User expertise has been a longstanding downside in cryptocurrency. Early adopters have accepted many points that simply don’t exist in conventional monetary markets, together with friction with onboarding, gradual block affirmation occasions, and trade outages.

However, maybe considered one of the most important UX points for cryptocurrency merchants and traders is liquidity. The cryptocurrency markets are closely fragmented, with every trade working as a digital silo, unconnected to the others. It may even be the case that if you wish to commerce a specific altcoin, it’s essential to transfer funds between a number of exchanges merely to entry the token you want.

Now, we’re in a brand new period of adoption, with establishments searching for to realize publicity to the quickly rising digital asset markets. From an institutional standpoint, liquidity is an much more important problem. In a fragmented trade panorama, the liquidity of a well-liked buying and selling pair like BTC-USD or ETH-USD is simply as deep as the quantity on the largest trade.

Furthermore, there are sometimes non-negligible value variations between exchanges and no simple method for a dealer to make certain that they’re all the time getting the finest value. Trackers providers like CoinGecko or CoinMarketCap could present averages and market overviews. But with the quick tempo of actions in the crypto markets, customers threat slippage in the event that they’re leaping round between completely different interfaces and providers.

Therefore, with BTC on a seemingly endless tear and institutional and retail newcomers flocking to the house, there’s by no means been a greater time to repair the liquidity problem as soon as and for all.

Enter OpenOcean.

What is OpenOcean?

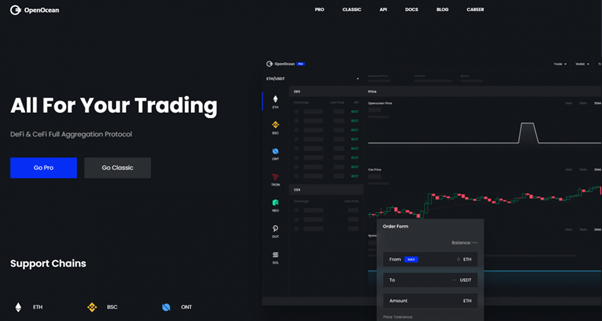

OpenOcean is the solely full market aggregator that gives customers a single interface to entry liquidity throughout centralized and decentralized exchanges. It makes use of an clever routing algorithm to seek out the finest value for any asset throughout all exchanges, with the lowest threat of slippage.

The algorithm is an optimized model of Dijkstra’s algorithm designed to seek out the shortest route between factors on a graph. OpenOcean applies its model of the algorithm, referred to as D-star, to seek out the finest costs with decrease slippage after which splits routing between completely different protocols for higher transaction charges. The web outcome for customers is the finest value with the lowest slippage in real-time throughout an energetic commerce.

Traders have the possibility of utilizing both the “Classic” interface, with is an easy field permitting customers to entry token swaps, or the “Pro” interface, which provides full market visibility throughout all CEXs and DEXs. Pro merchants can even plug into the protocol utilizing the API.

There are not any charges for utilizing the protocol. However, institutional traders wishing to make the most of customized UIs and funding technique execution are charged for setup.

Roadmap and Milestones

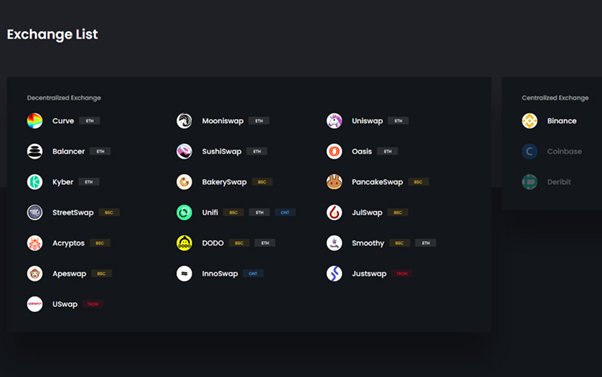

At the time of writing, OpenOcean has built-in 4 blockchains: Ethereum, Binance Smart Chain, Ontology, and TRON. Therefore, it aggregates liquidity from all DEXs operating on these platforms. It additionally plans to combine the Polkadot, Solana, and NEO blockchains.

Binance is the first centralized trade to grow to be built-in, with plans for Coinbase and Deribit to observe.

The roadmap for OpenOcean is break up into 4 phases, dubbed Antarctic Ocean, Indian Ocean, Atlantic Ocean, and Pacific Ocean.

Antarctic Ocean concerned aggregating DEXs operating on Ethereum, BSC, and Ontology. This section is already accomplished. Indian Ocean continued with cross-chain aggregation of swaps, aggregated spot merchandise on CEXs, and the issuance of the OOE governance token. Indian Ocean accomplished at the finish of March 2021.

The present section, Atlantic Ocean, is longer and can run till the finish of the first half of 2022. It will herald a number of updates, together with introducing CeFi futures merchandise, aggregating DeFi derivatives, and cross-chain mixed margin swimming pools. We can even count on to see extra centralized exchanges and blockchain platforms be part of OpenOcean as the roadmap progresses.

The remaining section, Pacific Ocean, will run from July 2022 till 2023. The final aim is to launch OpenOcean as a full clever asset administration platform protecting the complete spectrum of centralized and decentralized monetary options.

In early March, OpenOcean accomplished a strategic fundraising spherical led by Binance. A couple of weeks later, the firm confirmed that it had made a personal placement of shares to a specific group of traders, together with Altonomy and LD Capital, each of which participated in the funding spherical.

OOE Token

The OOE token provides a number of utilities, along with its perform as a protocol governance token. In future, OOE holders will profit from fuel and slippage subsidies, leading to minimal buying and selling prices. Holding OOE additionally confers CEX VIP membership, which incorporates advantages corresponding to charge premiums and decreased buying and selling charges and token withdrawals.

As OpenOcean delivers on its roadmap milestones of integrating derivatives merchandise, OOE holders will be capable to deploy their tokens as margin in mixed margin merchandise, enabling one-stop derivatives buying and selling throughout exchanges. Tokens may also be used as collateral for lending.

The undertaking is presently engaged in an airdrop of 1% of its OOE tokens to early customers. 34% of the whole OOE provide is allotted to the distribution of liquidity mining rewards over the subsequent 5 years. OpenOcean will function swimming pools on DEXs in varied public chains it aggregates on the protocol, together with Ethereum, Binance Smart Chain, Ontology, and Tron. OOE swimming pools will embrace pairs with DAI, ETH, USDT, BNB, and others.

Team

OpenOcean was based by Leo Xue and Cindy Wu. Leo Xue brings expertise from Intel and the China Financial Futures Exchange, the place he led the staff growing the buying and selling system. He began researching cryptocurrency protocols in 2015.

Cindy Wu was previously a technique supervisor at RBS, and M&A supervisor at the 3M firm. She additionally labored at a personal fairness fund as a senior funding director. She holds a Masters in Advanced Finance from the IE Business School.

Conclusion

Liquidity in cryptocurrency is a legit downside, and OpenOcean is the solely aggregator of its form searching for to pool liquidity from throughout the complete cryptocurrency markets. Therefore, it has an apparent worth proposition that can enchantment to cryptocurrency customers throughout the spectrum. If the undertaking delivers on its formidable roadmap, it is going to occupy an advantageous place in the market – one which others will undoubtedly try to copy.