It’s that point once more – time to search for upwardly cellular shares at relative discount costs. We’ve simply seen a pullback in market costs, however for some shares the pullback began earlier and has run deeper. That’s opened up alternatives that Wall Street’s analysts have been fast to level out.

These are Strong Buy shares, regardless of their latest slips in share worth. The analysts have famous that every one has a path towards near-term beneficial properties, making the risk-reward components appropriate for return-minded traders. And with costs down these days, these are appropriate for discount hunters, too.

We’ve used TipRanks’ database to seek out three shares which meet that profile. Let’s take a nearer look.

Farfetch, Ltd. (FTCH)

Online retailers have clearly had a bonus in the previous 12 months, however on the flip facet, the latest reopening of economies around the globe has put some strain on them. Farfetch, a web-based clothes retailer with a global profile – headquarters in London, workplaces in New York, LA, Tokyo, Shanghai, Portugal, and Brazil – exhibits each tendencies. The firm’s beneficial properties in 2H20 pushed its market cap properly above $16 billion, whereas latest stressors have compelled the inventory worth down by 38% since its February peak.

Farfetch has a strong basis, primarily based on greater than 3 million energetic clients and over 1,300 sellers on the platform. The firm noticed, in 2020, over $3.2 billion gross merchandise provided by the positioning, making it the highest world platform for getting luxurious merchandise on-line. The gross merchandise worth was up 49% from the prior 12 months. At the highest line, Farfetch’s 2020 revenues have been up 64% year-over-year, to $1.7 billion, with $540 million, about one-third of that complete, coming in This fall.

Covering Farfetch for J.P. Morgan, 5-star analyst Doug Anmuth notes that the latest weak spot has created a “compelling buying opportunity.”

This alternative relies on: “1) FTCH’s position as the leading global marketplace in the $300B luxury market that is rapidly shifting online; 2) FTCH’s well-established e-concessions model that attracts more brands & inventory to the platform; and 3) FTCH’s strong position in the high growth China luxury market through both the FTCH app & recently launched store on Alibaba’s Tmall Luxury Pavilion. FTCH should also see its first full year of EBITDA profit in 2021, with a path to greater scalability over time driven by leverage in both Gross Margin and G&A.”

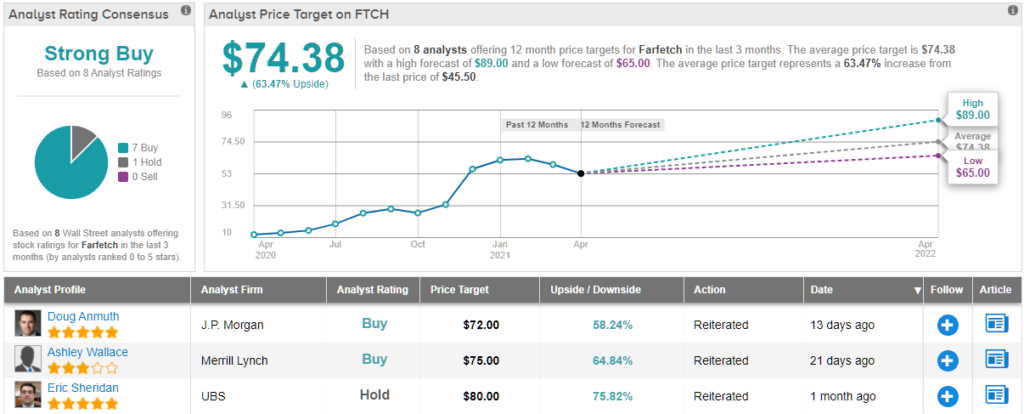

In line with this bullish outlook, Anmuth rates FTCH an Overweight (i.e. Buy), with a $72 price target suggesting a one-year upside of 58%. (To watch Anmuth’s track record, click here)

Overall, the Strong Buy consensus rating on Farfetch is based on 7 Buy reviews, which offset a single Hold. The stock’s share price is $45.50, and the average target of $74.38 implies ~63% upside for the next 12 months. (See FTCH stock analysis on TipRanks)

Oncternal Therapeutics (ONCT)

The next stock on our list, Oncternal, is a clinical stage biopharma company focused on oncology. The company is working to develop new treatments for cancers with unmet critical needs. The company’s pipeline has three drug candidate, in various stages of development from preclinical to a Phase 2 trial.

The lead candidate in the pipeline, cirmtuzumab, is the one undergoing that trial. The drug is a monoclonal antibody that inhibits the ROR1 receptor in certain hematologic cancers. In December, the company released interim Phase 1/2 results of cirmtuzumab’s efficacy in combination with ibrutinib. The combination compared favorably to ibrutinib as a single agent.

Cirmtuzumab is also in a Phase 1 clinical study as a treatment agent for breast cancer; updated results released earlier this month showed that a partial response or a stable disease in half or more of the patient cohort.

Despite the positive clinical results, Oncternal’s stock tumbled 30% this month. According to Northland analyst Carl Bynes, in a notice titled ‘Weakness Creates Buying Opportunity,’ traders ought to take this time to purchase in.

“We view shares of ONCT as an essential holding for those investing in the oncology segment, with multiple clinical updates anticipated in 2Q21 serving as MAJOR catalysts. We believe cirmtuzumab (anti-ROR1 mAb) is positioned to become a breakthrough therapeutic for treating MCL and other ROR1-expressing malignancies. Further, we anticipate first-in-human dosing of its ROR1 CAR-T candidate in 2H21 in China,” Bynes opined.

Congruent with his upbeat outlook, Bynes rates ONCT an Outperform (i.e. Buy), and his $21 price target implies an impressive upside of 265% in the year ahead. (To watch Bynes’ track record, click here)

Wall Street has taken a unanimous stance on ONCT, giving the stock 4 recent positive reviews for a Strong Buy consensus rating. The average price target, at $15.50, indicates ~170% upside from the share price of $5.75. (See ONCT stock analysis on TipRanks)

BioLife Solutions (BLFS)

Drug companies can’t do their jobs without support services – or the products supplied by companies like BioLife. The company supplies cell and gene therapy bioproduction tools, including cryopreservation storage units, biopreservation for blood storage, hypothermic storage and shipping media, and, importantly, cell thawing media allowing use of biosamples after cryopreservation.

BioLife’s quarterly top line has shown sequential gains in both Q3 and Q4. The third quarter gain was 14%, and increased to 30% in Q4. The Q4 revenue, at $14.7 million, was up 78% yoy. For the full year, the top line hit $48.1 million, a yoy gain of 76%. The company has provided 2021 revenue guidance in the range of $101 million to $110 million.

With this in the background, we can look at the share performance. BLFS shares peaked in December, after rising 176% in 12 months. Since then, the shares have retreated 31%.

Carl Bynes, of Northland Capital, sees that share retreat, again, as an ‘in’ for investors.

“We view the recent pullback in BioLife shares as a buying opportunity. BioLife, in our view, is uniquely positioned to emerge as the leading consolidator of the enabling technologies segment supporting the high-growth cell and gene therapy sector. The Co., through internal development and acquisitions, has amassed a comprehensive breadth of product and service offerings that support cell and gene therapy applications from development through commercialization,” Bynes famous.

To this finish, Bynes charges BioLife an Outperform (i.e. Buy), together with a $55 worth goal to point a 12-month potential upside of ~75%. (To watch Bynes’ monitor file, click here)

Looking on the consensus breakdown, Wall Street takes a bullish stance on BLFS. 6 Buys and 1 Hold issued over the earlier three months make the inventory a ‘Strong Buy.’ BLFS shares are selling for $31.51, and their $55.83 average price target suggests a 77% upside. (See BLFS stock analysis on TipRanks)

To find good ideas for beaten-down stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this text are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.