(Bloomberg) — After China imposed a report antitrust effective on Alibaba Group Holding Ltd., the e-commerce large did an uncommon factor: It thanked regulators.

“Alibaba would not have achieved our growth without sound government regulation and service, and the critical oversight, tolerance and support from all of our constituencies have been crucial to our development,” the corporate mentioned in an open letter. “For this, we are full of gratitude and respect.”

It’s an indication of how odd China’s crackdown on the ability of huge tech has been in contrast with the remainder of the world. Mark Zuckerberg and Tim Cook would possible not categorical such public gratitude if the U.S. authorities have been to hit Facebook Inc. or Apple Inc. with report antitrust fines.

But virtually the whole lot about China’s regulatory push is out of the unusual. Beijing regulators wrapped up their landmark probe in simply 4 months, in contrast with the years that such investigations take within the U.S. or Europe. They despatched a transparent message to the nation’s largest companies and their leaders that anti-competitive conduct may have penalties.

For Alibaba, the $2.Eight billion effective was much less extreme than many feared and helps elevate a cloud of uncertainty hanging over founder Jack Ma’s web empire. The 18.2 billion yuan penalty was primarily based on simply 4% of the web large’s 2019 home income, regulators mentioned. While that’s triple the earlier excessive of just about $1 billion that U.S. chipmaker Qualcomm Inc. handed over in 2015, it’s far lower than the utmost 10% allowed beneath Chinese regulation.

The effective got here with a plethora of “rectifications” that Alibaba must put in place — corresponding to curbing the apply of forcing retailers to decide on between Alibaba or a competing platform — lots of which the corporate had already pledged to ascertain.

Read extra: China Fines Alibaba Record $2.8 Billion After Monopoly Probe

Alibaba Chief Executive Officer Daniel Zhang on Saturday declared his firm now prepared to maneuver on from its ordeal, whereas China’s Communist Party mouthpiece People’s Daily issued assurances that Beijing wasn’t attempting to stifle the sector.

The Hangzhou-based agency “has escaped possible outcomes such as a forced breakup or divestment of assets. The penalty will not shake up its business model, either,” mentioned Jet Deng, an antitrust lawyer on the Beijing workplace of regulation agency Dentons.

Still, neither Zhang nor state media addressed lingering questions across the extent to which Beijing stays intent on reining in its web and fintech giants, a broad marketing campaign that’s wiped greater than $250 billion off Alibaba’s valuation since October. The e-commerce large’s speedy capitulation additionally underscores its vulnerability to additional regulatory motion — a far cry from simply six years in the past, when Alibaba brazenly contested one company’s censure over counterfeit items on Taobao and finally pressured the State Administration for Industry and Commerce to backtrack on its allegations.

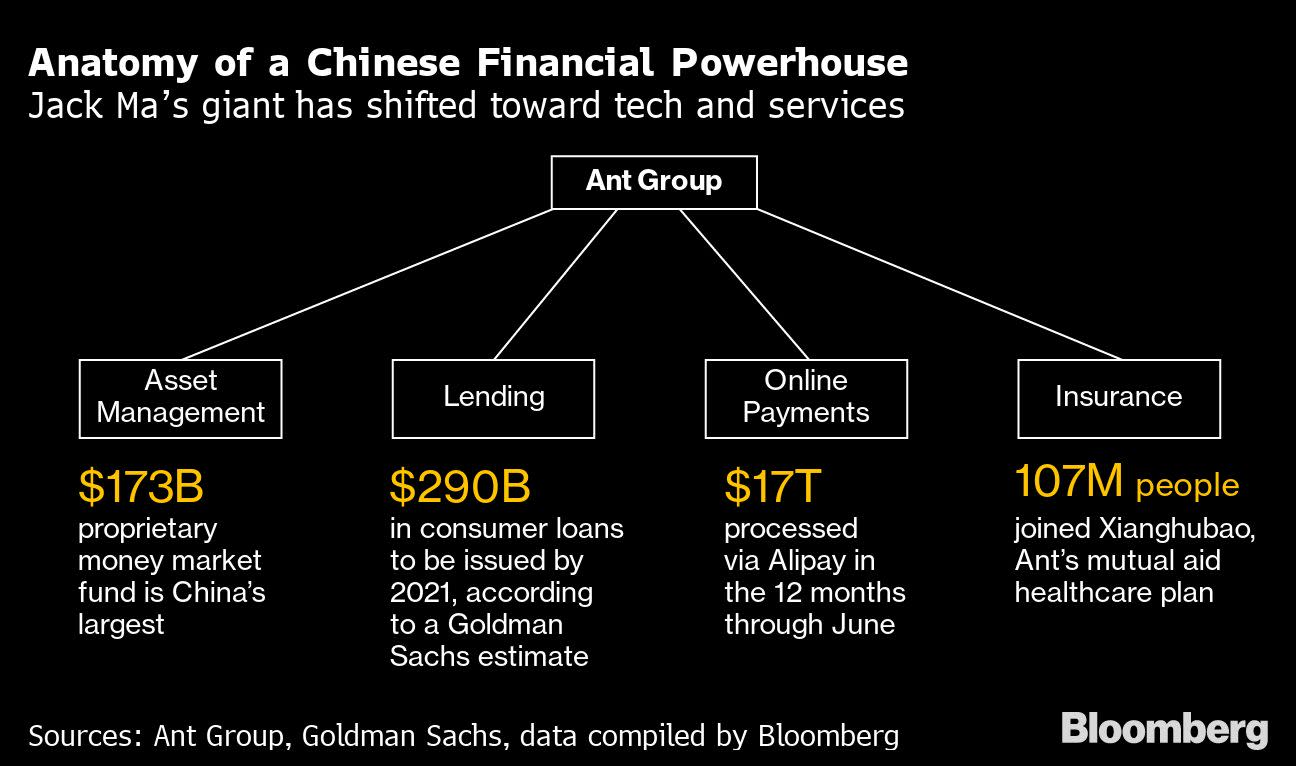

Beyond antitrust, authorities businesses are mentioned to be scrutinizing different components of Ma’s empire, together with Ant Group Co.’s consumer-lending companies and Alibaba’s in depth media holdings. And the shock of the crackdown will proceed to resonate with friends from Tencent Holdings Ltd. and Baidu Inc. to Meituan, forcing them to tread much more fastidiously on enterprise expansions and acquisitions for a while to come back.

What Bloomberg Intelligence Says

China’s report effective on Alibaba could elevate the regulatory overhang that has weighed on the corporate because the begin of an anti-monopoly probe in late December. The 18.2 billion yuan ($2.Eight billion) effective, to penalize the anti-competitive apply of service provider exclusivity, is equal to 4% of Alibaba’s 2019 home gross sales. Still, the corporate could must be conservative with acquisitions and its broader enterprise practices.

— Vey-Sern Ling and Tiffany Tam, analysts

Click right here for the complete analysis.

The investigation into Alibaba was one of many opening salvos in a marketing campaign seemingly designed to curb the ability of China’s web leaders, which kicked off after Ma infamously rebuked “pawn shop” Chinese lenders, regulators who don’t get the web, and the “old men” of the worldwide banking neighborhood. Those feedback set in movement an unprecedented regulatory offensive, together with scuttling Ant’s $35 billion preliminary public providing.

It stays unclear whether or not the watchdog or different businesses may demand additional motion. Regulators are mentioned, as an illustration, to be involved about Alibaba’s capacity to sway public discourse and wish the corporate to promote a few of its media property, together with the South China Morning Post, Hong Kong’s main English-language newspaper.

Read extra: China Presses Alibaba to Sell Media Assets, Including SCMP

China’s prime monetary regulators now see Tencent as the subsequent goal for elevated supervision, Bloomberg News has reported. And the central financial institution is alleged to be main discussions round establishing a three way partnership with native expertise giants to supervise the profitable information they gather from a whole bunch of tens of millions of shoppers, which might be a major escalation in regulators’ makes an attempt to tighten their grip over the nation’s web sector.

“The high fine puts the regulator in the media spotlight and sends a strong signal to the tech sector that such types of exclusionary conduct will no longer be tolerated,” mentioned Angela Zhang, creator of “Chinese Antitrust Exceptionalism” and director of the Centre for Chinese Law on the University of Hong Kong. “It’s a stone that kills two birds.”

For now, it seems buyers are simply glad it wasn’t worse. In its assertion, the State Administration for Market Regulation concluded Alibaba had used information and algorithms “to maintain and strengthen its own market power and obtain improper competitive advantage.” Its apply of imposing a “pick one from two” selection on retailers “shuts out and restricts competition” within the home on-line retail market, in accordance with the assertion.

The agency shall be required to implement “comprehensive rectifications,” together with strengthening inside controls, upholding truthful competitors and defending companies on its platform and shoppers’ rights, the regulator mentioned. It might want to submit experiences on self-regulation to the authority for 3 consecutive years.

Alibaba mentioned it is going to maintain a convention name Monday morning Hong Kong time to deal with the antitrust watchdog’s decree. The firm must make changes however can now “start over,” Zhang wrote in a memo to Alibaba’s workers Saturday.

“We believe market concerns over the anti-monopoly investigation on BABA are addressed by SAMR’s recent decision and penalties,” Jefferies analysts wrote in a analysis notice entitled “A New Starting Point.”

Indeed, The People’s Daily mentioned in its commentary Saturday that the punishment was meant merely to “prevent the disorderly expansion of capital.”

“It doesn’t mean denying the significant role of platform economy in overall economic and social development, and doesn’t signal a shift of attitude in terms of the country’s support to the platform economy,” the newspaper mentioned. “Regulations are for better development, and ‘reining in’ is also a kind of love.”

For extra articles like this, please go to us at bloomberg.com

Subscribe now to remain forward with probably the most trusted enterprise information supply.

©2021 Bloomberg L.P.