Shares in Advanced Micro Devices (NASDAQ: AMD) have tumbled 11% in the last three months.

The company has been a leading recipient of the recent boom in artificial intelligence (AI), with its stock up 147% since the start of 2023. AMD enjoyed a lot of sympathy growth as its rival, Nvidia (NASDAQ: NVDA), dominated the AI chip market. Because AMD is a leading chipmaker with the second-largest market share in graphics processing units (GPUs), Wall Street hoped it would follow in Nvidia’s footsteps.

However, a mediocre earnings release alongside stellar growth from Nvidia suggests AMD could face challenges in the coming years. So, the question is whether it’s worth making a long-term investment in AMD now while it’s down or opting for an alternative way to gain exposure to the same markets.

AMD stock just dipped, so is 2024 the time to invest? Let’s assess.

AMD’s latest earnings release didn’t do much to excite investors

AMD posted its first quarter of 2024 earnings on April 30. Revenue increased by 2% year over year to $5 billion, beating analysts’ expectations by $20 million. The company enjoyed solid gains in its data center and client segments, with revenue soaring 80% and 85% year over year. However, it was hit hard by more than 40% declines in its gaming and embedded divisions.

Overall, the company’s quarter was just fine. It beat revenue and earnings-per-share forecasts. However, AMD’s performance was dwarfed by Nvidia’s 262% year-over-year increase in revenue in the same quarter. And AMD isn’t just having trouble keeping up in AI. While the company’s gaming sales plunged, Nvidia’s gaming segment posted gains of 18% during the same period.

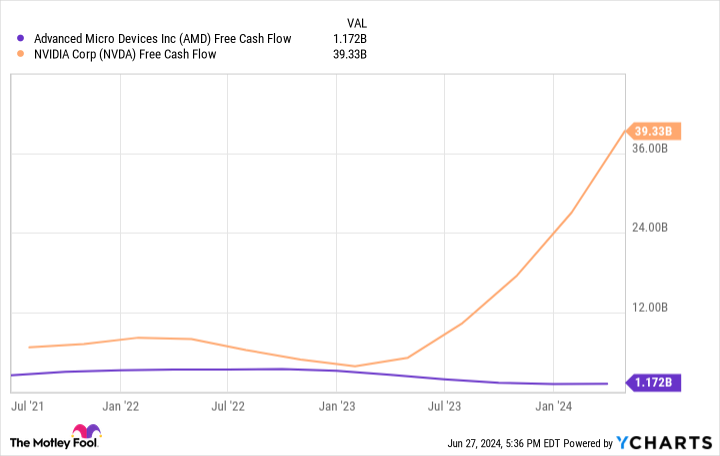

Consistent differences in the companies’ growth have led AMD’s free cash flow to fall 52% since 2021, while Nvidia’s skyrocketed 490%. The chart above illustrates Nvidia’s massive lead over AMD by this metric, suggesting Nvidia is better financially equipped to keep expanding its chip business and retain its market dominance.

AMD remains a prominent chipmaker with positions throughout tech, from PC gaming to consoles, data centers, consumer products like laptops, and more. However, the looming threat of Nvidia means AMD will need to differentiate itself in the industry and give customers a reason to choose its products.

Competing in AI will likely be an uphill battle

Nvidia has cornered the market on AI GPUs, snapping up an estimated 70% to 95% share of the industry. The sector is expanding quickly, suggesting there should be room for the company to retain its lead and welcome newcomers like AMD. However, past trends in the chip market indicate AMD will have a mountain to climb if its goal is ever to dethrone its biggest rival.

Nvidia has held a majority market share in discrete GPUs for at least the last decade, with its share rising from 65% to 88%. Meanwhile, since 2014, AMD’s position in the market has fallen from 35% to 12% in Q1 2024.

AMD has similarly had trouble overtaking Intel (NASDAQ: INTC) in the central processing unit (CPU) industry. AMD’s Ryzen processors were a hit when they launched in 2017, with the company’s CPU market share rising from 18% to 33% since then. Yet, Intel has managed to hang on to its leading role, with a 64% share in CPUs as of this year, proving it can be near impossible to lose dominance in a chip sector once you’ve achieved it. The data suggests Nvidia will retain its AI chip dominance, making it challenging for AMD to see significant growth in the industry.

Moreover, AMD is a hard sell as it struggles to differentiate itself from the competition. While Nvidia is leading in GPUs, chip rival Intel is developing its own AI chips and expanding into manufacturing. Intel has plans to open plants throughout the U.S., with hopes of becoming the AI chip fab of the nation. The move could allow it to profit from rising AI chip demand throughout the industry as companies like Nvidia and AMD outsource their manufacturing. Alternatively, AMD has yet to find a niche to dominate in AI as it continues to develop chips to compete with Nvidia and Intel’s offerings.

As a result, AMD’s two biggest competitors look like potentially better investments as the AI market develops.

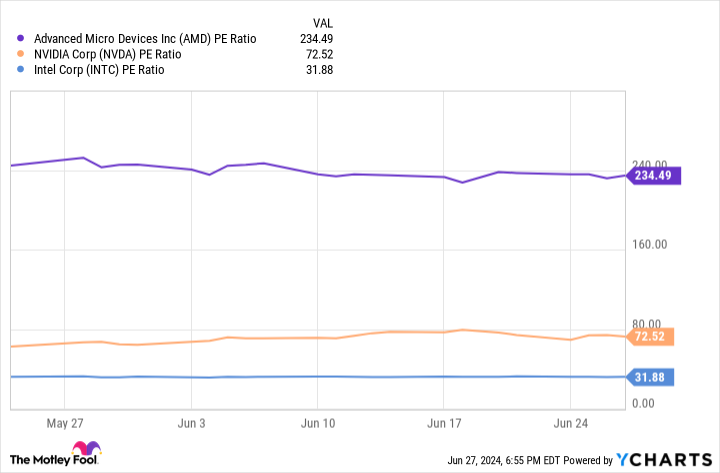

To add insult to injury, AMD’s stock offers far less value than its peers. This chart shows AMD has the highest price-to-earnings ratio alongside Nvidia and Intel, making their stocks look like bargains in comparison.

So, despite its recent dip, I’d hold off buying AMD stock for now and consider loading up on better-valued options.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

AMD Stock Just Dipped. Is 2024 the Time to Invest? was originally published by The Motley Fool