Much has been stated these days about Bitcoin’s impression on the atmosphere. Mainstream media has been particularly eager on declaring BTC’s consensus mechanism (Proof-of-Work) a possible hazard for the way forward for the planet.

A White paper printed by Square and ARK Invest, as a part of “The Bitcoin Clean Energy Initiative”, makes the alternative case and argues Bitcoin is actually a “key driver of renewable energy’s future”. The analysis paper claims Bitcoin mining together with renewable power to facilitate an “energy transition”.

Thus, power asset homeowners might grow to be the “bitcoin miners of tomorrow” working a resilient electrical energy grid. BTC miners have sure traits which might maintain this new power mannequin. First, miners are geographically agnostics, with a “flexible and easily interruptible load”, because the White paper claims.

As such, they’re “unique energy buyers” applicable to face the clear power sector’s principal challenges: low manufacturing when demand rises and intermittency. The analysis claims the next:

Bitcoin miners, alternatively, are a great complementary know-how for renewables and storage. Combining technology with each storage and miners presents a greater total worth proposition than constructing technology and storage alone.

Bitcoin Leverage The Cleanest And Cheapest Form Of Energy

The Levelized Cost of Energy (LCOE), metric use to measure how costly is to supply a sort of power, for photo voltaic and wind have seen a decline up to now ten years. The White paper claims photo voltaic power value has fallen by 90% and wind by 71%. Therefore, the price with out exterior elements (like subsidies) sits at about Three to four cents per KWh and a couple of to five cents per KWh, respectively.

In distinction, the identical metric (LCOE) for fossil power stands at 5 to 7 cents per KWh for coal and pure gasoline. The analysis provides:

(…) photo voltaic and wind are actually the bottom value and most scalable. What’s extra, we consider they’ll solely proceed to get extra inexpensive over time.

Bitcoin mining generally is a “complementary” know-how that leverages these cleaner and least expensive power sources. The mixture of the above with strategies to retailer power can result in, based on the White paper, a migration of fresh power tasks into “profitable territory” with advantages for buyers.

Also, extra flexibility to assemble photo voltaic and wind tasks. Sustainable with BTC mining, they will discover their integration with the principle power grid when “interconnection studies are completed”. Such power sources will be resilient in “black swan events” offering the power grid with “readily available excess”.

The miners can take up this “excess” power on account of their “unlimited appetite” whereas a Lithium-Ion based mostly storage, for instance, can maintain its capability to satisfy the buyer’s demand throughout the day. In the long run, the White paper predicts a situation the place there might be a much bigger want for electrical provide with the expansion of electrical car use.

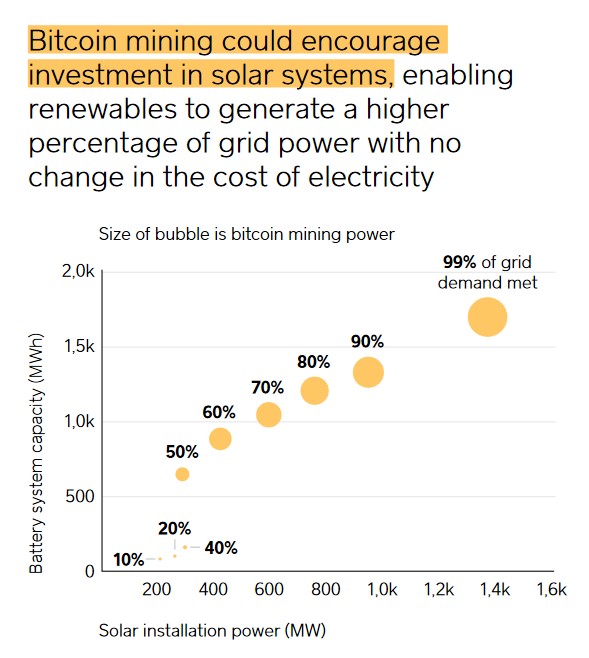

The mannequin offered by Square and ARK Invest might increase the deployment of photo voltaic and wind power sources. At the identical time, turning the BTC mining industry into a much “sizable” and greener sector. Without the miners, the analysis estimates solely 40% of grid energy earlier than costs should be elevated to satisfy demand. The reverse case is extra worthwhile and sustainable:

With bitcoin mining built-in right into a photo voltaic system nevertheless, power suppliers – whether or not utilities or impartial entities – would have the power to play the arbitrage between electrical energy costs and bitcoin costs, in addition to doubtlessly promote the “surplus” photo voltaic and provide nearly all grid energy calls for with out reducing profitability.

BTC is buying and selling at $55.394,97 with a 1.8% loss within the day by day chart. In the weekly and month-to-month chart, BTC has a 12.9% and three.8% loss, respectively. The market cap stands at $1.3 Trillion.