Remember again in February, once we have been anxious a few market correction? Back when the NASDAQ dipped 10% from its peak… Yeah, properly, by no means thoughts about that. Markets are up, up, up these days. A robust jobs report final Friday has helped, displaying 916,000 new positions in March, one of the best print since final August, and virtually a quarter-million greater than expectations.

Rising markets make it a superb time to take a look at the ‘top picks’ from Wall Street’s inventory analysts. The three shares we’re are an attention-grabbing lot, they usually have sure commonalities: a Strong Buy consensus ranking, tangible upside potential for traders, and a ‘Top Pick’ evaluation.

Using the TipRanks database, we’ve pulled the main points on these shares to seek out out what makes them so compelling. Here are the outcomes.

Ascendis Pharma (ASND)

First up, Ascendis Pharma, is an ‘emerging’ biotechnology firm with a major give attention to uncommon ailments in endocrinology. The firm has an energetic pipeline, with three drug candidates in medical trials for endocrine ailments, together with pediatric and grownup development hormone deficiency, grownup hypoparathyroidism, and achondroplasia. The firm develops its medicines utilizing its TransCon know-how, which permits the direct utility of proteins, peptides, and small molecules to focus on areas of the physique via a service drug with recognized organic motion. In addition to its major pipeline, Ascendis additionally has two oncology drug candidates in preclinical growth.

The firm’s pediatric development hormone deficiency (GHD) drug, TransCon HGH (lonapegsomatropin), has accomplished a Phase 3 trial and the corporate is making ready for the PDUFA date on the finish of June – with expectation of launching the drug commercially on the US market in 3Q21. Ascendis anticipates a European Commission determination on use of lonapegsomatropin throughout 4Q21. There is an ongoing world Phase 3 trial for adults with GHD, with full enrollment anticipated by early subsequent 12 months, and Ascendis has submitted its medical trial notification to start a Phase 3 trial for pediatric sufferers in Japan.

Furthermore, the corporate is making ready for Phase 3 medical trials for TransCon PTH, a remedy for grownup hypoparathyroidism. The firm anticipates topline ends in 4Q21. As above, the corporate can be continuing with medical trial notification in Japan, for 2Q21.

With all of that within the background, Wedbush analyst Liana Moussatos listed ASND as one in all her prime picks for 2021

“In 2021, we look forward to 1) TC-hGH/pediatric growth hormone deficiency (GHD; lonapegsomatropin) June 25, 2021, PDUFA date; 2) potential TC-hGH/GHD MAA approval in Q4:21; and 3) topline results from the pivotal Phase 3 PaTHway for TCPTH in adult hypoparathyroidism (HP) in Q4:21. We see these events as potential inflection points for the stock. We expect 2021 to be a transformative year for Ascendis in front of several potential value creation events,” Moussatos famous.

In line with these feedback, Moussatos charges ASND shares an Outperform (i.e. Buy), and units a $209 value goal indicating a 60% one-year upside potential. (To watch Moussatos’ monitor report, click here)

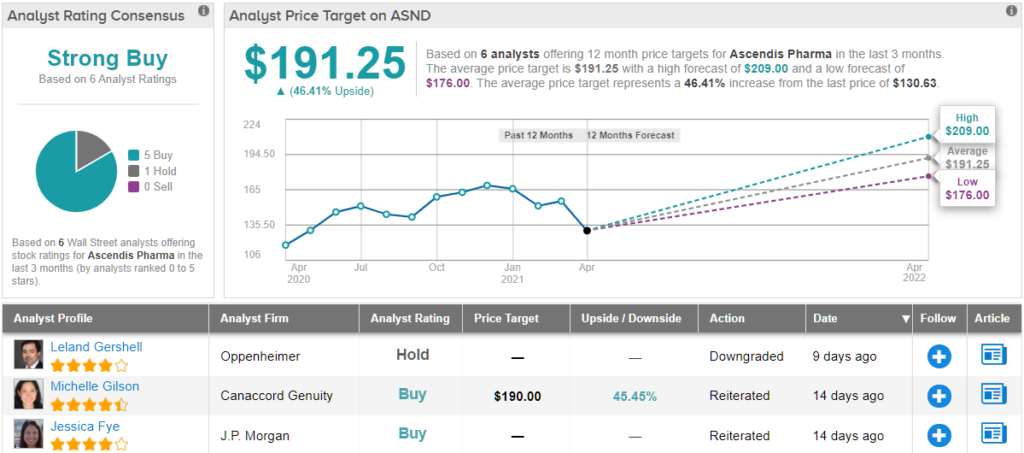

Moussatos is not any outlier on Ascendis; this inventory has 6 current opinions, with 5 to Buy and 1 to Hold. The shares are priced at $130.63 and their $191.25 common value goal suggests 46% development within the subsequent 12 months. (See ASND stock analysis on TipRanks)

AlloVir (ALVR)

The subsequent firm on our listing, AlloVir, is one other cutting-edge biotech agency. AlloVir’s focus is the event of allogenic, off-the-shelf virus-specific T-cell candidates. These are medicine particularly designed to forestall or deal with viral infections in immunocompromised sufferers with T-cell deficiencies – and restricted remedy choices. The firm’s pipeline options 5 candidate brokers for the remedy of twelve ‘devastating’ viruses, together with HHV-6, EBV, PIV, HBV, and even COVID-19.

The most superior drug candidate within the pipeline, ALVR105, additionally referred to as Viralym-M, is present process trials for a variety of purposes, together with the remedy of virus-associated hemorrhagic-cystitis, cytomegalovirus (CMV), and adenovirus (AdV). In addition, there are medical research of the drug candidate as a preventative for BKV, CMV, AdV, EBV, HHV-6 and others viral ailments. The medical trials vary from Phase 1b/2 to Phase 3.

The firm’s lead candidate, Viralym-M, is in an ongoing Phase 3 trial for the remedy of virus-associated hemorrhagic-cystitis. The firm additionally exams Viralym-M in two proof-of-concept Phase 2 trials. These embrace a medical research of the drug candidate as a primary of its variety, multi-virus preventative for HSCT recipients and a research of the drug within the remedy of BK viremia in kidney transplant sufferers. These trials are ongoing, and actively recruiting sufferers.

In addition to ALVR105/Viralym-M, the corporate subsequent two most superior packages are ALVR 109 and ALVR106. ALVR109 has entered Phase 1 proof-of-concept medical trial as a remedy for COVID-19. Preclinical information launched in December demonstrated illness particular antiviral exercise. ALVR 106 has had its investigation new drug (IND) utility accepted, and is cleared to provoke medical trials within the remedy of affect, PIV, and respiratory syncytial virus.

In his protection of this inventory for Piper Sandler, 5-star analyst Christopher Raymond writes, “[All] important timelines remain essentially on track. To us, the most critical of those are Phase 2 POC data for Viralym-M in the prevention setting for HSCT patients and for Phase 2 POC data for Viralym-M in the treatment of BK virus in kidney transplant recipients. Those two events remain on track for 2H21. While we do not model contribution form ALVR109 (in high-risk patients with COVID-19), we note that POC data from that program is also anticipated 2H21.”

At the underside line, Raymond says, “[We] continue to view ALVR as an emerging leader in virus specific cell therapies… it remains a top 2021 pick.”

To this finish, Raymond provides ALVR an Overweight (i.e. Buy) ranking, and his $55 value goal implies a strong upside of ~132% for the 12 months forward. (To watch Raymond’s monitor report, click here)

Like the Piper Sandler analyst, the remainder of the Street is bullish on ALVR. 3 Buy rankings in comparison with no Holds or Sells add as much as a Strong Buy consensus ranking. At $49.33, the common value goal implies upside potential of ~108%. (See ALVR stock analysis on TipRanks)

Western Digital (WDC)

From biotech to high-tech, we’ll change gears and take a look at Western Digital. The firm produces onerous disks and different information storage, together with SSDs and flash reminiscence. Western Digital’s merchandise are used within the information middle and cloud storage industries; Western Digital consists of well-known manufacturers like WD and SanDisk.

As may be imagined, Western Digital has seen regular enterprise within the final 18 months, regardless of the COVID pandemic. The transfer towards distant work and digital workplaces put a premium on laptop chips of all types, together with reminiscence and cloud storage. WDC’s revenues have held regular via that interval, close to $Four billion quarterly. For the previous two years, the corporate has reported quarterly revenues within the vary between $3.67 billion and $4.29 billion; the newest quarter, 2Q fiscal 21, confirmed $3.94 billion on the prime line, with non-GAAP EPS of 69 cents per share and free money movement of $149 million. The firm offered ahead steerage for fiscal Q3, projecting the highest line between $3.85 billion and $4.05 billion and non-GAAP EPS between 55 and 75 cents.

Investors like predictability, and Western Digital’s efficiency has been simply that. The firm’s inventory has benefited, and the shares are up 87% over the previous 12 months. This is a modest outperformance in comparison with the NASDAQ index, which is up 73% over the identical interval.

C J Muse, 5-star analyst with Evercore ISI, digs deep below the hood of Western Digital, and summing up writes, “While WDC shares are up 25% YTD, we see at least another 30% upside fueled by meaningful positive revisions to forward EPS estimates…. consensus estimates are moving materially higher with potential CY21 exit run rate of ~$10+ (cons $7.60) and additional upside into CY22 (we see stretch goal of $15.00 vs. current cons $7.44)…. With vision to at least 30% upside as the NAND industry emerges from a cyclical trough, WDC remains a Top Pick.”

Muse places a $100 value goal on WDC, for a 38% one-year upside potential. (To watch Muse’s monitor report, click here)

Tech corporations usually garner numerous analyst consideration, and Western Digital has 21 current inventory opinions. These break right down to 17 Buys towards simply 4 Holds, giving the inventory its Strong Buy consensus ranking. Shares are priced at $72.22, and the $80.26 common goal implies an 11% upside from that degree. (See WDC stock analysis on TipRanks)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your personal evaluation earlier than making any funding.