One factor is definite already: the market atmosphere for 2022 is not going to be the identical as that in 2021. This might or will not be good for traders, per se, however like each shift in market circumstances, it is going to current alternatives for these ready to grasp them.

Some components are simply reruns. COVID is rearing its ugly head once more, threatening us with lockdowns and shutdowns. That’s working towards the grain of a resurgent financial system, an financial system that’s making an attempt to achieve extra traction – but it surely’s dealing with headwinds in a shaky labor market. Even although unemployment is again down beneath 4%, the labor drive participation fee remains to be too low and December noticed lower than half the anticipated jobs good points. And to high this off, inflation remains to be rising and the Administration needs to push extra multi-trillion greenback spending packages.

It’s on this atmosphere that Morgan Stanley’s chief cross-asset strategist, Andrew Sheets, has two essential insights. First, he notes, “…that global growth has become less sensitive to each subsequent COVID wave as vaccination rates have risen, treatment options have improved and the appetite for restrictions has declined.” And second, “…it would seem for the moment that central banks in a lot of countries are increasingly comfortable pushing a more hawkish line until something pushes back. And so far, nothing has.”

Now that’s a optimistic spin for an unsure time, and it has led Sheets’ colleague and Morgan Stanley inventory analyst Robert Kad to pick a variety of high-yield dividend shares as potential winners for the approaching yr. We’ve used the TipRanks database to choose two of his picks for a better look. These are shares with a ‘double whammy’ when it comes to dividend payers: a excessive yield, on this case, 6% or higher, together with higher than 25% upside potential. Let’s dive into he particulars.

Energy Transfer (ET)

First up is Energy Transfer, a midstream firm within the oil and fuel sector. Midstreamers are very important parts of the hydrocarbon trade, shifting the crude oil, pure fuel, and pure fuel liquids from the wellheads to the storage services after which from the storage tanks to the refiners, distribution hubs, and export terminals. In this sector, Energy Transfer is a significant participant. The $29 billion firm has an in depth community of fuel and crude oil pipelines and storage and processing services. While this community is centered primarily on the Texas-Oklahoma-Arkansas-Louisiana area, it extends to the Great Lakes, Florida, and the Dakotas as properly. ET has export terminals on the Gulf coast and within the Chesapeake Bay.

Energy Transfer is likely one of the largest midstream corporations within the US, and in December it accomplished an acquisition that boosted its whole pipeline miles to 114,000. The firm acquired Enable Midstream, an Oklahoma-based competitor in a deal value $7.2 billion in inventory.

ET’s most up-to-date monetary launch, for 3Q21, confirmed $16.66 billion in whole income, up 67% from the prior yr’s third quarter. Net earnings had been damaging in 3Q20, however has circled. In the final quarterly launch, whole internet earnings was up $1.29 billion year-over-year, to attain $635 million. Per share, this got here to 20 cents, up from the 29-cent EPS loss recorded within the year-ago quarter. The firm is predicted to launch 4Q21 numbers within the final week of February.

On the dividend, ET declared its most up-to-date fee at 15.25 cents per frequent share, or 61 cents annualized. This was paid out this previous November and marked the fifth quarter in a row with the fee at this degree. The dividend yields a robust 6.7%, far larger than present rates of interest – and better than the typical dividend discovered on the broader market.

Covering the inventory for Morgan Stanley, analyst Robert Kad sees the present valuation as a horny entry level.

“ET has traded at a discount to the group in recent years despite a high quality, diversified and vertically integrated asset base, likely attributable to several factors: elevated leverage that has risked IG credit ratings, concern with commitment to capital discipline and durability of FCF, execution risk around perceived acquisitiveness, regulatory risk around key projects (DAPL, Mariner), and suboptimal governance protections as an MLP. As a result, ET now trades at the lowest EV/EBITDA and highest FCF yield before dividends within our coverage. Given prevailing valuation and our view that some of these factors are likely to improve in 2022, we see meaningfully positive risk/reward skew at current levels,” Kad opined.

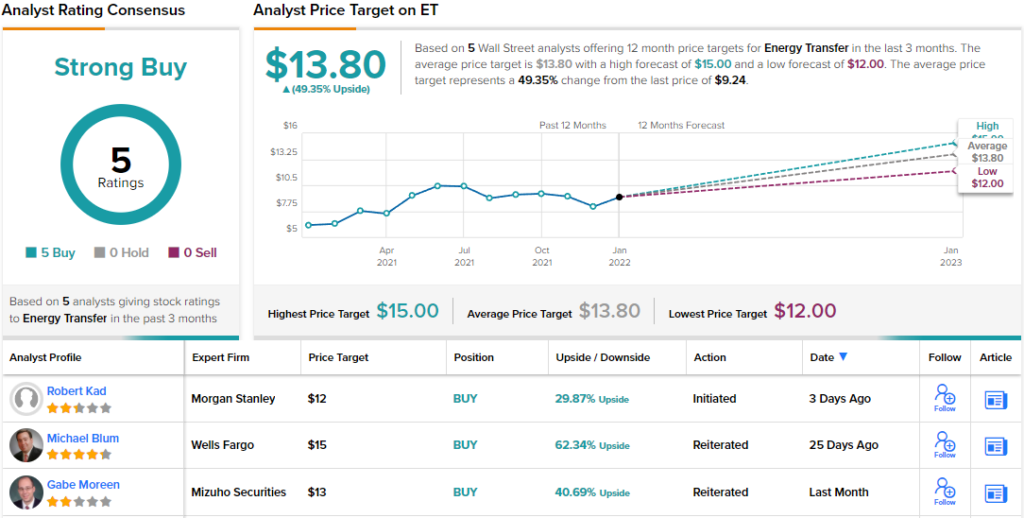

In line together with his bullish take, Kad charges ET an Overweight (i.e. Buy). Should his $12 worth goal be met, a twelve-month achieve of ~30% may very well be in retailer. (To watch Kad’s monitor document, click here)

Overall, ET has a unanimous Strong Buy consensus score based mostly on 5 optimistic evaluations. ET has a median worth goal of $13.80, giving ~49% upside potential from the $9.24 buying and selling worth – much more bullish than the Morgan Stanley view. (See ET stock analysis on TipRanks)

Plains All American Pipeline (PAA)

Like Energy Transfer, the second inventory we’re trying at, Plains All American, is one other midstream power firm. PAA’s community contains oil gathering belongings in California, and a community of pipelines and gathering/refining services within the Northern Rockies and Great Plains, stretching from Alberta into Montana and the Dakotas and south to Colorado, in addition to the same community centered in Texas, Oklahoma, and Louisiana. The firm additionally has pure fuel belongings within the Great Lakes area and maritime hydrocarbon terminal belongings within the Chesapeake Bay.

In October of final yr, PAA entered right into a three way partnership (JV) with Oryx Midstream, a competing firm within the Texas Permian Basin. The JV permits each companions to pool belongings to mutual profit. The two corporations will supply improved ‘flexibility, optionality, and connectivity’ to their clients, whereas enhancing efficiencies and money circulate.

That final is essential, as PAA’s earnings have turned to a internet loss for the previous two quarters. However, revenues have been rising over the previous yr. PAA has seen 5 quarters in a row of sequential income good points, and the final reported, for 3Q21, confirmed $10.eight billion at the highest line. This was practically double the $5.eight billion reported the yr earlier than. The firm additionally reported $24 billion in whole belongings, together with $213 million in money and liquid belongings. PAA reported Q3 free money circulate of $1.09 billion, or $927 million after distributions.

The distribution included the 18-cent per frequent share dividend fee, the seventh consecutive fee at this degree. The dividend yields 7.1%, greater than triple the typical div fee discovered within the broader markets.

In his protection of this inventory for Morgan Stanley, Robert Kad writes: “PAA offers leverage to recovery in Permian Basin oil production, where we see strong growth in 2021/2022… PAA’s strategic combination with Oryx provides downside mitigation through a broader footprint with greater Permian gathering scale and customer/acreage diversification…. Valuation remains below that of large-cap peers, with a path to partial narrowing of the discount supported by way of above median FCF profile, expected de-leveraging cadence and potential upside to return of capital…”

To this finish, Kad offers PAA an Overweight (i.e. Buy) score, whereas his $14 worth goal signifies room for a 39% one-year upside.

Plains All American has, like ET above, picked up 5 optimistic analyst evaluations. But these are partially balanced by 3 Holds, for a Moderate Buy consensus score. The inventory is at the moment buying and selling for $10.07 and the typical worth goal of $13.29 suggests an upside of 31% for 2022. (See PAA stock analysis on TipRanks)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant to be used for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.