At first glance, Roku (NASDAQ: ROKU) looks like a stock to avoid. Shares are trading down 87% from their 2021 peak, for instance, and still within sight of their early 2023 low. The company also remains unprofitable. Never even mind the fact that the streaming industry’s growth that Roku was built on appears to be at an end.

However, there are two important pieces of investing advice to remember here. First, there’s often more to the story than what you see on the surface. Second, stocks eventually reflect the underlying company’s likely future rather than its past.

When you embrace both of those concepts, Roku stock suddenly looks like a compelling addition to risk-tolerant investors’ growth portfolios.

What exactly is Roku anyway?

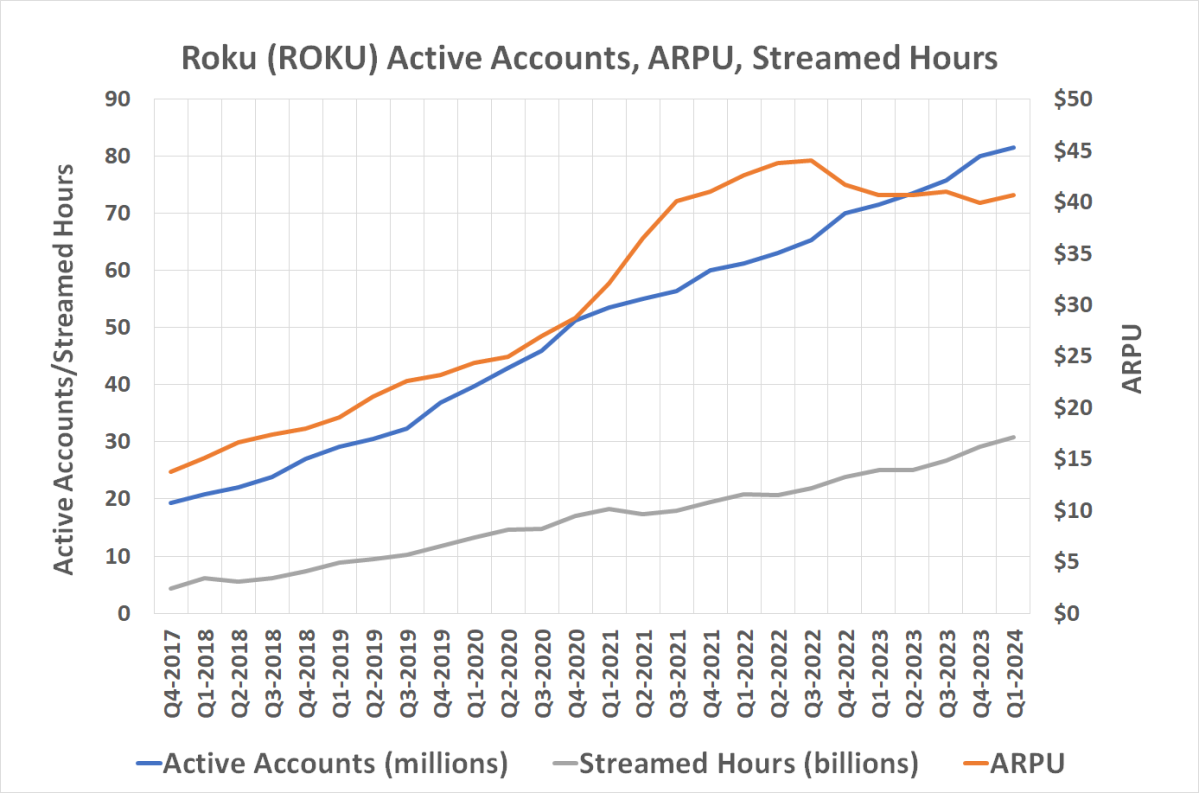

On the off-chance you’re reading this and aren’t familiar with it, Roku makes and licenses devices that “stream” digital video from services like Netflix or Walt Disney‘s Hulu. It’s the United States’ most used connected television platform, in fact, serving as the technological middleman to 81.6 million households as of the end of March. Most of those users are located in the U.S., although the company serves a handful of overseas customers as well.

But its business isn’t really about streaming boxes or smart TVs. Those are just a means to an end. Roku’s chief profit center is advertising, which accounts for 85% of its revenue and all of its profits. Rather, Roku is a tollbooth of sorts. Once people subscribe to Netflix, Walt Disney’s Disney+, or any other streaming services, they need a device to view this streaming programming. Roku provides these devices, charging a nominal fee to the company providing the programming.

The monetization of Roku’s platform doesn’t end there. Brands of all sorts can also pay to have their goods, services, and even just their brand names featured on these devices’ home screens and screen-savers.

Roku is even wading into the streaming industry’s latest and hottest growth engine. That’s free, ad-supported television, or FAST. Roku operates its own streaming channel — called The Roku Channel — which injects occasional TV commercials into its programming.

All of these contribute to an ever-growing top line.

Right place, right time, right platform

What this ever-growing top line has not yet done is produce a consistent profit, which is arguably the reason shares have performed so poorly since soaring during and because of the COVID-19 pandemic.

As was noted, a company’s past doesn’t have to be its future. In this case, it probably isn’t. Based on the streaming industry’s current trends and trajectories, the analyst community is calling for Roku to swing to a profit by 2027, which should then widen in 2028.

The thing is, there’s no reason to doubt these optimistic outlooks.

Investors keeping tabs on the streaming industry likely recognize it’s hitting a growth wall of sorts. That’s why we’re seeing strange bedfellows now forming once-unlikely partnerships. Netflix is now bundling its service with Apple‘s Apple TV+ and Comcast‘s Peacock, for instance, while Walt Disney’s Disney+ and Hulu can be bought at a discount when purchased along with Warner Bros. Discovery‘s Max (formerly HBO Max). These companies are clearly looking for new ways to reignite stagnating growth. The launch of ad-supported versions of Netflix and Max point to the same concern.

Roku isn’t in the same boat with the studios and brands creating the content you watch, however. You still need a means of watching it, and they still need a means of delivering it. Roku’s strong hold on its position as the market’s chief middleman isn’t threatened.

Indeed, if anything, Roku is a beneficiary of consumers’ subscription fatigue that’s steering them toward free-to-watch ad-supported programming. Data from television-ratings agency Nielsen indicates that while The Roku Channel doesn’t garner anywhere near the sort of viewing time that market-leading Netflix does within the United States, it is rapidly growing its share of this time (largely at Peacock’s and Amazon Prime’s expense). In fact, in June, Americans spent more time watching The Roku Channel than they did watching Max or free-to-watch Pluto TV, and spent almost as much time watching the Roku Channel as they did watching Disney+ or free-to-watch Tubi. That’s impressive.

There’s plenty more growth for Roku on this particular front, too. Industry research outfit Digital TV Research suggests the world’s free-ad-supported-TV business is set to grow from last year’s $7.6 billion to $16.5 billion in 2029, with the United States poised to remain the global industry’s biggest market.

Roku stock offers more reward than risk

There are risks here, to be sure.

Perhaps chief among these risks is Walmart‘s plan to acquire smart TV maker Vizio, which has developed its own ad-centric smart television operating system. Although it’s not yet clear what Walmart might do with Vizio that isn’t already being done, it would be naïve to suggest it isn’t a potential threat to Roku’s reach. Walmart’s official announcement even made a point of highlighting Vizio’s relationship with over 500 advertisers and more than 18 million users of its television sets.

Roku is also still booking losses. Although the current trajectories of its top and bottom lines should pull it out of the red and push it into the black in the foreseeable future, that path isn’t entirely paved, or straight.

These potential stumbling blocks aren’t enormous risks, though. They’re also already largely baked into Roku stock’s present price. The only new important warning to pass along to interested investors right now is simply to be prepared for continued volatility.

This might help: Analysts’ consensus price target of $76.24 is 22% above Roku stock’s present price.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has positions in Warner Bros. Discovery. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, Roku, Walmart, Walt Disney, and Warner Bros. Discovery. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.

1 Growth Stock Down 87% to Buy Right Now was originally published by The Motley Fool