BlackRock’s fastened revenue chief, Rick Rieder, says the Treasury market is making historical past earlier than our eyes.

Though rates of interest stay low by historic measures, the sharp rise in long-term bond yields in the previous few weeks has caught even the most jaundiced and skilled merchants unexpectedly. Yields and bond costs transfer in reverse instructions.

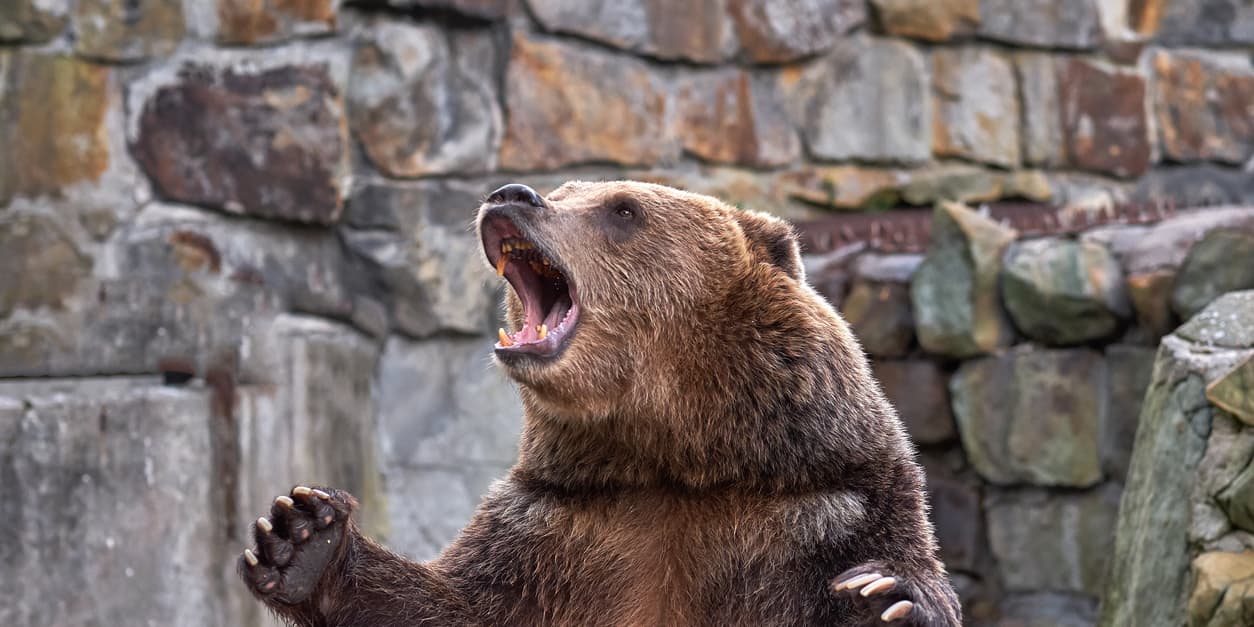

In a tweet on Thursday, Rieder famous an index monitoring the efficiency of long-dated Treasurys had fallen greater than 20% from peak to trough, assembly the extensively accepted definition of a bear market. That drawdown was unmatched in the final 4 many years.

The Barclays Long Treasury Index tracks the efficiency of all Treasury securities with remaining maturities of 10 years and longer.

This comes after the 10-year Treasury observe yield

TMUBMUSD10Y,

touched 1.75% this week, and the 30-year bond yield

TMUBMUSD30Y,

flirted with 2.50%, with each ranges thought of as key strains in the sand for long-dated authorities bonds. Bond costs transfer in the other way of yields.

The bond market selloff over the previous seven weeks initially unsettled shares, although the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

subsequently pushed to new all-time highs. The Nasdaq Composite

COMP,

has lagged behind as rising yields stoked a rotation away from beforehand highflying tech-related shares towards extra cyclical sectors anticipated to shine as the economic system accelerates following vaccine rollouts and trillions of {dollars} in fiscal reduction.

Treasurys remained below stress this week as the Federal Reserve declined to intervene straight and stop long-term yields from rising, although Fed Chairman Jerome Powell maintained his dovish stance.

Investors mentioned the monumental uncertainty round how briskly U.S. development and inflation will bounce again because of unprecedented fiscal and financial coverage help was main bondholders to demand greater yields in return for that threat.

See: The Fed is dovish but bond yields are soaring. What gives?