the sourcing of key work packages,” Faury added.

Airbus and its rival Boeing are paid when they deliver aircraft, thus the supply chain problems are holding back earnings as both firms have huge order books.

In June, Airbus said it intends to deliver around 770 commercial aircraft in 2024, down from the 800 it forecast at the beginning of the year.

While the 323 aircraft delivered in the first half of the year was an improvement over the same period last year, deliveries dropped during the second quarter due to supply chain problems.

A number of suppliers who downsized during the pandemic are having difficulty scaling production back up, limiting Airbus’s ability to assemble more aircraft.

04:52 PM BST

FTSE 100 closes down

The FTSE 100 closed down this afternoon by 0.2pc. The top riser was Standard Chartered, up 5.9pc, followed by Burberry, up 3.7pc. The top faller was medical device company ConvaTec, down 5.8pc, followed by gambling group Entain, down 5.5pc.

Meanwhile, the mid-cap FTSE 250 rose 0.9pc. The top riser was wealth manager St James’s Place, up 24.8pc, followed by sausage roll giant Greggs, up 5pc. The biggest faller was Ocado, down 6pc, followed by City firm Close Brothers, down 2.9pc.

04:33 PM BST

Microsoft shares dip 1pc ahead of results

Microsoft shares have dipped this afternoon as investors wait for tonight’s financial results.

The software giant, with a market capitalisation of $3.1 trillion (£2.4 trillion), has benefited hugely from the hype around artificial intelligence.

Its shares up more than quarter in the past year, with investors hopeful that it is able to translate its investments in AI into greater revenues at its cloud computing unit Azure.

Ted Mortonson, managing director at wealth management firm Robert W. Baird, said:

Microsoft has to beat in a big way and they’ve got to show Gen AI monetisation. [It is] the most over-owned name globally, next to Nvidia. So those two really have to put up some good numbers.

And you’re going to have to see Azure accelerate … to make it work.

04:25 PM BST

Drug giant’s sales in China cause shares to sink

Shares in the drug giant Merck plunged 10pc after shipments of its Gardasil vaccine in the important China market declined in the second quarter, sparking investor concerns.

Gardasil, which prevents cancer caused by the human papillomavirus, has been one of Merck’s top growth drivers aside from cancer immunotherapy Keytruda – the world’s top-selling prescription medicine – with much of its increase coming from demand from China.

Sales of the drug have more than doubled since 2020 and are expected to close in on $10bn (£7.8bn) this year.

Merck said it was trying to determine the reason for the change in China, where it was seeing lower shipments from its distributor Zhifei to vaccination centers.

04:22 PM BST

World stocks mixed amid investor jitters, while commodities tumble

World stocks are mixed in choppy trading today. Investors are jittery ahead of major corporate earnings reports and central bank moves – with the much-anticipated Microsoft rates out after 9pm tonight.

Meanwhile, concern over the global economic outlook dented commodities and oil prices touched lows from early June.

Brent Crude, the international benchmark for oil prices, fell 1.4pc as worry over Chinese energy demand outweighed any concern about tensions in the Middle East or Venezuela.

Copper and iron ore prices were also lower, and aluminium fell to multi-month lows. It came after little by way of support from China’s Politburo, which at its July meeting announced no new detailed efforts to boost the economy.

Chris Scicluna, an economist at Daiwa Capital, said:

China has got its own problems and doesn’t look like it’s going to snap into gear.

Understandably, we might have been hoping for the global economy to be gaining traction and momentum to be picking up … but it looks like maybe things are coming off the boil a bit.

The MSCI World index dropped 0.3pc. However, the pan-European Stoxx 600 rose 0.5pc, and France’s Cac 40 and Germany’s Dax both rose 0.4pc. The FTSE 100 is down 0.2pc.

04:10 PM BST

US job openings fall as high interest rates slowly cool a hot labour market

US job openings fell slightly last month, a sign that the American labour market continues to cool in the face of high interest rates.

There were 8.18m job vacancies in June, down from 8.23m in May, the US Labor Department reported this afternoon. The June number was stronger than expected: forecasters had expected 8m job openings.

Still, the report showed other signs of a slowing job market. Employers hired 5.3m people, the fewest since April 2020 when the pandemic was hammering the economy.

The number of people quitting their jobs – a decision that reflects confidence in their ability to find higher pay or better working conditions elsewhere – slid to 3.3m, the fewest since November 2020.

But layoffs dropped to 1.5 million, lowest since November 2022 and down from 1.7 million in May, a sign that employers remain reluctant to let go of staff.

The Fed is widely expected to leave interest rates unchanged at its meeting this week but to begin cutting them at its next gathering in September.

04:05 PM BST

US consumer confidence edges up in July

American consumers felt more confident in July as expectations over the future rebounded.

The Conference Board, a business research group, said that its consumer confidence index rose to 100.3 in July from 97.8 in June.

The index measures both Americans’ assessment of current economic conditions and their outlook for the next six months.

The July figure was slightly higher than market expectations, according to Briefing.com.

Dana Peterson, Conference Board chief economist, said:

Confidence increased in July, but not enough to break free of the narrow range that has prevailed over the past two years.

Even though consumers remain relatively positive about the labor market, they still appear to be concerned about elevated prices and interest rates, and uncertainty about the future … things that may not improve until next year.

03:57 PM BST

Investors ‘investors pile back’ into FTSE 250

The FTSE 250 has jumped by 1.2pc in trading today, as investors warm to the index – which contains UK-focused stocks.

The FTSE 100 is currently flat.

Chris Beauchamp, chief market analyst at online trading platform IG, said:

News from Standard Chartered has helped provide some support to the FTSE 100, but fresh weakness for mining stocks and Diageo’s poor results have cast a shadow over the index.

The FTSE 100’s recent poor performance has seen its mid-cap cousin the FTSE 250 move further ahead, as investors pile back into UK-focused stocks despite the tough times ahead highlighted in the chancellor’s statement yesterday.

03:54 PM BST

Yen weakens before Bank of Japan rate decision

Markets believe there could be an interest rate hike tomorrow by the Bank of Japan.

The Japanese central bank will announce its rate decision at the conclusion of its two-day meeting on Wednesday. Markets are currently pricing in a 55pc chance of a 0.1 percentage point hike.

The yen weakened against the pound and the dollar ahead of the decision. It follows a significant rally this month that has seen the dollar lose around 4pc against the Japanese currency.

“We’ve obviously had a very big move in the month of July,” said Brad Bechtel, global head of FX at Jefferies in New York. Traders “are probably cleaning up ahead of the events, and month-end flows are dominating today.”

Some economists are also not convinced that the BOJ is ready to hike rates.

Jane Foley, head of FX strategy at Rabobank, said:

The market certainly has been quite excited about a rate hike, but economists and Bank of Japan watchers are far less certain.

03:47 PM BST

Wall Street drifts as profit reports keep pouring in

American stock indexes are drifting in quiet trading this afternoon as profit reports keep pouring in from big companies during Wall Street’s so-called earnings season.

The S&P 500 is down 0.1pc. The Dow Jones Industrial Average is up 0.4pc, and the Nasdaq Composite was down 0.4pc.

Trading on Wall Street has been relatively quiet so far this week ahead of profit reports from some of the market’s most influential companies. Microsoft will say how much it earned during the spring after trading ends this evening. Facebook-owner Meta, Apple and Amazon will follow in the coming days.

Those four are among the small group of Big Tech stocks that drove the S&P 500 to dozens of records this year, in part on investors’ frenzy around artificial intelligence technology.

But they ran out of momentum this month amid criticism they have grown too expensive and expectations had run too high.

Last week, investors found profit reports from Tesla and Alphabet underwhelming, which raised concerns that other stocks in what is known as the “magnificent seven” group of Big Tech stocks could also fail to impress.

Helpfully for the market, other stocks rose up to cushion their fall, including smaller stocks and companies whose profits are closely tied to the strength of the economy.

03:35 PM BST

Handing over

With that I am going to head off and leave you in the capable hands of Alex Singleton.

My parting gift is this chart on the US national debt:

03:28 PM BST

Drivers face longer wait for mis-selling compensation as review extended

Motorists who may have been mis-sold loans will have to wait even longer for potential compensation after a lengthy extension to a regulatory review.

Our reporter Michael Bow has the details:

The Financial Conduct Authority has extended an investigation into motor finance loans to May 2025 from an original deadline of September.

The watchdog is examining whether millions drivers may have been unfairly treated over the sale of loans used to fund the purchase of vehicles.

Some have compared the issue to the PPI scandal.

The Financial Ombudsman Service upheld two complaints over so-called discretionary commissions paid to car dealers earlier this year, prompting action by the FCA.

Banks like Lloyds have already booked a £450m provision while other lenders like Close Brothers have cut their dividend.

Under the new timetable, lenders can delay responding to complaints until December 2025.

The FCA said the chances of having to establish a full blown redress scheme were now more likely, leading to the timetable extension.

03:08 PM BST

Thousands of reports of outages

Down Detector, a website that tracks web outages, has received thousands of reports of Microsoft outages, which began at around 1pm UK time on Tuesday.

The productivity suite Microsoft 365, the Xbox Live gaming service, Minecraft servers and the Microsoft store all appear to have been affected.

The outage is ongoing, according to the website.

It comes as Microsoft is set to report quarterly results this evening.

02:39 PM BST

Wall Street rises at opening bell

The main US stock indexes opened higher as cautious investors awaited Big Tech earnings later,

The Dow Jones Industrial Average rose 82.2 points, or 0.2pc, at the open to 40,622.13 ahead of jobs market numbers which could offer clues on the timing of interest rate cuts in the US.

The S&P 500 rose 15.2 points, or 0.3pc, at the open to 5,478.73​, while the Nasdaq Composite rose 53.9 points, or 0.3pc, to 17,424.1.

02:37 PM BST

Microsoft suffers outage weeks after mass tech blowout

Microsoft has said it is investigating some outages on some of its Office applications and services weeks after an anti-virus update on some of its operating systems caused a global IT meltdown.

The tech giant, which reports its second quarter results after markets close on Wall Street later, tweeted that “multiple Microsoft 365 services and features” had been impacted.

Earlier this month, 8m computers running on the Windows operating system crashed after the cybersecurity company CrowdStrike released a flawed software update.

The outage caused travel chaos and left some businesses unable to take payments.

We’re currently investigating access issues and degraded performance with multiple Microsoft 365 services and features. More information can be found under MO842351 in the admin center.

— Microsoft 365 Status (@MSFT365Status) July 30, 2024

02:24 PM BST

Google owner’s deal with AI start-up faces competition probe

The competition watchdog has said it will more closely scrutinise Google-parent Alphabet’s partnership with artificial intelligence start-up Anthropic.

More than 18 months after Microsoft-backed OpenAI triggered an AI boom with the release of ChatGPT, regulators around the world have been increasingly concerned by multiple deals struck between smaller industry startups and big tech giants.

Agreements under scrutiny include Microsoft’s partnerships with startups such as OpenAI, Inflection AI, and Mistral AI, as well as Alphabet’s ties to other smaller companies such as Anthropic and Cohere.

Anthropic’s Claude AI models have vied for prominence with OpenAI’s GPT series.

Last week, the Competition and Markets Authority (CMA) issued a joint statement alongside its counterparts in the United States and the European Union, promising to work together to safeguard fair competition in the AI industry.

Anthropic, which was co-founded by former OpenAI executives and siblings Dario and Daniela Amodei, last year said it had secured $500 million in investment from Alphabet, promising another $1.5 billion over time.

Today, the CMA said it was now seeking views on whether the Alphabet-Anthropic partnership could lessen competition in the UK, and has set a deadline of August 13 for its invitation to comment.

02:05 PM BST

New Zealand’s flag carrier drops net zero targets

New Zealand’s flag carrer has become the first major airline to drop its net zero targets in a blow to campaigners seeking to decarbonise the polluting travel industry.

Air New Zealand has abandoned its 2030 emissions reduction target, which it blamed on delivery delays of fuel-efficient aircraft and high green fuel prices.

The carrier said it was committed to an industry-wide target of net zero emissions by 2050 and was working on a new near-term goal.

Aviation is deemed responsible for about 2pc of the world’s emissions but is considered one of the hardest sectors to decarbonise as fuel for flights cannot be easily replaced with other kinds of power.

Air New Zealand said: “Many of the levers needed to meet the target, including the availability of new aircraft, the affordability and availability of alternative jet fuels, and global and domestic regulatory and policy support, are outside the airline’s direct control and remain challenging.”

Airlines are banking on plant-based Sustainable Aviation Fuels (SAF) and more efficient aircraft to reduce emissions in the near-term, but SAF production is expensive and challenging to ramp-up, and plane manufacturers are struggling to deliver new-generation aircraft on time.

Air New Zealand had aimed to reduce carbon intensity 28.9pc by 2030 compared with 2019 levels, which went further than the global aviation industry’s aim to lower carbon emissions by 5pc by that time.

01:52 PM BST

BDO and Forvis Mazars threatened with action over poor audits

The UK accounting watchdog has threatened to take action against BDO and Forvis Mazars over the weakening quality of their audits.

The Financial Reporting Council (FRC) said inspections from its annual review of the UK’s largest auditors found the firms’ work did not meet its quality standards.

It came as the watchdog hailed an improved performance from the sector’s big four – Deloitte, EY, KPMG and PwC – after they came under scrutiny following a number of high-profile collapses over the past decade.

The FRC said on Tuesday that audit results for BDO “declined significantly from 69pc to 38pc” in its annual review.

It added that rival Forvis Mazars’ results declined from 56pc to 44pc year-on-year.

“Given their strategic importance to the audit market, both firms must urgently address the causes of these declines and undertake significant audit quality improvement plans which will be closely monitored by the FRC,” the regulator said.

It said it would work with the companies to monitor audit quality but could take “stronger action” if it fails to see improvements by next summer.

01:40 PM BST

Rayner: I will force councils to build houses if they miss targets

Angela Rayner has vowed to impose housebuilding plans on councils that refuse to meet new targets under a major overhaul of the planning system.

Our politics live blog editor Jack Maidment has the details:

The Deputy Prime Minister said she “will not hesitate” to intervene in areas that don’t build enough as she released swathes of the green belt for development.

Speaking in the House of Commons, she unveiled sweeping planning reforms designed to unblock construction and deliver 1.5 million new homes by 2030.

Ms Rayner announced that she is re-imposing mandatory housing targets, which were scrapped by Rishi Sunak, and increasing them from 300,000 a year to 370,000 a year.

Read on for details on the proposals.

01:25 PM BST

Gas prices edge lower amid strong stockpiles

Gas prices have steadied as Europe’s ample stockpiles allays concerns about stronger global competition.

Dutch front-month futures fell 0.8pc to less than €34 per megawatt hour after rising more than 4pc on Monday.

Prices have been rising amid increasing competition from Asia for liquefied natural gas (LNG) which Europe relies on more after Vladimir Putin halted Russian pipeline supplies following his invasion of Ukraine.

Frank van Doorn, head of trading at Vattenfall Energy, said: “Europe has become more dependent on LNG, which means that if there’s anything happening in the LNG world — like extreme search and demand in Asia or upstream problems, for example — prices will react.”

The UK equivalent contract was down 1.3pc to less than 79p per therm.

01:11 PM BST

German inflation rises as economy shrinks

German inflation edged higher at the start of the third quarter after its economy suffered a contraction in the three months to June.

The consumer prices index for Europe’s largest economy rose by 2.3pc in July, faster than the 2.2pc in the previous month and higher than economists’ predictions that it would be unchanged.

01:03 PM BST

Pound inches down ahead of interest rate decision

The pound has edged lower against the dollar as investors look ahead to the Bank of England’s interest rate decision on Thursday.

Sterling traded down 0.1pc at $1.285, after having touched a near three-week low of $1.281 against the dollar on Monday.

The euro gained 0.2pc against the pound to 84.3p, with the common currency helped by data showing the eurozone’s economy grew slightly more than expected in the three months to June.

Traders are pricing in a 58pc chance that the Bank of England will cut interest rates by 25 basis points from 5.25pc to 5pc on Thursday, with two cuts priced in by the end of the year.

It comes as prices in British shops rose at the joint-slowest rate since October 2021 this month, held down by falls in the cost of non-food items, according to the British Retail Consortium.

Jane Foley, head of FX strategy at Rabobank, said: “If we just go back week or two ago, the market was thinking 50:50 chance of a rate cut but economist surveys are more confident that there will be a move this week.”

12:41 PM BST

Scottish drinks maker boosted by surging Irn-Bru demand in England

Growing demand for Scottish soft drink Irn-Bru among English customers has helped boost sales for owner AG Barr.

The company, which owns a string of drinks brands including Rubicon and is based in Cumbernauld in Scotland, said sales of its soft drinks increased by about 7pc this year.

It expects to report total sales of about £221m for the six months to the end of July, 5pc higher than the prior year.

AG Barr said that sales of Irn-Bru, the sparkling soft drink launched in Scotland more than a century ago, were higher in terms of both value and volume – meaning it sold more than a year ago.

It also said Irn-Bru was growing its share of the soft drinks market in England as the brand, badged Scotland’s “other national drink”, grows in popularity across the border.

The company launched a new advert for the drink linked to the Scotland men’s football team qualifying for the Euro 2024 tournament, which it said had been “highly successful”.

12:11 PM BST

PayPal bets on consumers holding up in face of high interest rates

PayPal has raised its forecast for full-year adjusted profit for the second time as it bet on resilient consumer spending in the back-to-school and upcoming holiday shopping seasons.

American consumers have remained remarkably hardy despite higher interest rates burning a hole in their pockets.

Even as rival payments companies have flagged worries of increasing pressure on the lower-income bracket, the sector logged broadly steady growth in transaction volumes this year.

Meanwhile, under chief executive Alex Chriss, the payments giant has focused on improving operating margins by restructuring, aggressively cutting costs and reducing its headcount.

In January, it announced plans to slash about 2,500 jobs, or 9pc of its global workforce.

PayPal now expects adjusted profit growth in a “low to mid-teens percentage” in 2024, compared with its April forecast of a “mid-to-high single-digit” increase.

Total payment volumes increased 11pc, to $416.8bn (£324.2bn) in the second quarter, while net revenue climbed 9pc, to $7.9bn on an constant currency basis.

PayPal’s operating margins expanded 231 basis points on an adjusted basis, to 18.5pc in the quarter. Its margins have been central to investor anxiety over the past year, after post-pandemic growth slowed.

11:52 AM BST

Wall Street poised to open higher ahead of jobs figures

US stock markets are on track to open higher ahead of closely watched jobs figures which could give a clue on the path to interest rate cuts.

Microsoft will later kick off the week’s Big Tech earnings reports, with Apple, Amazon and Meta due to reveal their results later this week.

The results are expected to have a high bar to impress investors after Alphabet’s better-than-expected second-quarter results failed to halt a sharp sell off on Wall Street last week amid fears that the AI excitement has been overdone.

After trading begins, the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) is expected to show 8m job openings in June, down from 8.14m in May.

The continued improvement in inflation and an easing jobs market have bolstered expectations that the Federal Reserve will signal an interest-rate cut in September when it announces its next monetary policy decision tomorrow.

In premarket trading, the Dow Jones Industrial Average, S&P 500 and Nasdaq 100 were all up about 0.2pc.

11:50 AM BST

Germany ‘stuck in crisis’ as economy unexpectedly shrinks

The latest German GDP figures mean that since the start of 2022, Europe’s largest economy has registered a negative growth rate for five out of 10 quarters.

Klaus Wohlrabe, head of surveys for the Ifo Institute for Economic Research, said:

The German economy is stuck in crisis.

Hardly any improvement is to be expected in the third quarter of 2024 either. That is indicated by the results of the Ifo Business Climate Index in July.

Kathleen Brooks, research director XTB, said: “Germany is once again the sick man of Europe.”

11:37 AM BST

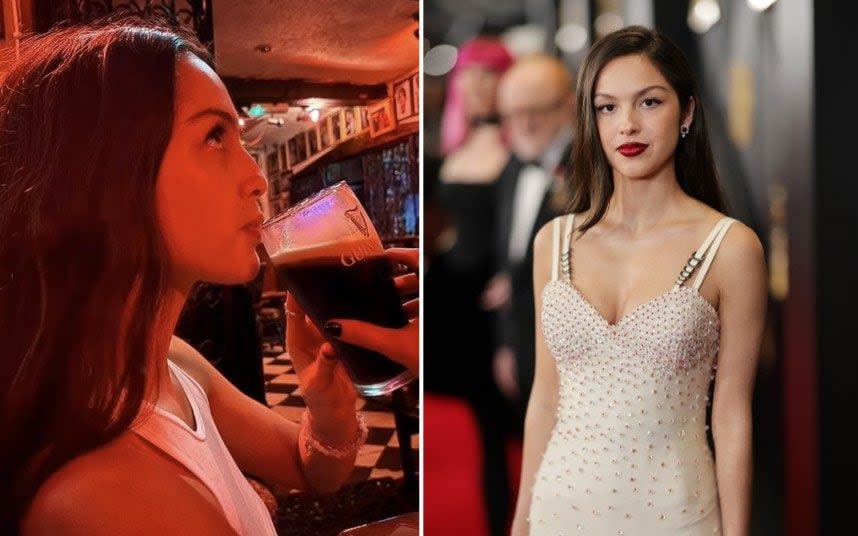

Demand for zero-alcohol Guinness surges among teetotal Gen Z

Non-alcoholic Guinness sales have doubled in Europe amid surging demand from teetotal Gen Z drinkers.

Melissa Lawford and Hannah Boland have the details:

Guinness 0.0 now accounts for 3pc of all global Guinness sales after consumption doubled across Europe in the year to June, according to maker Diageo’s preliminary results.

Debra Crew, chief executive of the distiller, said: “We literally cannot make enough of it. It is flying off the shelves.”

Guinness 0.0 was launched in 2021 and in the last six months has become the UK’s top selling non-alcoholic beer.

Read how, despite the strong Guinness sales, it was a tough year for Diageo.

11:21 AM BST

US ‘hawkishness’ on China to remain, says top bank boss

America’s hardline approach to China is likely to remain whoever wins the White House in November, the chief executive of global bank Standard Chartered said.

Our reporter Michael Bow has the details:

Bill Winters said he expected the new US administration’s “hawkish” approach to stay in place for next four years, with Democratic candidate Kamala Harris and Republican nominee Donald Trump likely to maintain the same foreign policy of the last eight years.

“The Biden administration has been very hawkish on China, with the combination of trade restrictions and sanctions and the Trump administration was also hawkish on China,” he said.

“Whoever wins this election, Harris or Trump is likely to continue to be hawkish on China.”

The US presidential run-off in November is likely to pit Harris against Trump after President Biden announced he would not run again.

Standard Chartered is based in the UK but its clients are based in Asia, leaving it more exposed to rising US-China tensions.

Mr Winters said the bank had swerved any fall-out from the chilly relationship so far, saying the services offered by the bank benefited from China having to “open up”.

11:06 AM BST

Oil prices fall amid doubts over China demand

In energy markets, oil prices hit seven-week lows amid doubts over demand from China.

Brent crude, the international benchmark, was down 0.2pc to less than $80 a barrel amid worries over the health of the world’s second largest economy.

US-produced West Texas Intermediate was down 0.2pc to less than $76.

China suffered a slowdown in growth in the three months to June, falling to the worst pace in five quarters, as faltering consumer spending undermined a boom in exports.

Steve Clayton, head of equity funds at Hargreaves Lansdown, said: “Traders are struggling to see anything other than a fully supplied market for crude in the months ahead, suggesting that major producers are going to need to show supply restraint if prices are to make any sort of meaningful recovery.”

10:52 AM BST

Foxtons sales and lettings revenue rises

London’s largest estate agent continued the recovery in its share price as it said profits targets remain on track.

Foxtons said it is on course to deliver its medium-term target of £25m to £30m adjusted operating profit amid a turnaround that has seen its share price rise 72pc over the last year.

Britain’s largest letting agency by share of instructions increased revenue by 11pc to £78.5m as its lettings, sales and financial services businesses all delivered growth.

Pre-tax profits rose 24pc to £7.5m, boosting its shares by 2.3pc today.

Chief executive Guy Gittins said:

Despite macro headwinds and the election interruption, we continued to outperform the market, delivering strong sales revenue growth of 28pc and market share growth of 30pc.

Growth was also delivered in lettings, with a double-digit increase in new business volumes, further bolstered by the acquisitions we made in 2023.

10:26 AM BST

Eurozone recovery means to need to rush interest rate cuts, say economists

The European Central Bank will be in “no rush” to cut interest rates after official data showed the eurozone economy grew faster than expected, according to economists.

Jack Allen-Reynolds of Capital Economics, said:

The eurozone’s recovery continued at a decent pace in Q2 and it should get a small boost from the Paris Olympics in Q3.

But the bigger picture is that the timeliest surveys are fairly weak and we expect the economy to undershoot consensus forecasts over the next few years.

In the third quarter, we think that the Olympics will add about 0.2pc to France’s GDP, raising eurozone GDP by 0.04 percentage points.

But that boost will disappear in the fourth quarter and the latest surveys suggest that underlying growth prospects are subdued.

July’s PMIs were surprisingly weak and the European Commission’s economic sentiment indicator, published this morning, was some way below its long-run average too.

Together with the better-than-expected second quarter growth number, this will reinforce ECB policymakers’ view that there is no rush to loosen monetary policy significantly.

10:15 AM BST

Ex-BT boss Jansen hired as WPP chairman

WPP has appointed former BT boss Philip Jansen as its new chairman as the advertising giant grapples with the rapid rise of artificial intelligence.

Our reporter James Warrington has the details:

Mr Jansen, who stepped down as BT chief executive in February after five years in the role, will join the WPP board in September.

He will take over as chairman in January, succeeding Roberto Quarta, who has led the ad group for almost a decade.

It comes at a critical time for WPP, which has restructured its sprawling network of agencies and has embarked on a heavy cost-cutting plan.

The London-listed group is also contending with the impact of AI on advertising and is planning to spend hundreds of millions of pounds on the new technology.

During his time at BT, Mr Jansen oversaw radical cost-cutting that included a plan to slash 55,000 jobs from the business. He was paid £3.7m in his final year at the company.

Prior to BT, he led fintech Worldpay and began his career at consumer goods group Procter & Gamble.

10:03 AM BST

Eurozone economy grows more than expected

The eurozone economy grew at a faster pace than forecast as stronger growth in Spain and France offset a slump in Germany.

Seasonally adjusted gross domestic product (GDP) increased by 0.3pc in the three months to June, which was more than the 0.2pc predicted by economists.

The single currency bloc’s economy was also revised higher for the first quarter of the year, rising from 0.2pc to 0.3pc.

09:52 AM BST

Germany ‘performing very poorly’, say economists

The unexpected 0.1pc contraction in German GDP in the second quarter poured cold water on hopes of a tentative recovery in Europe’s largest economy.

There was a noticeable decline in investments in equipment and construction in the three months to June, statistics office Destatis said.

Germany, traditionally a driver of European growth, was the the only major advanced economy to shrink in 2023 as it battled high inflation, a manufacturing slowdown and cooling export demand.

A string of indicators had suggested a recovery was getting under way at the start of the year, but hopes of a strong rebound have been tempered by weaker data in recent weeks.

LBBW economist Jens-Oliver Niklasch, said:

Germany is performing very poorly at the moment, especially in comparison with neighbouring European countries where we have seen quite robust growth figures.

Of course, Germany’s export-orientated industry is more exposed to the weakness of the Chinese economy, for example, but many of the problems are homemade.

09:44 AM BST

Spanish economy grows faster than expected

The Spanish economy grew by a faster-than-expected 0.8pc in the second quarter on the back of higher exports and strong household spending, official data showed.

The growth rate is one of the highest in the eurozone where it is the fourth biggest economy and contrasts with a 0.1pc contraction logged by Germany over the same period.

The Bank of Spain had forecast economic growth of 0.6pc for the three months to June period and the preliminary INE national statistics institute figures matched the revised 0.8pc growth seen in the first three months of 2024.

Growth was driven by a 1.2pc rise in exports and higher business investment, which rose by 0.9pc after expanding 2.6pc in the previous three months.

Higher household spending also helped, rising 0.3pc, down slightly from a 0.4pc expansion in the previous quarter.

Economy Minister Carlos Cuerpo said the rise in exports “reflects the dynamism and competitiveness of our companies”, adding that Spain’s overall economic growth “continues to be balanced with a very positive contribution from our foreign sector”.

The Spanish government this month increased its growth forecast for the economy this year to 2.4pc from 2pc.

09:13 AM BST

Germany at risk of recession as economy unexpectedly shrinks

The German economy unexpectedly shrank in the second quarter of the year in a blow to Olaf Scholz’s hopes of a recovery.

Europe’s largest economy contracted by 0.1pc in the three months to June, federal statistics office Destatis said, which was lower than economist estimates of growth of 0.1pc.

Germany dodged a technical recession at the start of the year after its gross domestic product (GDP) grew by 0.2pc, after contracting by 0.4pc at the end of 2023.

The German economy unexpectedly contracted 0.1% on quarter in the second quarter of 2024, reversing from a 0.2% growth in the first three months of the year and compared to forecasts of a 0.1% gain, preliminary estimates showed.https://t.co/KzieO2dmwM pic.twitter.com/oWZAbMXUQY

— TRADING ECONOMICS (@tEconomics) July 30, 2024

08:57 AM BST

St James’s Place surges as it reveals cost-cutting plans

St James’s Place shares surged to the top of the FTSE 250 after it said it plans to cut tens of millions of pounds of costs.

The wealth manager jumped 19.9pc as it said a business review would save £100m before tax per year – or 15pc – by 2027.

It said it expects this to result in pre-tax benefits of £30m in 2027, £50m in 2028, and £70m from 2029 onwards.

It comes after an overcharging scandal at St James’s Place, which in February set aside £426m for potential refunds for clients who were overcharged for advice they had not received.

In its half year results, the wealth manager said gross inflows rose by 6.3pc to £8.5bn as it revealed record funds under management of £181.9bn.

Its client base increased by 4pc to 988,000.

08:45 AM BST

UK shares mixed ahead of interest rate decisions

UK stocks were mixed as investors were cautious ahead of interest rate decisions in Britain and the UK.

The blue-chip FTSE 100 index was down 0.4pc after hitting its highest level since early June on Monday. The mid-cap FTSE 250 index was up 0.3pc.

The beverages sector was the worst hit, down 6.8pc to its lowest since November 2020.

It comes after Diageo fell 8.3pc to the bottom of the FTSE 100 after the spirits maker reported a steeper than expected 4.8pc decline in annual organic operating profit.

Energy shares climbed as much as 1.4pc, buoyed by a 2.3pc gain for BP, which reported a second-quarter profit above expectations, raised its dividend and extended its share repurchase programme.

Precious metal miners rose 1.5pc as heavyweight Fresnillo gained as much as 3.6pc after its half-year results.

Investors exercised caution ahead of interest rate decisions in the US and the UK, due later this week. The Federal Reserve is expected to keep rates unchanged, while bets of a cut from the Bank of England stand at just over 58pc, despite data showing sticky services inflation.

Also on the radar this week are a crucial jobs report in the US and quarterly earnings from Big Tech names like Microsoft, which is set to report after the closing bell today.

08:20 AM BST

Standard Chartered’s ‘crap’ share price jumps as profits rise

Standard Chartered shares surged on the FTSE 100 as it expanded its share buyback programme after its wealth business drove a rise in profits.

The lender said it will repurchase a record $1.5bn (£1.2bn) of shares as it aims to return at least $5bn (£3.9bn) to shareholders by 2026.

Shares jumped 6.2pc in early trading, months after its chief executive Bill Winters called the bank’s share price “crap” as he unveiled a major overhaul designed to simplify the sprawling lender.

Its stock have gained 16pc since he made the comments in February, with its latest boost coming after it said second quarter pre-tax profits hit $1.8bn, beating analyst estimates of $1.6bn.

Mr Winters told Bloomberg TV:

We are pursuing the strategy, it’s working quite well, earnings are strong.

Especially given where our stock price is, which is not as high as we think it should be, we will buy back as many shares as we can with surplus capital.

08:06 AM BST

UK markets fall as oil prices decline

UK markets have begun the day lower as oil prices hit seven-week lows amid worries over Chinese demand.

The energy-heavy FTSE 100 fell 0.2pc to 8,279.31 while the midcap FTSE 250 dropped 0.2pc to 21,214.09.

07:58 AM BST

French economy grows faster than expected

France’s economy expanded by a stronger-than-expected 0.3pc in the second quarter, the national statistics institute reported.

The quarter-on-quarter growth outperformed the INSEE institute’s earlier estimate of 0.1pc, lifted by foreign trade and a recovery in corporate investment.

Domestic demand made a small positive contribution to growth while household spending, a main driver of first-quarter expansion, was steady in the three months to June.

INSEE also revised its first-quarter growth estimate to 0.3pc from a previous 0.2pc.

07:55 AM BST

Greggs reveals cool profits amid boost from iced drinks

High street bakery chain Greggs said strong demand for its pizza box deals and iced summer drinks have helped drive higher half-year sales and profits.

The group posted a 16.3pc rise in underlying pre-tax profits to £74.1m for the six months to June 29 as like-for-like company-managed shop sales jumped 7.4pc.

Greggs said profit growth was also supported by “better recovery” of cost inflation than a year earlier.

The group said it remains committed to its aims to have “significantly” more than 3,000 shops across the UK, having opened 51 outlets on a net basis to reach 2,524 in the first half.

07:50 AM BST

Consumer confidence jumps amid falling food inflation

Consumer confidence has hit a three year high as food inflation has fallen to a two-and-a-half-year low, new figures show.

Our reporter Melissa Lawford has the details:

Confidence rose from a reading of -5 over the Easter weekend to a neutral level of 0 in July, according to PwC.

The figure was published as separate data from the British Retail Consortium (BRC) showed that annual food inflation slowed from 2.5pc in June to 2.3pc in July, the slowest pace of growth since December 2021.

Overall shop price inflation held steady at just 0.2pc, the lowest pace of annual growth since October 2021.

PwC’s confidence figure was the highest it has been since September 2021 and was based on a survey of more than 2,000 people undertaken shortly after the general election.

The public is feeling more upbeat as the inflation crisis that has gripped the country for more than two years recedes and amid hopes of looming interest rate cuts.

Lisa Hooker, from PwC, said: “It is good to see the improvement in consumer sentiment this summer to the highest level in three years as this, together with more money in shoppers’ pockets from falling inflation and pay and benefit increases, means the outlook for spending should improve.”

07:44 AM BST

BP makes $5.5bn profit after scaling back green push

BP has revealed it increased second quarter profits as it focuses more closely on oil and gas developments.

The oil giant said its underlying replacement cost profit rose to nearly $2.8bn (£2.1bn) in the three months to June, up by 6pc on the same period last year, as its new chief executive Murray Auchincloss targets fossil fuel developments.

It made a better-than-expected half-year profit of $5.5bn (£4.3bn), although it was down on last year’s $7.6bn (£5.9bn) amid lower profitability in its refining business.

The energy company took a $1bn hit during the second quarter as a result of its decision to scale back its oil production operations in Germany.

BP announced a $1.75bn share buyback for the second quarter and committed to announcing $3.5bn of share buybacks for the second half of the year as it seeks to support “growing returns for shareholders”.

It also said that it has decided to push ahead with investment in the deepwater Kaskida development in the Gulf of Mexico, some 14 years after the Deepwater Horizon environmental disaster in which it spilled 4.9m barrels of oil off the coast of the US.

It also announced the “scaling back plans for new biofuels projects” a month after it emerged that it has put all new offshore wind projects on pause.

Mr Auchincloss, who became permanent head of the business at the start of the year, said: “We are driving focus across the business and reducing costs, all while building momentum in our drive to 2025.”

07:21 AM BST

Good morning

Thanks for joining me. BP has revealed higher profits as it scales back its push into greener technology.

The oil giant’s underlying replacement cost profit rose to nearly $2.8bn (£2.1bn), up by 6pc on the same period last year, as its new boss Murray Auchincloss said he was focusing on “growing returns for shareholders”.

5 things to start your day

1) Nationalised railways risk costing taxpayers £1bn a year, warn train operators | Labour’s plans will make sector ‘lose the grit in the oyster’, says Rail Partners

2) OBR to investigate Hunt’s Treasury spending forecasts over £22bn black hole | Chancellor accuses previous Conservative government of ‘covering up’ real state of finances

3) Why Labour’s bonfire of big projects risks dooming Britain to another lost decade | Cost-cutting measures set UK to be only G7 country where investment forecast to reverse

4) Obese people can’t help it, says boss of Zoe app | Nutrition company boss blames profitable, ultra-processed foods for growing waistlines

5) Ben Wright: It’d be a mistake to make a festish out of restoring Britain’s lost industrial past | Nostalgia for manufacturing heyday undermines other paths to a productive, resilient economy

What happened overnight

Asian shares mostly declined in cautious trading on Tuesday ahead of central bank meetings around the world.

The Federal Reserve, the Bank of England and the Bank of Japan are holding monetary policy meetings this week.

Japan’s benchmark Nikkei 225 lost 0.5pc in morning trading to 38,268.72, Australia’s S&P/ASX 200 decreased 0.9pc to 7,915.10 and South Korea’s Kospi shed 0.7pc to 2,747.06.

Meanwhile, Hong Kong’s Hang Seng slipped 0.8pc to 17,093.32 and the Shanghai Composite declined 0.7pc to 2,871.62.

On Wall Street yesterday, the S&P 500 gained 0.1pc, closing at 5,463.54, as did the technology-heavy Nasdaq Composite index, reaching 17,370.20. The Dow Jones Industrial Average of 30 leading US companies fell 0.1pc, to 40,539.93.

The yield on benchmark 10-year US Treasury slipped to 4.17pc from 4.19pc late Friday. It was as high as 4.70pc in April.