(Bloomberg) — The unprecedented oil stock glut that amassed throughout the coronavirus pandemic is sort of gone, underpinning a value restoration that’s rescuing producers however vexing shoppers.

Barely a fifth of the surplus that flooded into the storage tanks of developed economies when oil demand crashed final 12 months remained as of February, in response to the International Energy Agency. Since then, the lingering remnants have been whittled away as provides hoarded at sea plunge and a key depot in South Africa is depleted.

The re-balancing comes as OPEC and its allies hold huge swathes of manufacturing off-line and a tentative financial restoration rekindles international gas demand. It’s propping worldwide crude costs close to $67 a barrel, a boon for producers but an rising concern for motorists and governments cautious of inflation.

“Commercial oil inventories across the OECD are already back down to their five-year average,” mentioned Ed Morse, head of commodities analysis at Citigroup Inc. “What’s left of the surplus is almost entirely concentrated in China, which has been building a permanent petroleum reserve.”

The course of isn’t fairly full. A substantial overhang seems to stay off the coast of China’s Shandong province, although this will likely have gathered to feed new refineries, in response to consultants IHS Markit Ltd.

Working off the the rest of the international extra might take some extra time, as OPEC+ is reviving some halted provides and new virus outbreaks in India and Brazil threaten demand.

Still, the finish of the glut not less than seems to be in sight.

Oil inventories in developed economies stood simply 57 million barrels above their 2015-2019 common as of February, down from a peak of 249 million in July, the IEA estimates.

It’s a stark turnaround from a 12 months in the past, when lockdowns crushed world gas demand by 20% and buying and selling big Gunvor Group Ltd. fretted that space for storing for oil would quickly run out.

Stockpile Slump

In the U.S., the stock pile-up has successfully cleared already.

Total stockpiles of crude and merchandise subsided in late February to 1.28 billion barrels — a degree seen earlier than coronavirus erupted — and proceed to hover there, in response to the Energy Information Administration. Last week, stockpiles in the East Coast fell to their lowest in not less than 30 years.

“We’re starting to see refinery runs pick up in the U.S., which will be good for potential crude stock draws,” mentioned Mercedes McKay, a senior analyst at consultants FGE.

There have additionally been declines inside the nation’s Strategic Petroleum Reserve, the warren of salt caverns used to retailer oil for emergency use. Traders and oil corporations had been allowed to quickly park oversupply there by former President Trump, and in latest months have quietly eliminated about 21 million barrels from the location, in response to individuals accustomed to the matter.

The oil surplus that gathered on the world’s seas can be diminishing. Ships had been become makeshift floating depots when onshore services grew scarce final 12 months, however the volumes have plunged, in response to IHS Markit Ltd.

They’ve tumbled about by 27% in the previous two weeks to 50.7 million barrels, the lowest in a 12 months, IHS analysts Yen Ling Song and Fotios Katsoulas estimate.

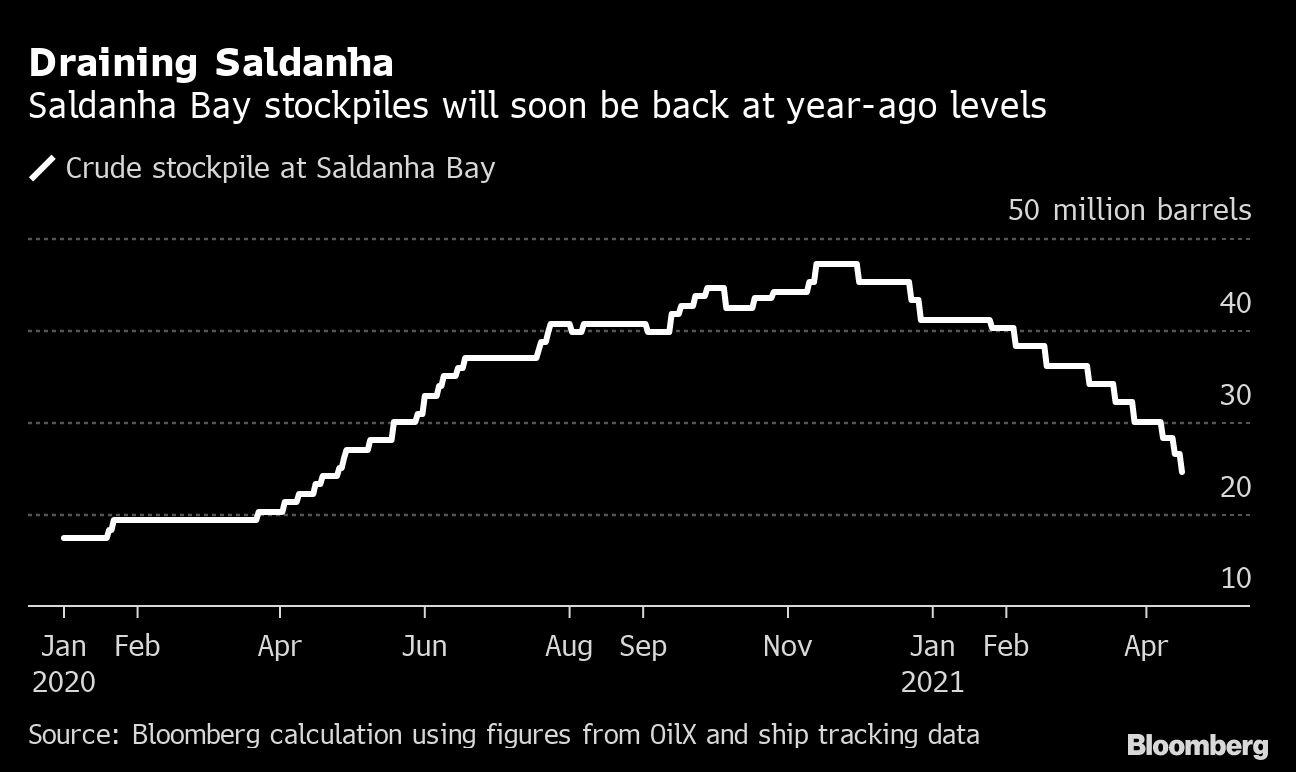

A very vivid image is the draining of crude storage tanks at the logistically-critical Saldanha Bay hub on the west coast of South Africa. It’s a preferred location for merchants, permitting them the flexibility to rapidly ship cargoes to completely different geographical markets.

Inventories at the terminal are set to fall to 24.5 million barrels, the lowest in a 12 months, in response to ship monitoring knowledge monitored by Bloomberg.

For the 23-nation OPEC+ coalition led by Saudi Arabia and Russia, the decline is a vindication of the daring technique they adopted a 12 months in the past. The alliance slashed output by 10 million barrels a day final April — roughly 10% of worldwide provides — and is now in the strategy of fastidiously restoring a few of the halted barrels.

The Organization of Petroleum Exporting Countries has constantly mentioned its key goal is to normalize swollen inventories, although it’s unclear whether or not the cartel will open the faucets as soon as that’s achieved. In the previous, the lure of excessive costs has prompted the group to maintain manufacturing tight even after reaching its stockpile goal.

Mixed Blessing

To consuming nations the nice de-stocking is much less of a blessing. Drivers in California are already reckoning with paying nearly $four for a gallon of gasoline, knowledge from the AAA auto membership reveals. India, a significant importer, has complained about the monetary ache of resurgent costs.

For higher or worse, the re-balancing ought to proceed. As demand picks up additional, international inventories will decline at a price of two.2 million barrels a day in the second half, propelling Brent crude to $74 a barrel and even increased, Citigroup predicts.

“Gasoline sales are ripping in the U.S.,” mentioned Morse. “Demand across all products will hit record levels in the third quarter, pushed up by demand for transport fuels and petrochemical feed-stocks.”

For extra articles like this, please go to us at bloomberg.com

Subscribe now to remain forward with the most trusted enterprise information supply.

©2021 Bloomberg L.P.