The inventory market’s bears lastly haven damaged by way of and a number of other components have mixed to spark this setback in inventory costs.

First, retail buyers are dropping curiosity in shares. Remember the retail frenzy as the Reddit crowd whipped up enthusiasm for meme shares? Remember how flash mobs drove up chosen points with call-option shopping for which compelled market-makers to hedge by shopping for the underlying shares?

That’s largely gone. In the quick run, there was lots of hand-wringing about the name shopping for as an indication of extreme hypothesis. My longer-term view is a rising fairness name/put ratio is an indication of bullish momentum and rising name/put ratios had been coincidental with fairness bull phases. In the previous, a decline of the 50-day transferring common (dma) of the name/put ratio under the 200-day transferring common has signaled pauses in bullish advances in the previous.

Bad information from abroad on the pandemic entrance might have additionally contributed to the risk-off tone. Taiwan introduced limits on crowds, following Singapore’s transfer to limit overseas employees, in a wave of latest restrictions in Asian nations attempting to stamp out small outbreaks after months of protecting COVID-19 contained.

The new curbs prompted fears that financial development might stall out, which led to inventory selloffs in each nations this week. Low vaccination charges as properly are contributing to considerations that their populations might be weak if faster-spreading variants take hold.

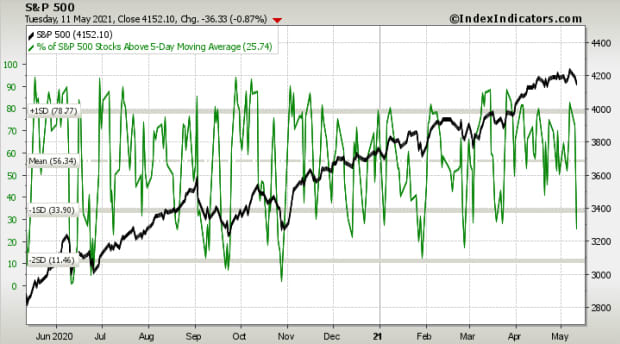

The burst of stock-market beneficial properties and push to new highs early on Monday was reversed throughout the session, inflicting a spike in the variety of shares struggling a shopping for climax. This is triggered when a inventory hits a 52-week excessive then reverses to shut under the prior day’s shut, probably an indication of exhaustion amongst patrons.

Our Backtest Engine exhibits that that is the sixth-largest variety of climaxes in a single day since the inception of the SPDR S&P 500 ETF Trust

SPY,

Every time greater than 95 shares suffered a shopping for climax, the S&P 500

SPX,

confirmed a loss over the subsequent one-to-two months. There had been few losses over the subsequent six-12 months, and so they had been comparatively small.

Equally disturbing is the efficiency of the bellwether growth-cyclical PHLX Semiconductor Index

SOX,

This index has now violated each absolute- and relative rising development strains that stretched again a 12 months.

Putting it all collectively, these are all indicators that the bears are taking control of the tape.

Where’s the backside?

This S&P 500 pullback is unlikely to be very deep. A logical assist stage is the 50-day transferring common, at about 4050, which represents a peak-to-trough draw back threat of -4.4% and simply 1% down from present ranges.

Some of my bottoming indicators are already beginning to come into place. The five-day RSI is flashing an oversold studying, which is the first signal of a bottoming course of. The CBOE Volatility Index

VIX,

(VIX) has spiked above its higher Bollinger Band, which can also be a short-term oversold indicator for the inventory market.

However, the time period construction of the VIX isn’t inverted, indicating worry. Markets want panic to set in for a sturdy backside to be made. As properly, the NYSE McClellan Oscillator (NYMO) has not flashed an oversold situation but.

While the S&P 500 is holding up comparatively properly and being supported by the relative power of worth shares, development shares present significantly extra draw back threat. Despite violating its 50-day transferring common and violating an vital relative assist zone, the NASDAQ 100

NDX,

isn’t displaying any indicators of a sturdy backside forward. The share of Nasdaq shares above their 50-day transferring common isn’t oversold, and neither is the NASDAQ McClellan Oscillator (NAMO). The most reasonable assist stage for NASDAQ 100 is the 200-day transferring common at about 12,500.

The market was already oversold as of Tuesday’s shut. Wednesday’s skid will undoubtedly stretch short-term readings additional. In all probability, the market will bounce on Thursday, but how it holds the power will be a check for each bulls and bears in the coming days. The main development remains to be up, and the threat/reward of attempting to revenue from a countertrend correction in a bull market is unfavorable.

Cam Hui writes the funding weblog Humble Student of the Markets. He is a former fairness portfolio supervisor and sell-side analyst.

More: There is a ‘super sale’ in Big Tech and other ‘high-quality’ stocks, says this fund manager

Also learn: What does inflation mean for the stock market? It’s supposed to be a positive—but investors are spooked now