Nvidia Corp. dominates coverage of the semiconductor industry, and this will continue as long as this company keeps blowing past even its own expectations for sales and profits each quarter. But there are other semiconductor manufacturers that are also growing quickly during this upcycle for the industry.

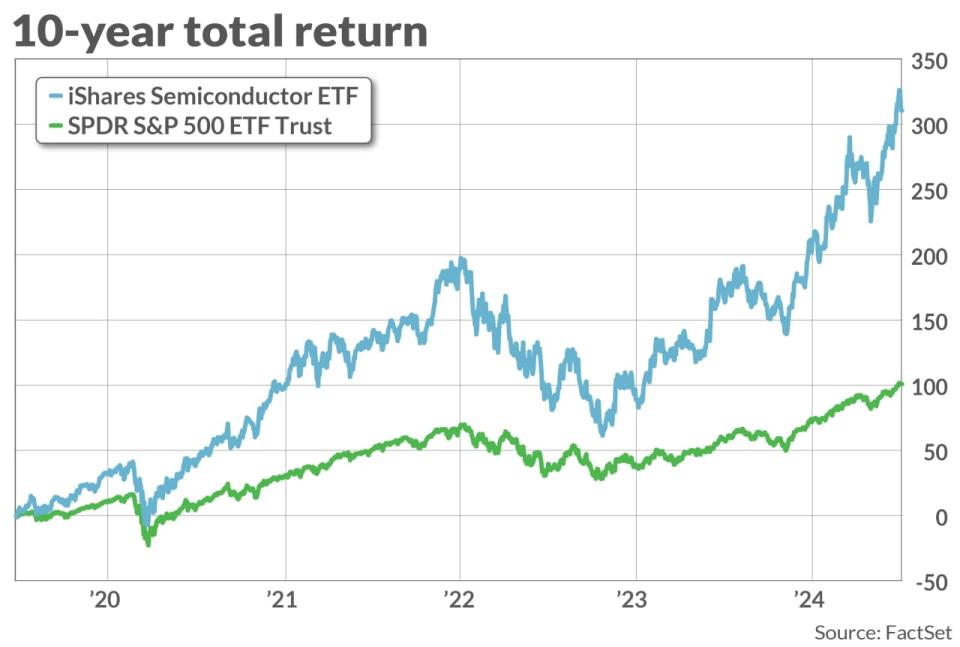

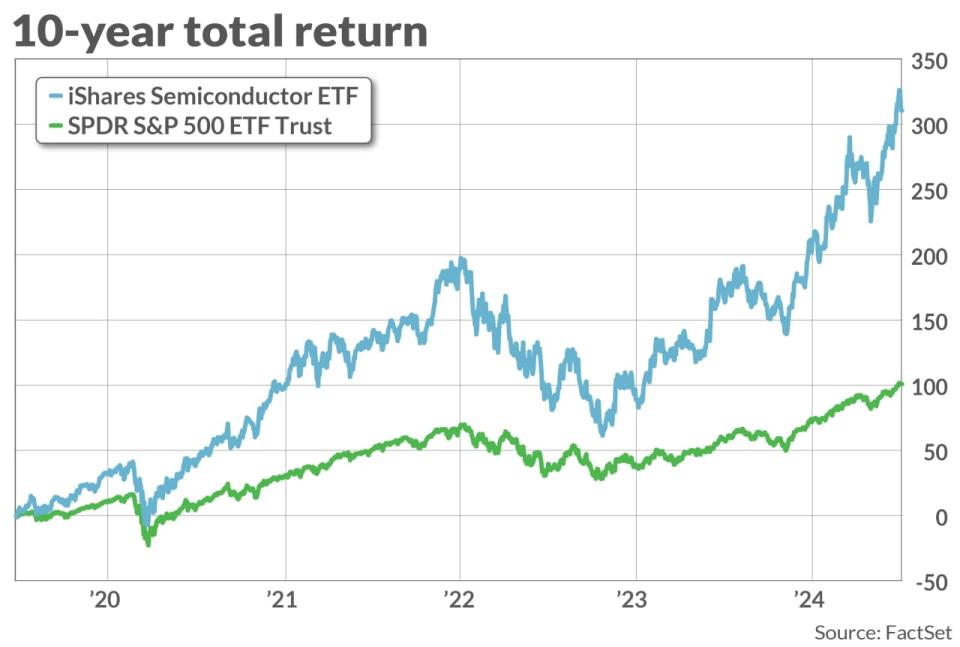

As shown below, investors who have taken a patient approach to investing in this industry group have fared very well. But some investors will want to push for shorter-term gains by selecting individual stocks. For these investors, it might help to screen an expanded list of semiconductor stocks to see which ones are favored by analysts working for brokerage firms.

Most Read from MarketWatch

For traders: Semiconductor stocks look ripe for a pullback: RenMac

A broad screen of semiconductor stocks

The initial list included 61 companies listed on U.S. exchanges, starting with the 30 in the PHLX Semiconductor Index SOX, which is tracked by the iShares Semiconductor exchange-traded fund SOXX. From there we added 31 more companies in the S&P Composite 1500 Index XX:SP1500 that are in the semiconductor industry, as determined by FactSet, or in the Semiconductors and Semiconductor Equipment Global Industry Classification Standard group. The S&P Composite 1500 is made up of the S&P 500 SPX, the S&P MidCap 400 MID and the S&P Small Cap 600 SML.

We then trimmed the list to 54 companies covered by at least five analysts working for brokerage firms polled by FactSet.

We cut the list further to a dozen companies with at least 75% buy or equivalent ratings among the analysts.

Here they are, sorted by implied 12-month upside potential, based on the consensus price targets:

|

Company |

Ticker |

Share buy ratings |

June 21 price |

Consensus price target |

Implied 12-month upside potential |

Market cap ($bil) |

|

Semtech Corp. |

SMTC |

85% |

$30.14 |

$49.64 |

65% |

$1.9 |

|

Allegro MicroSystems Inc. |

ALGM |

100% |

$27.67 |

$35.38 |

28% |

$5.4 |

|

Ichor Holdings Ltd. |

ICHR |

100% |

$36.62 |

$46.60 |

27% |

$1.2 |

|

Marvell Technology Inc. |

MRVL |

91% |

$71.89 |

$89.75 |

25% |

$62.2 |

|

Advanced Micro Devices Inc. |

AMD |

80% |

$161.23 |

$190.02 |

18% |

$260.6 |

|

SiTime Corp. |

SITM |

86% |

$118.60 |

$139.17 |

17% |

$2.7 |

|

Onto Innovation Inc. |

ONTO |

83% |

$216.40 |

$253.00 |

17% |

$10.7 |

|

Micron Technology Inc. |

MU |

89% |

$139.54 |

$159.17 |

14% |

$154.5 |

|

Broadcom Inc. |

AVGO |

86% |

$1,658.63 |

$1,879.79 |

13% |

$772.1 |

|

First Solar Inc. |

FSLR |

78% |

$258.87 |

$283.76 |

10% |

$27.7 |

|

Taiwan Semiconductor Manufacturing Co. ADR |

TSM |

95% |

$173.96 |

$176.73 |

2% |

$902.3 |

|

Nvidia Corp. |

NVDA |

90% |

$126.57 |

$128.33 |

1% |

$3,113.6 |

|

Source: FactSet |

||||||

Despite having 90% buy or equivalent ratings, the consensus price target for Nvidia NVDA is only 1% higher than Friday’s closing price.

Here is recent coverage of some calls by analysts related to stocks listed above:

Now let’s take a look at how valuations for the group of 12 most favored semiconductor stocks have changed. Here are comparisons of forward price-to-earnings and price-to-sales ratios as of Friday’s close and a year earlier. Ratios for the iShares Semiconductor ETF and the SPDR S&P 500 ETF Trust SPY are at the bottom.

|

Company |

Ticker |

Forward P/E |

Forward P/E one year ago |

Forward price/ sales |

Forward price/ sales one year ago |

12-month price change through June 21 |

|

Semtech Corp. |

SMTC |

28.1 |

26.6 |

2.0 |

1.5 |

26% |

|

Allegro MicroSystems Inc. |

ALGM |

45.0 |

27.9 |

6.3 |

7.2 |

-33% |

|

Ichor Holdings Ltd. |

ICHR |

35.6 |

33.2 |

1.3 |

1.2 |

1% |

|

Marvell Technology Inc. |

MRVL |

40.0 |

32.0 |

10.2 |

8.6 |

22% |

|

Advanced Micro Devices Inc. |

AMD |

35.9 |

32.3 |

9.0 |

7.2 |

44% |

|

SiTime Corp. |

SITM |

107.9 |

221.3 |

13.1 |

15.0 |

1% |

|

Onto Innovation Inc. |

ONTO |

37.9 |

25.8 |

10.6 |

6.0 |

104% |

|

Micron Technology Inc. |

MU |

18.6 |

N/A |

4.4 |

3.6 |

112% |

|

Broadcom Inc. |

AVGO |

29.6 |

19.2 |

13.6 |

9.4 |

96% |

|

First Solar Inc. |

FSLR |

15.1 |

18.8 |

5.5 |

4.9 |

40% |

|

Taiwan Semiconductor Manufacturing Co. ADR |

TSM |

25.4 |

17.7 |

8.4 |

6.2 |

71% |

|

Nvidia Corp. |

NVDA |

41.4 |

50.4 |

22.9 |

22.9 |

194% |

|

iShares Semiconductor ETF |

SOXX |

29.5 |

22.8 |

7.1 |

5.2 |

53% |

|

SPDR S&P 500 ETF Trust |

SPY |

21.1 |

18.9 |

2.8 |

2.4 |

25% |

|

Source: FactSet |

||||||

Looking first to the bottom of the table, the past year has been one of impressive performance for the S&P 500, with Nvidia and other technology stocks having an outsize effect. SOXX has more than doubled the S&P 500’s price change over the past 12 months.

Keep in mind that P/E ratios can be distorted if a company is only marginally profitable or is focusing so much on growing its business that little revenue flows through to the bottom line. For Micron Technology Inc. MU, there was no forward P/E a year ago, because at that time the rolling 12-month earnings-per-share estimate was negative.

It is interesting to see that Nvidia’s forward P/E is less than it was a year ago, even though the share price has nearly tripled. This shows that the rolling 12-month EPS estimate has risen even more quickly than the share price. Moving to forward price-to-sales ratios, Nvidia’s is the highest among the S&P 500 — hefty expectations are baked into that share price. And Nvidia’s price-to-sales ratio is rather close to its P/E, showing how high the profit margins are for its graphics processing units, or GPUs. The company continues to dominate this part of the industry, as data centers install the units as quickly as they can to support corporate clients’ efforts to create new products and services making use of generative artificial intelligence.

More on rising stocks with declining P/E ratios: Nine hot stocks, including Nvidia, that have become more attractive by this critical metric

Looking further ahead

Over the long term, a “beat-and-raise” pattern can support rising share prices. Analysts estimate companies’ quarterly revenue and profit, and after companies announce their results, which might include changing their own guidance for coming quarters, analysts will follow by updating their estimates.

For Nvidia, it is difficult to estimate results in what still seems to be the new industry of using GPUs to support AI. But the analysts keep trying. Here are projected compound annual growth rates for sales and EPS for the same group of 12 companies for the next two calendar years. The 2026 estimates are available for all but Semtech Corp. SMTC and Micron, with a 2026 sales estimate available for Broadcom Inc. AVGO. We have used consensus estimates as adjusted by FactSet from calendar 2024 through calendar 2026, because some of the companies have fiscal years that don’t match the calendar.

At the bottom of the table are expected CAGR for the PHLX Semiconductor Index and the S&P 500. Some notes about the data follow.

|

Company |

Ticker |

Expected two-year sales CAGR through 2026 |

Expected two-year EPS CAGR through 2026 |

|

Semtech Corp. |

SMTC |

N/A |

N/A |

|

Allegro MicroSystems Inc. |

ALGM |

14.0% |

38.8% |

|

Ichor Holdings Ltd. |

ICHR |

9.8% |

142.2% |

|

Marvell Technology Inc. |

MRVL |

24.2% |

50.3% |

|

Advanced Micro Devices Inc. |

AMD |

23.2% |

43.3% |

|

SiTime Corp. |

SITM |

27.7% |

89.6% |

|

Onto Innovation Inc. |

ONTO |

15.2% |

31.6% |

|

Micron Technology Inc. |

MU |

N/A |

N/A |

|

Broadcom Inc. |

AVGO |

11.3% |

N/A |

|

First Solar Inc. |

FSLR |

22.0% |

47.3% |

|

Taiwan Semiconductor Manufacturing Co. ADR |

TSM |

18.0% |

21.8% |

|

Nvidia Corp. |

NVDA |

26.1% |

26.5% |

|

PHLX Semiconductor Index |

SOX |

12.4% |

22.7% |

|

S&P 500 |

SPX |

5.8% |

13.2% |

|

Source: FactSet |

|||

For Semtech, estimates are not available for calendar 2026. The consensus among analysts polled by FactSet is for the company’s revenue to increase by 19% in calendar 2025, with EPS increasing by 143%.

For Micron, analysts expect calendar 2025 sales to increase 35%, with EPS increasing 173%.

For Broadcom, the table shows an expected two-year sales CAGR of 11.3% through 2026, but no EPS estimate is available for 2026. For 2025, EPS is expected to increase by 24%.

Market Extra: As Nvidia drives a chip rally in 2024, why are some AI stocks getting left behind?

Looking back through up/down cycles

Take a look at this five-year total-return chart for SOXX against SPY, with dividends reinvested. It shows not only that the semiconductor group has been outperforming, but also how volatile these stocks can be. During 2022 — a down year for the stock market — SPY fell 18%, but SOXX dropped 35%.

Can you ride out these difficult cycles for several years? If so, narrowing some of your portfolio allocation to semiconductors may be worthwhile over the long term.

You should do your own research to form your own opinions before making any investment. One way to begin is by clicking on the tickers for any company, ETF or index above.

Don’t miss: Nine hot stocks, including Nvidia, that have become more attractive by this critical metric