Super Micro Computer (NASDAQ: SMCI) was one of this year’s best-performing stocks, even outpacing Nvidia. However, it has fallen on hard times after a poorly received earnings report and a short-seller announcement. The stock now sits more than 60% off its all-time highs after combining these two factors and a general sell-off due to extreme valuation.

With the stock now at this low point, many investors (including myself) may wonder whether shares might be a steal at these levels. Let’s take a look, as there is a lot to be excited and concerned about.

Supermicro’s products are in high demand

Super Micro Computer (often called Supermicro) provides components necessary for building large-scale data centers and servers. Because of the high demand for extreme computing power to train artificial intelligence (AI) models, Supermicro is seeing a demand spike similar to that of Nvidia for its products.

This space is fairly commoditized, as there isn’t much to differentiate between providers. But Supermicro’s highly customizable server products set it apart from the competition. Additionally, the company’s architecture is the most energy-efficient offering available. This is critical because energy costs are incredibly high for these servers.

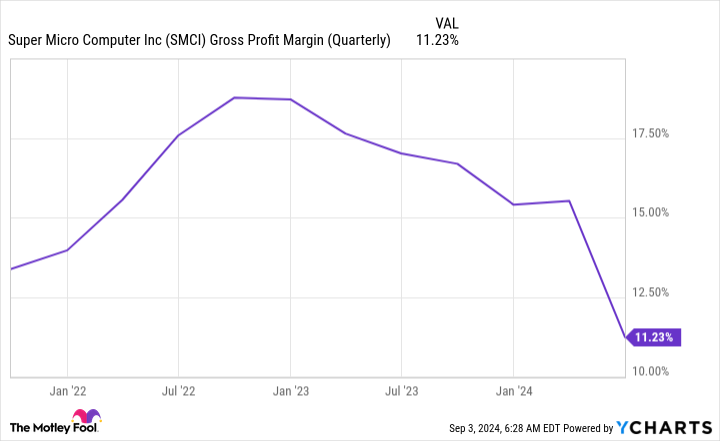

Supermicro’s business has exploded as the demand for AI computing has increased. In the fourth quarter of fiscal year (FY) 2024 (ending June 30), its revenue rose 143% year over year to $5.3 billion. It also guided for $26 billion to $30 billion in revenue for FY 2025, indicating 74% to 101% growth. However, its gross margin has significantly declined because its product mix is becoming more heavily slated toward its new liquid-cooled technology.

Management expects its gross margin to improve throughout 2025 and beyond due to relocating its production facilities, but this short-term headwind is expected to put a lot of pressure on its profit margin. This is if Supermicro’s accounting is accurate, as there are recent allegations regarding concerns with its internal controls.

Are there legitimate question marks associated with Supermicro’s accounting practices?

Supermicro also announced it would be late filing its end-of-year Form 10-K to the Securities and Exchange Commission (SEC) due to management’s assessment of internal controls over financial reporting. This announcement came nearly at the same time as famed short-seller Hindenburg Research announced its short position in the company.

While Hindenburg’s announcement included several reasons it believes the company is engaged in some level of impropriety, it mainly alleges that Supermicro’s end-of-quarter accounting techniques make it seem like the company is doing better than it actually is. Of course, Hindenburg is a motivated short-seller, and the validity of its claims must still be proven.

Additionally, in 2018, Supermicro was temporarily delisted from the Nasdaq stock exchange because it failed to file timely financial statements. The SEC fined the company in 2020 for improper accounting. While some people lost their jobs because of this, Hindenburg alleges that these people were rehired within three months of paying the fines.

Nearly all investors’ actions are based on the financials the company reports to them. If that information is unreliable, it’s nearly impossible to assess the stock adequately.

The report caused the stock to plummet nearly 30%, indicating that most investors wanted nothing to do with it.

But is this a legitimate reaction? While there are likely some accounting issues at Supermicro, there is also real demand for its products and services. While this may affect a few percentage points of revenue, it’s unlikely to be billions of dollars’ worth. Furthermore, the stock trades for just 13 times forward earnings after the sell-off.

That’s dirt cheap for a company benefiting from the massive AI demand wave.

So, what should investors do? I think investors should be patient before taking a large position in the stock. There are a lot of unknowns right now, and it’s too early to tell how the stock will react. However, taking a tiny position (say less than 1% of overall portfolio weight) may not be a bad idea, as there is a lot of upside here. And if Supermicro declines more, it won’t affect the overall portfolio much.

Supermicro is still a company with huge demand for its product, but some allegations surround its financials and internal controls. So, only time will tell.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Should You Load Up on Super Micro Computer Stock While It’s Down 60% From Its All-Time High? was originally published by The Motley Fool