Artificial intelligence (AI) is already driving solid growth for many companies involved in the proliferation of this technology, such as semiconductor companies whose chips are being deployed for AI training and inference applications. At the same time, there are many companies busy integrating AI into their products and services so that they can arm their customers with more productive tools and grow their businesses.

Marvell Technology (NASDAQ: MRVL) and The Trade Desk (NASDAQ: TTD) are two companies that fit the above description. Let’s take a closer look at how these two tech stocks can deliver healthy long-term gains to investors thanks to AI.

1. Marvell Technology

AI has already started contributing to chipmaker Marvell Technology’s top line as major cloud service providers are turning toward the company to make custom chips. Marvell specializes in making application-specific integrated circuits (ASICs) based on advanced 3-nanometer (nm) and 5nm process nodes, which are deployed in data centers, automotive, and telecommunications, among others.

It was back in 2020 when Marvell launched a new generation of ASICs for accelerating AI workloads. It is now reaping the benefits of that move. On its November 2023 earnings conference call for the third quarter of fiscal 2024, Marvell management pointed out that its data center business benefited from “stronger-than-forecasted AI revenue.”

Marvell was earlier forecasting its AI business to hit a quarterly revenue run rate of $200 million by the end of fiscal 2024. However, the company added on its previous conference call that “demand has continued to grow, and we now expect our AI revenue in the fourth quarter to come in significantly above our forecast.”

So, there is a good chance that Marvell’s revenue in fiscal 2025 (which has just begun) could exceed the $1 billion mark. However, don’t be surprised to see Marvell’s AI business getting better this year, as it seems to be capitalizing on the growing demand for custom AI chips. The company has already started building custom chips for one of its cloud customers, and it expects to start volume production for another AI customer this year.

JPMorgan analyst Harlan Sur predicted that the market for advanced ASICs was worth somewhere between $13 billion and $18 billion last year. He further added that generative AI-powered demand could help the advanced ASIC market clock annual growth of 20% in the future. Marvell’s market share of 12% in ASICs means that it is well-placed to benefit from this market.

This probably explains why Marvell’s top line is expected to grow in the double digits in fiscal 2025, following an estimated contraction of 7% in fiscal 2024 to $5.5 billion.

What’s more, as the above chart indicates, Marvell’s revenue growth is anticipated to accelerate nicely next fiscal year. If Marvell does hit $7.31 billion in revenue in fiscal 2026 and maintains its current price-to-sales ratio of 12 at that time, its market cap could jump to $88 billion within two years. That would be a 31% increase from current levels.

But if the market decides to reward Marvell with a richer price-to-sales multiple thanks to its AI-driven growth, the stock could deliver stronger gains.

2. The Trade Desk

AI is predicted to play a key role in digital advertising. Data Bridge Market Research predicts that the adoption of AI in the digital marketing space could increase at an annual rate of 28% through 2028.

Programmatic advertising company The Trade Desk operates a platform that allows ad buyers and marketers to purchase ad inventory in real-time with the help of data so that they can reach their target audience across multiple channels and increase their returns on investment. It has been using AI in its platform since 2016.

On its earnings conference call last month, The Trade Desk pointed out that it is distributing AI “across our platform so our clients can make even better choices among the 15 million ad impression opportunities a second and understand which of those ads are most relevant to their audience segments at any given time.” The company wants to position itself as “the ad tech AI leader,” and the good part is that its efforts seem to be bearing fruit.

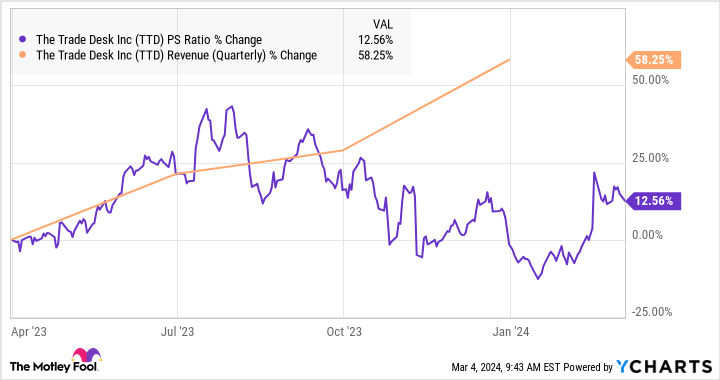

The Trade Desk reported better-than-expected results for the fourth quarter of 2023, which sent the stock soaring. It finished the year with a 23% increase in revenue to $1.95 billion. It is worth noting that the company grew at a much faster pace than the digital ad market’s 10.7% growth in 2023. The Trade Desk’s revenue forecast of $478 million in revenue for the current quarter points toward a 25% year-over-year increase, suggesting that the company’s growth could accelerate in 2024.

Given that the digital ad market is predicted to clock 13.2% growth this year, up from 2023’s jump, it won’t be surprising to see The Trade Desk do better in 2024. After all, the company has been cornering a bigger share of the digital ad market. Its 2023 advertiser gross spending increased to $9.6 billion from $7.8 billion in 2022, an increase of 23%.

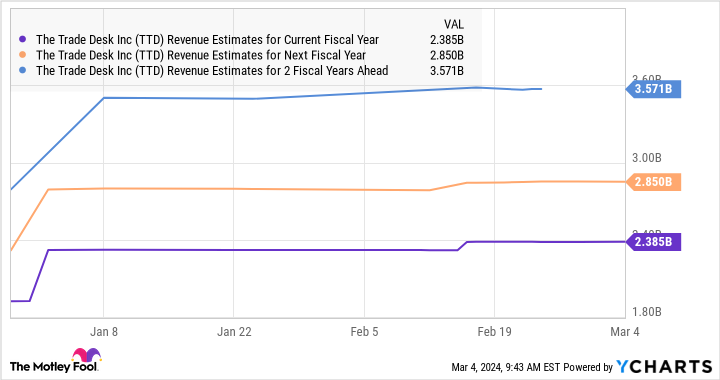

The infusion of AI-focused tools such as Kokai, which gives advertisers access to millions of ad impressions each second so that they can buy the right inventory at the right time and at the right price to maximize their returns on ad dollars spent, could help The Trade Desk win a bigger share of the digital ad market in the future. This is probably why analysts have been boosting their expectations from the company.

Assuming the company’s growth does accelerate in 2026 and its revenue jumps to $3.57 billion, its market cap could increase to $77 billion based on its current price-to-sales ratio of 21.5. That would be an 88% jump from current levels.

One might argue that the stock is expensive, but it is cheaper when compared to its five-year average sales multiple of 23.7. Also, the stock appears cheaper when compared to the impressive revenue growth that The Trade Desk has been clocking.

As such, investors looking to buy an AI stock to take advantage of the adoption of this technology in the digital ad industry should consider taking a closer look at The Trade Desk, as its improving growth could lead to robust long-term gains.

Should you invest $1,000 in Marvell Technology right now?

Before you buy stock in Marvell Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Marvell Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and The Trade Desk. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks You May Regret Not Buying Right Now Before They Soar 31% to 88% was originally published by The Motley Fool