US stocks rebounded on Monday on the heels of the S&P 500’s worst week since early 2023, as inflation came back into focus for investors gauging pressures that could influence the size of interest rate cuts.

The S&P 500 (^GSPC) climbed nearly 1.2%, coming off a hefty weekly loss. The Dow Jones Industrial Average (^DJI) jumped more than 450 points, or 1.2%, while the tech-heavy Nasdaq Composite (^IXIC) rose more than 1%.

Financials (XLF), Industrials (XLI), and Energy (XLE) stocks led the market rebound. Nvidia (NVDA), Tesla (TSLA), and Amazon (AMZN) led gains among the megacaps.

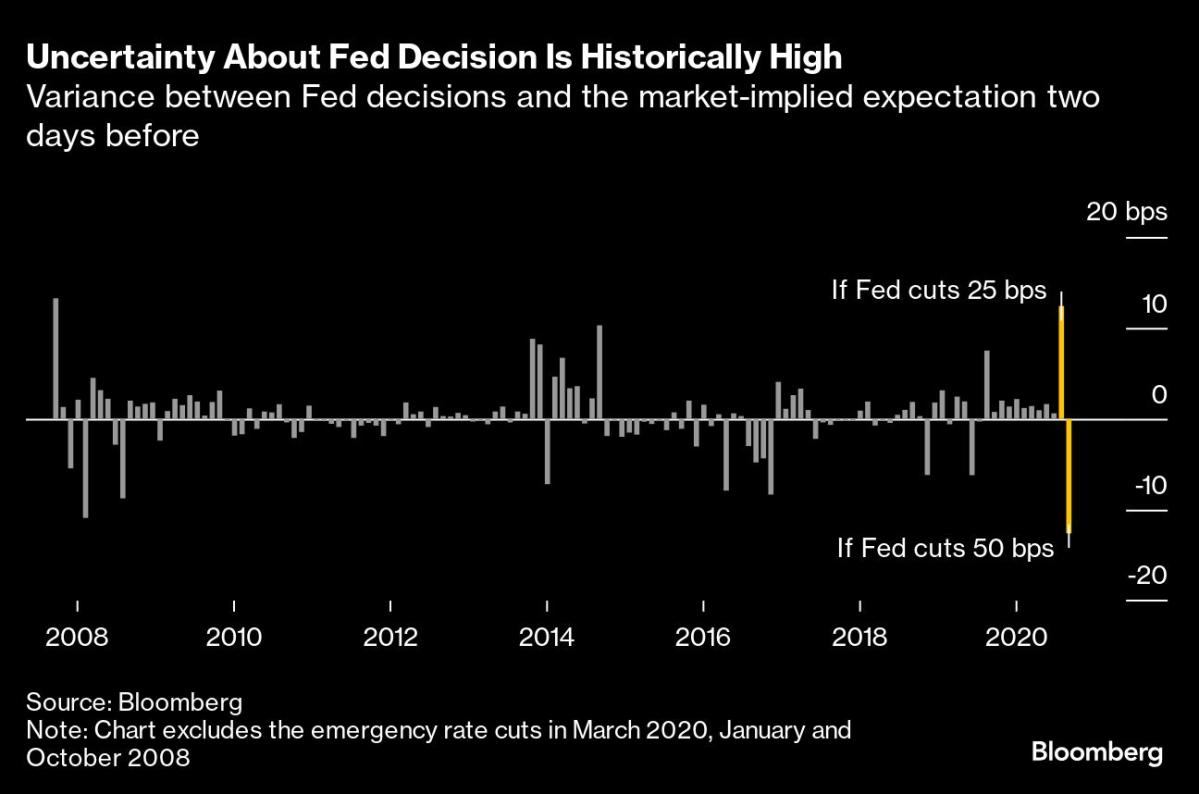

The major averages regained some of the ground they lost after the August jobs report failed to settle a key question: How aggressively will the Federal Reserve lower interest rates? The neither-hot-nor-cold data left Wall Street guessing whether a cut of 25 or 50 basis points is likely at this month’s policy meeting.

Read more: Fed predictions for 2024: What experts say about the possibility of a rate cut

Focus is now on a fresh consumer inflation print due Wednesday to provide clues to the path of rates. The reading on price pressures will be followed by a producer inflation report on Thursday, the last inflation inputs before the Fed’s policy decision on Sept. 18.

Meanwhile, Apple (AAPL) debuted its iPhone 16 smartphone at its annual product unveiling event in Cupertino, California. The tech giant also announced updates to its entire Apple Watch lineup, and AirPods Pro 2 which include new hearing protection features. Shares were little changed on the day.

Live13 updates

-

-

-

-

-

-

-

Dow gains 600 points, S&P 500, Nasdaq near session highs amid rebound

Stocks rose to hover near session highs on Monday afternoon amid a market rebound following last week’s sharp losses.

Industrials (XLI), Financials (XLF), and Consumer Discretionary (XLY) led the gains as the Dow Jones Industrial Average (^DJI) soared more than 600 points, or 1.6%.

The S&P 500 (^GSPC) also gained more than 1% while the tech-heavy Nasdaq Composite (^IXIC) increased roughly 1.3%.

Stocks were rebounding on Monday following their worst week of the year.

All of the S&P 500 sectors were in green territory on Monday during a broad market rebound. -

-

-

-

-

-