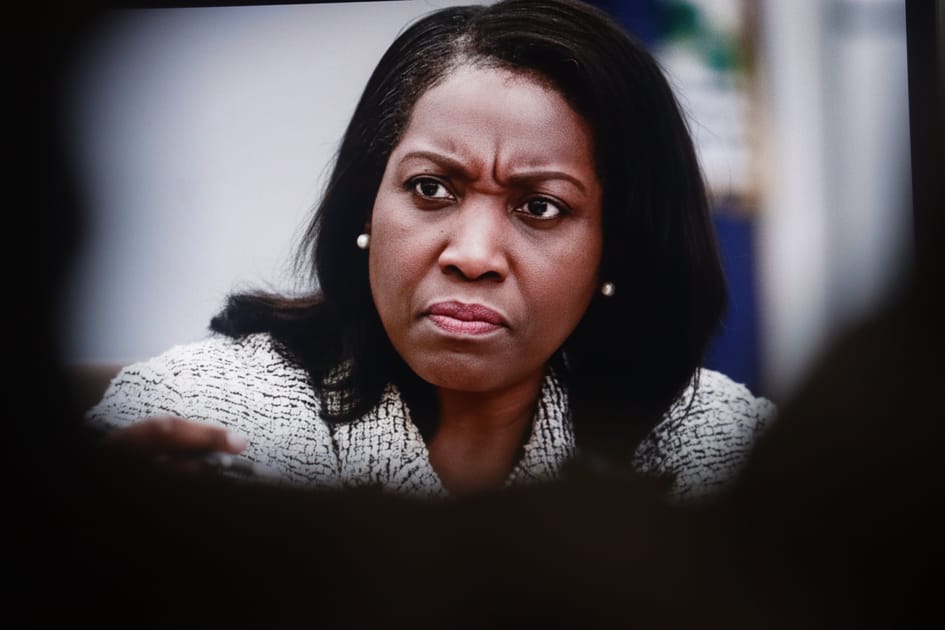

President Donald Trump announced in an Aug. 25 letter that he is firing Federal Reserve Board of Governors member Lisa Cook over mortgage fraud allegations.

“In light of your deceitful and potentially criminal conduct in a financial matter, [the American people] cannot and I do not have such confidence in your integrity,” wrote Trump in the letter.

Cook, appointed to the Fed Board of Governors in 2022 by President Joe Biden, said the firing was illegal and vowed to stay in her position. “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so,” Cook said in a statement.

“I will not resign.

“I will continue to carry out my duties to help the American economy as I have been doing since 2022.”

Here are four takeaways.

Mortgage Fraud Allegations

In a criminal referral letter posted to X on Aug. 20, Bill Pulte, chairman of the Federal Housing Finance Agency, accused Cook of potentially falsifying bank documents and property records to secure more favorable loan terms and lower interest rates.

Pulte alleged that Cook may have misrepresented the status of two properties—one in Ann Arbor, Michigan, and another in Atlanta—by designating both as her primary residence in 2021, just weeks apart. He also alleged in the letter that Cook listed the Atlanta property for rent, despite declaring it as her primary residence in mortgage filings.

This prompted Trump to demand her resignation in an Aug. 20 Truth Social post. Days later, Trump told reporters that he would fire her if she did not resign.

Cook, in a statement to The Epoch Times, confirmed that she would not step down.

“I have no intention of being bullied to step down from my position because of some questions raised in a tweet,” Cook said. “I do intend to take any questions about my financial history seriously as a member of the Federal Reserve and so I am gathering the accurate information to answer any legitimate questions and provide the facts.”

Commerce Secretary Howard Lutnick suggested that Cook should consider leaving voluntarily.

“It’s alleged that she’s committed mortgage fraud, and she says, ‘I’m not going anywhere,’” Lutnick told CNBC’s “Squawk Box.”

Ultimately, it comes down to whether she committed mortgage fraud, he said.

“Yes or no, and if you did commit mortgage fraud, please get out of the federal government,” Lutnick said. “Get out of the seat of the governor of the Federal Reserve and go away. You don’t deserve to be there if you’ve committed mortgage fraud, right?”

Legal Challenges

Cook is preparing to launch legal proceedings contesting her removal by the president. Abbe David Lowell, counsel for the Fed official, said Trump “has no authority” to fire Cook.

“His attempt to fire her, based solely on a referral letter, lacks any factual or legal basis. We will be filing a lawsuit challenging this illegal action,” Lowell said in a statement to The Epoch Times.

Section 10 of the Federal Reserve Act states that a president has the authority to remove a member of the Fed Board “for cause.”

“Each member shall hold office for a term of fourteen years from the expiration of the term of his predecessor, unless sooner removed for cause by the President,” the Federal Reserve Act states.

The case could end up in the Supreme Court.

The president, speaking to reporters at the Aug. 26 Cabinet meeting, said he will abide by a court decision.

History of Scrutiny

While this is the first time that a president has attempted to forcibly remove a Fed governor since the institution’s creation in 1913, other central bank officials have been pressured to quit.

In 2021, then-Dallas Fed President Robert Kaplan resigned over scrutiny regarding personal stock trading during the COVID-19 pandemic.

Kaplan was not found to have committed any wrongdoing, as his trades complied with regulatory standards. However, Kaplan stated that his financial disclosures became a distraction to the institution.

“Unfortunately, the recent focus on my financial disclosure risks becoming a distraction to the Federal Reserve’s execution of that vital work. For that reason, I have decided to retire,” he said in a statement.

Eric Rosengren, head of the Boston Fed, stepped down shortly afterward, citing health concerns. His resignation coincided with concerns surrounding his personal trading activity, particularly in real estate investment trusts.

Like Kaplan, his trades satisfied regulatory requirements, but they sparked criticisms over possible conflicts of interest.

Then-Fed Vice Chair Richard Clarida submitted his resignation in January 2022. Ethics concerns were raised when he reported moving $1 million to $5 million from a bond fund to a stock fund in February 2020, right before Fed Chair Jerome Powell signaled rate cuts.

Fed Independence and Credibility

As the Trump administration has intensified the pressure campaign on Powell to lower rates, critics have raised concerns about the Fed’s independence in light of Cook’s termination.

“Do not forget. It’s about control of the Fed. This is a very dark day,” former Fed economist Claudia Sahm said in an Aug. 25 post on X.

Meanwhile, Treasury Secretary Scott Bessent says it is about restoring public trust.

“The Federal Reserve’s independence comes from a political arrangement between itself and the American public,” he said at the Cabinet meeting. “Having the public’s trust is the only thing that gives it credibility.”

Trump’s actions “are restoring trust to government,” Bessent said. “The old ways of doing things are not good enough,” he said.

In addition to finding a successor for Powell when his term expires in May 2026, Trump recently appointed Council of Economic Advisers’ Stephen Miran as Fed Gov. Adriana Kugler’s temporary replacement. Kugler abruptly resigned earlier this month.

Jamie Cox, managing partner for Harris Financial Group, said Trump will be remaking the Fed over the next year, “and he’s doing so in very unconventional ways.”

“Trump has essentially usurped the Fed’s forward guidance function for the time being and [is] telling markets [that] lower rates are coming, which is being manifest in a steeper yield curve, with short term treasuries dropping like a rock,” Cox said in a note emailed to The Epoch Times.

A divergence occurred in the U.S. Treasury market, as short-term yields tumbled and long-term yields rose.

The two-year yield declined by 4.5 basis points to 3.685 percent, while the 30-year bond ticked up by more than 2 basis points to above 4.91 percent.

U.S. stocks, meanwhile, were little changed in the aftermath of Cook’s termination.

The leading benchmark averages were flat during the Aug. 26 session, led by the tech-heavy Nasdaq Composite Index’s 0.2 percent gain.

While investors overwhelmingly anticipate that the Fed will cut interest rates in September, they are also forecasting lower rates. This should be a positive for markets—and the economy—but could present long-term risks, according to Tom Essaye, co-founder and president of the Sevens Research Report.

“But this pressure from the administration on the Fed to cut rates is also pushing long-end rates higher because, on a theoretical level, the Fed caving to White House pressure erodes Fed independence, which will cause some bond investors to flee long-term Treasuries,” Essaye said in a note emailed to The Epoch Times.

The U.S. Dollar Index, a gauge of the greenback against a weighted basket of currencies, weakened by 0.1 percent.

If you found this article interesting, please consider supporting traditional journalism

Our first edition was published 25 years ago from a basement in Atlanta. Today, The Epoch Times brings fact-based, award-winning journalism to millions of Americans.

Our journalists have been threatened, arrested, and assaulted, but our commitment to independent journalism has never wavered. This year marks our 25th year of independent reporting, free from corporate and political influence.

That’s why you’re invited to a limited-time introductory offer — just $1 per week — so you can join millions already celebrating independent news.