(Bloomberg) — The surge in Nvidia Corp. shares on Thursday has left short sellers with about $3 billion in paper losses, according to an analysis by S3 Partners LLC, which called it an “AI generated nightmare” for bearish traders.

Most Read from Bloomberg

The mark-to-market losses are another blow for contrarians who argued that Nvidia’s sky-high valuations and speculative fever had all the makings of a market bubble about to pop. The chipmaker is the third-largest US short with $18.3 billion of shares that have been borrowed and sold, according to S3.

“The early mark-to-market losses were inescapable for many short sellers that were looking to trim their positions after NVDA’s earnings report,” Ihor Dusaniwsky, managing director of predictive analytics at S3, wrote in the note. “Short sellers will probably wait a bit to look for more favorable exit points.”

Read more: The AI Chip Behind Nvidia’s Supersonic Stock Rally: QuickTake

The rally in Nvidia sparked broader gains across the US chip industry. Short sellers had a one-day paper loss of $4.3 billion from semiconductor stocks, S3 data showed. Semiconductors are the worst-performing sector for short sellers this year, with mark-to-market losses of $7.2 billion in February.

Nvidia shares continued their climb on Friday, rising as much as 4.9% in early trading in New York.

Some investors say Nvidia’s blockbuster earnings will cement optimism that AI spending is strong, justifying the big stock market gains.

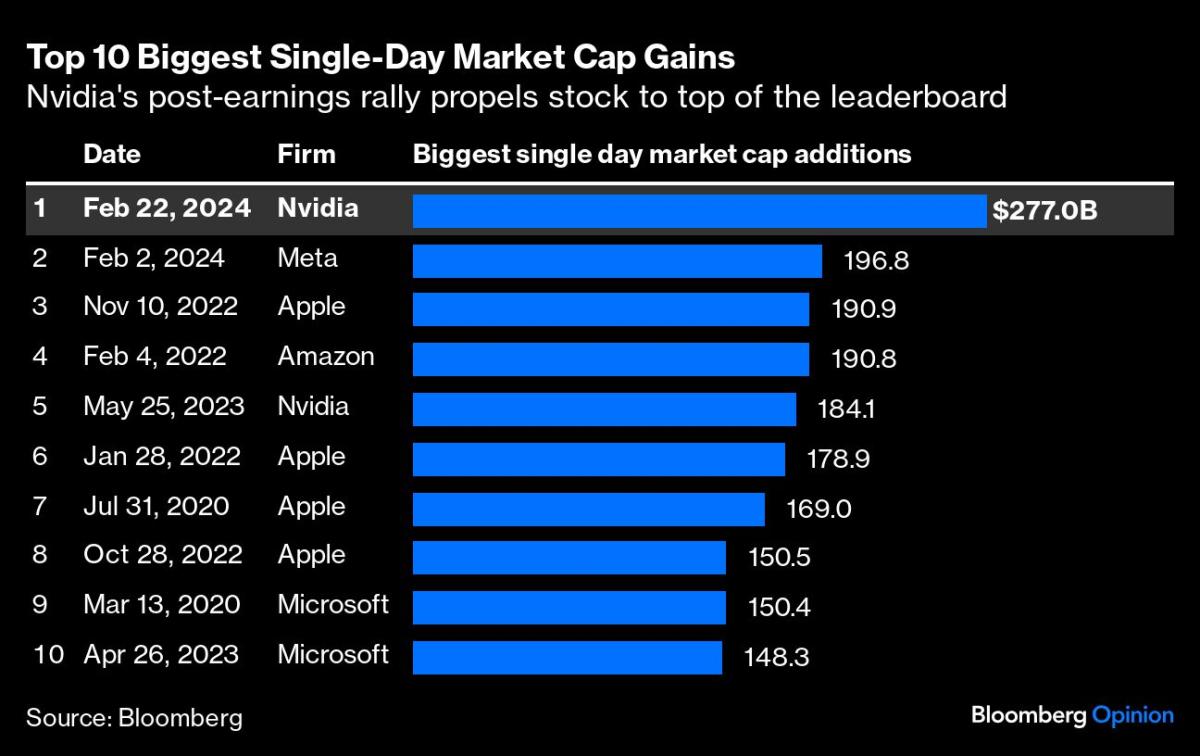

Nvidia surged 16% on Thursday, making it the third-biggest S&P 500 company and putting it on track to breach $2 trillion in market value. The Philadelphia Semiconductor Index climbed nearly 65% in 2023 and is up another 13% this year.

–With assistance from Subrat Patnaik.

(Updates with stock moves at market open.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.