The S&P 500 is up 27% during the last 6 months, and Wall Street’s analyst class is beginning to level out that we could also be due for some deceleration. In half, this can be an software of physics to market actions – what goes up should come down – however it could even be tied to an outdated market saying, ‘Buy in May and go away.’ It’s a long-recognized sample that the hotter months are inclined to see a slowdown in market exercise.

Among the skeptics is Stifel strategist Barry Bannister, who believes the nice instances might not stick round by means of 2021.

“When you think about it, the stock market is typically very strong from the 1st of November to the 30th of April. That’s the seasonality effect… [The S&P 500] went to right where it was supposed to at 4,200, it looks like it’s going to be. But it also argues that the summer of 2021 will be difficult… That can be caused by China tightening, which they’re doing, Europe hesitating on fiscal, which they’re doing, and the US dollar perhaps strengthening a little bit, which weighs on global liquidity growth. So I think it’s been a fun ride, and it’s typically strong in November to April, but it sometimes fades,” Bannister opined.

If Bannister’s views come near the precise occasions, then it makes now the time to maneuver towards a extra diversified, defensive portfolio. Dividend shares are a conventional defensive play. A dependable dividend payer usually positive aspects much less in a bullish market, however makes up for that with a gradual dividend fee.

With this in thoughts, we’ve used the TipRanks’ database to search out three shares providing dividend fee of seven% or higher, together with a Buy ranking from the Street. Let’s take a better look.

Suburban Propane Partners (SPH)

The vitality business isn’t all Big Oil. Households want gasoline, too, and that’s the place Suburban Propane is available in. The firm obtained its begin advertising and marketing propane for residence use, and has since expanded to supply a variety of fuels and gasoline oils, together with pure fuel and electrical utility providers, to the residential, industrial, and agricultural markets. The firm is headquartered in New Jersey and boasts 3,300 staff and operations in 41 states to greater than 1 million prospects by means of some 700 places.

Suburban’s enterprise exhibits a robust seasonal sample, with the primary and second quarters of the 12 months having increased revenues and earnings than the third and fourth quarters. This was clear within the latest 1Q21 report, with the sample overlaid by losses because of the now-receding COVID pandemic. Q1 revenues got here in at $305.2 million, under the consensus estimates and in addition down 8.5% from the prior-year Q1. EPS got here in at 61 cents, down from 64 cents one 12 months in the past.

On a optimistic notice, earnings are greater than adequate to pay the common dividend, which the corporate has just lately declared for fee on May 4. The dividend, at 30 cents per widespread share annualizes to $1.20 and provides a yield of 8.2%. Suburban Propane has an extended historical past of preserving the dividend fee dependable – and of adjusting the fee when wanted to maintain it in-line with earnings.

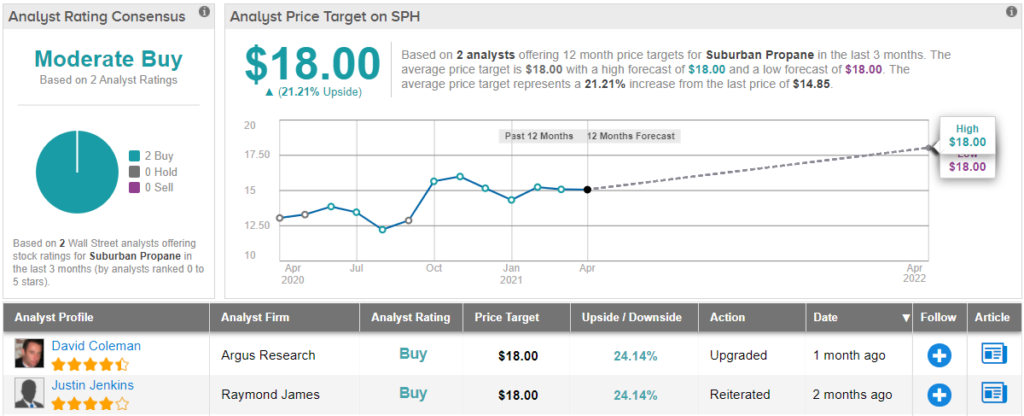

Covering SPH for Argus, 5-star analyst David Coleman acknowledges the corporate’s weak factors, however sees it as an total progress proposition.

“Although Suburban posted weaker-than-expected fiscal 1Q21 earnings, reflecting unseasonably warm weather and the impact of the pandemic, we note that industry trends for propane companies are now improving. The company cut its quarterly dividend in half, to $0.30 per unit, in July 2020; however, we believe that the cut was prudent and note that the stock still yields about 8%, which is attractive in a low-interest-rate environment,” Coleman wrote.

To this finish, Coleman charges SPH shares a Buy, and his $18 value goal implies an upside of 21% for the 12 months forward. (To watch Coleman’s observe report, click here)

SPH has slipped beneath most analysts’ radar; the inventory’s Moderate Buy consensus is predicated on simply two latest Buy scores. The shares are promoting for $14.85, and the $18 common value goal matches Coleman’s. (See SPH stock analysis on TipRanks)

Rattler Midstream (RTLR)

Rattler Midstream, like Suburban Propane, lives within the vitality universe – however Rattler is a midstream firm, spun off of Diamondback Energy in 2018 to develop, function, and purchase midstream property within the dad or mum firm’s working areas of the Midland and Delaware formations of Texas’ Permian Basin.

Rattler has been climbing, for a number of months, out of a deep gap attributable to the COVID pandemic and depressed demand. Higher oil costs are serving to the corporate, and in This fall Rattler reported $109.2 million in revenues, up from $96.5 million in Q3, however nonetheless down 12.8% from the year-ago quarter. EPS confirmed the identical sample; at 21 cents, it was up from 19 cents within the prior quarter, however down 25% year-over-year.

Even with revenues and earnings not absolutely recovered from the pandemic hit, Rattler stored up its dedication to returning income to traders. The firm purchased again 1.65 million widespread shares throughout This fall, at a price of $14.7 million, and authorized a This fall dividend of 20 cents per share. The present fee annualizes to 80 cents per share, and provides a yield of seven.3%.

Covering Rattler for Raymond James, Justin Jenkins notes, “While RTLR has only one main customer, it is an investment grade large-cap near pure-play Permian producer with scale. We also expect RTLR to recruit slightly more generalist interest relative to peer MLPs thanks to its involvement with FANG.”

Jenkins goes on to clarify why he believes Rattler is sound proposition: “Once we move past the 1Q21 noise, we expect 2021 to be a relatively quiet period of solid execution for RTLR. While the potential for a dropdown could create some headlines, we expect a relatively small, leverage neutral, and moderately valued transaction that does little to shift the overall story. Increasing confidence in the FANG outlook will improve the relative standing of RTLR on a similar basis.”

Based on the above, Jenkins charges RTLR an Outperform (i.e. Buy), and units a $13 value goal, indicating ~19% upside for the following 12 months. (To watch Jenkins’ observe report, click here)

Overall, there are 6 analyst evaluations on report right here, together with 2 to Buy and Four to Hold, for an analyst consensus of Moderate Buy. The common value goal is $12, suggesting ~9% upside from the $10.97 buying and selling value. (See RTLR stock analysis on TipRanks)

Broadmark Realty Capital (BRMK)

Shifting gears, we’ll transfer over to the Real Estate Investment Trust phase. In a means, that is inevitable; REIT corporations are recognized for his or her excessive yielding, dependable dividend funds, dictated at least partly by tax rules that require them to return a excessive share of income direct to traders. Broadmark Realty Capital holds a portfolio of mortgages and mortgage-backed securities, with a concentrate on building and improvement. The firm has funded over 1,200 loans over the previous decade, for an combination of greater than $2.Eight billion.

In its most up-to-date quarterly report, for 4Q20, Broadmark reported making $194.Eight million in mortgage commitments, and producing $32.5 million in high line income. The income was up 8.3% from the $30 million reported within the year-ago quarter, in addition to up 12.4% from Q3. EPS was 17 cents per share, a far cry from the 5-cent loss recorded in 4Q19. The firm reported ending 2020 with over $223 million in money readily available.

Plenty of money and rising revenues and earnings implies that Broadmark can afford its dividend. The firm pays this out month-to-month, and in April declared the May fee for 7 cents per widespread share. This annualizes to 84 cents per share, and provides traders a yield of seven.8%.

B. Riley analyst Randy Binner, rated 5-stars by TipRanks, sees a transparent path forward for Broadmark’s continued progress.

“Our view is that FY21 should see credit trends revert back to more normalized levels, which should be an added tailwind to net interest income… we see potential upside to the stock as the company continues to resolve defaults, grows the public REIT portfolio and private AUM, and gets the dividend growth story back on track in FY21,” the analyst famous.

In line with these feedback, Binner places a Buy ranking on BRMK, together with a $12.50 value goal, suggesting 15% upside within the 12 months forward. (To watch Binner’s observe report, click here)

Overall, BRMK will get a Moderate Buy ranking from the analyst consensus, based mostly on 2 Buys and 1 Hold. The comparatively small variety of evaluations displays the ‘under the radar’ profile of most REITs within the markets. Shares in BRMK promote for $10.87, and the $11.75 common value goal suggests an 8% upside potential. (See BRMK stock analysis on TipRanks)

To discover good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.