The artificial intelligence (AI) boom promises to create fortune-building opportunities for forward-thinking investors. Key providers of AI infrastructure and applications could be particularly attractive investments as they’re likely to benefit disproportionately from the tech industry’s growth.

AI leaders that enact forward stock splits could receive an additional boost. Splits may not change the fundamental value of a business, but investors view them as a vote of confidence from management on the company’s prospects. Stocks that split tend to be performing well and often go on to set new highs.

If you’re looking to buy some top-quality AI stocks that could choose to split their stocks in the near future, read on.

Potential stock split No. 1: Super Micro Computer

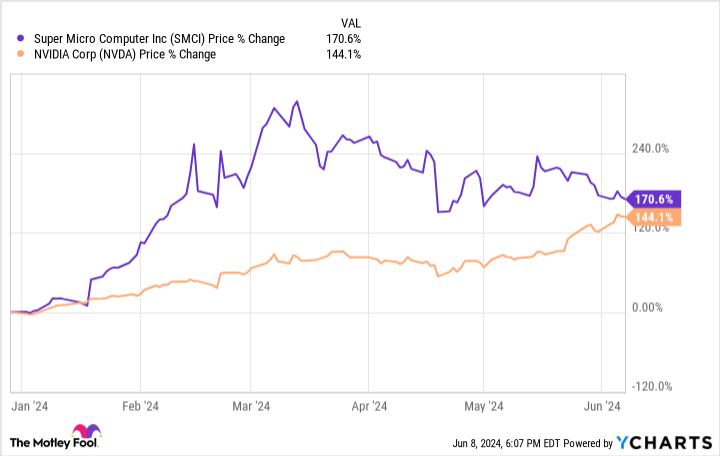

Nvidia‘s (NASDAQ: NVDA) state-of-the-art semiconductor technology has helped to usher in the AI explosion. The chipmaker’s stock price, in turn, has soared. Super Micro Computer (NASDAQ: SMCI) supplies high-performance servers and data storage systems that go hand in hand with Nvidia’s massively popular AI chips — and its shares have performed even better than the tech giant’s so far this year.

The company — known as Supermicro — grew at a blistering pace in its most recent quarter. Sales for the period ended March 31 rocketed 201% year over year to $3.9 billion. Earnings per share increased an even more impressive 329% to $6.56.

Supermicro’s close ties to Nvidia and rapid pace of innovation are enabling the AI hardware manufacturer to outpace its competitors. Supermicro was fast to market with its liquid-cooled AI SuperClusters for Nvidia’s new Blackwell AI computing platform. The easily scalable data center systems help to accelerate AI model training and inference while also reducing energy costs.

“Supermicro has designed cutting-edge Nvidia accelerated computing and networking solutions, enabling the trillion-dollar global data centers to be optimized for the era of AI,” Nvidia CEO Jensen Huang said in a press release announcing Supermicro’s new SuperClusters on June 4.

Considering its sterling recent operating performance and tantalizing growth potential, you’d think that Supermicro’s shares would be trading near all-time highs. Yet that’s not the case today. Its previously high-flying stock price has pulled back as of late and now sits about 37% off from its 52-week highs.

Therein lies your opportunity. Supermicro’s stock can now be had for less than 23 times its projected profits in 2025. That’s an attractive price for an AI star that’s forecast to increase its earnings by 62% annually over the next half-decade.

Moreover, with its share price standing at nearly $800, Supermicro might soon decide to split its stock to make it more affordable for everyday investors. This could help spark a rally in its stock price that sends it back higher.

Potential stock split No. 2: Palo Alto Networks

In addition to high-performance hardware, cybersecurity is a vital component of any effective AI strategy. Palo Alto Networks (NASDAQ: PANW) is a leading provider of crucial cloud security services, and AI is set to fuel its growth.

AI demands data. Protecting that data is of paramount importance. Failure to do so could result in loss of customer trust, massive regulatory fines, and other costly financial penalties.

In turn, global demand for cybersecurity solutions will reach $500 billion by the end of the decade, according to Grand View Research. Consulting giant McKinsey, meanwhile, expects the market for products and services that safeguard the digital economy to eventually grow to a whopping $2 trillion.

Palo Alto Networks is a top dog in this booming industry. It offers a broad array of tools, such as next-generation firewalls and advanced threat prevention services, delivered through a single, consolidated platform. This unified approach helps to reduce complexity and accelerate incident response times for customers.

Its scale is another powerful competitive advantage. With more than 80,000 business customers, the cyber guardian has more data to analyze. That helps its machine learning technology constantly grow smarter. And once its AI-powered platform detects a new threat, it updates its defenses immediately.

Palo Alto clearly has a promising long-term future. It could also receive a near-term lift from a potential stock split. Like Supermicro, its shares are trading at a relatively lofty price of around $300. The company chose to split its stock back in 2022 to make it more accessible for prospective shareholders. Doing so again today could boost demand for its shares among individual investors, which could help to place its stock price on a path to new highs.

Should you invest $1,000 in Palo Alto Networks right now?

Before you buy stock in Palo Alto Networks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palo Alto Networks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $746,217!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palo Alto Networks. The Motley Fool has a disclosure policy.

Stock Split Watch: 2 Artificial Intelligence (AI) Stocks to Buy Now That Look Ready to Split was originally published by The Motley Fool